“Gen Z young adults look to payment mechanisms other than credit cards.” This is an example of a typical headline that often forms conventional wisdom about the youngest cohort of adults. The truth, as always, lies somewhere in the middle.

CNBC Select recently posted an article about credit card ownership among the 18 to 24 year age group. 50% of “credit-active” Gen Z have a credit card and a prime credit score—and they’re more credit active than millennials were at the same age.

When we consider the hue and cry that many media outlets have created over this generational group running away from credit, I think this is a very important finding. A significant proportion of these folks have a credit card. Stated another way, most are not eschewing credit cards for other options. Mercator Advisory Group’s PaymentsInsights data seems to align pretty well with this.

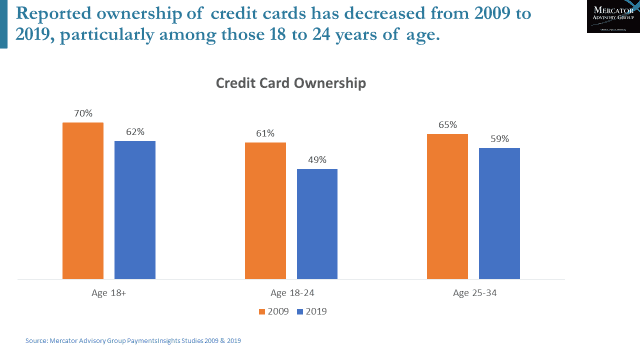

I took the opportunity to go into the “way back machine”, look at our PaymentsInsights data from 2009, to compare it to 2019 results:

As the graph shows, credit card ownership among this age cohort is actually lower than it was in 2009. I think this decline can be attributed to two key reasons: the recession and the 2009 Card act.

The recession, which many attribute to the banking system, left a lasting impression on many people, including Gen Z consumers who were entering their teens at the time. This left some of them with concerns (some might say fears), that they would get caught up in some of the same troubles others did during the recession.

The Credit Card Accountability, Responsibility, and Disclosure (CARD) Act Of 2009 – or the CARD Act – had provisions limiting the marketing and issuing of credit cards to young adults. This too, was a likely cause behind the decline in card ownership among younger adults.

To sum it all up, I would contend that the conventional wisdom that Gen Z doesn’t have or use credit cards is far from reality. To be honest, looking only at ownership numbers alone is not really enough to make predictions about this generational group. Maybe I’m just being a data guy, but I think there is a lot more empirical data to review before anyone can make any grand proclamations about how these individuals choose to pay for things.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group