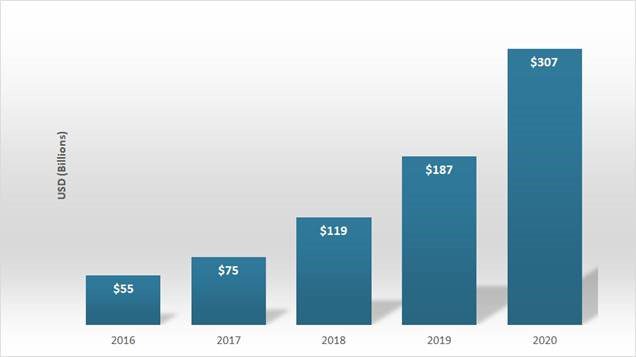

Early Warning’s Zelle reported their 2020 results for the P2P app. Growth continued at a sharp pace, closing out 2020 having processed $307 billion in value (up 58%) and 1.2 transactions (up 62%). Here’s a graph of Zelle’s growth since launching in 2016:

If we consider the timeframe from 2017 when Zelle really started taking off to 2020, we find the network has achieved a CAGR of 60%. Now the next trick will be to continue that level of growth.

In a conversation with Early Warning’s CEO, Al Ko, a portion of the go-forward growth will come from extending the use case for Zelle to include small business transactions. Small business, often service providers like contractors, can get paid by consumers through Zelle. More financial institutions are rolling this solution out as a part of their faster/real-time payments strategy.

For the moment at least, financial institutions are charging small transaction fees to businesses to use this service to get paid instantly. The number of financial institutions rolling out this service for small businesses has expanded to 11. Here’s what the press release had to say on the topic:

Today, more than 80% of consumers either use or plan to use P2P services – and nearly 1/5 (19%) of consumers began or planned to use P2P during the pandemic, according to research by Zelle. These same consumers and more can now use Zelle to send money to eligible small businesses, with 11 financial institutions—Bank of America, Bank of the West, Chase, Citi, FirstBank, Frost, Investors Bank, Morgan Stanley, Truist, U.S. Bank, and Wells Fargo—having launched Zelle for small businesses in 2020. Corporations are also turning to Zelle to meet consumer demands. In 2020, Disbursements with Zelle achieved a 41% increase year-over-year as corporations disbursed funds to individuals electronically rather than checks.

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group