With Valentine’s Day approaching, here is an interesting read on credit card loyalty from Forbes.

- Google “best credit card rewards” and you’ll get 387 million potential answers, including links to hundreds of websites dedicated to “hacking” reward programs to help customers earn the greatest amount with the least possible effort.

- There’s no question that rewards programs are a powerful driver of consumer behavior in the credit card space.

- A recent J.D. Power study found that 47% credit card holders who had switched to a new card issuer in the last year did so for a better rewards program.

- In 2017 and 2018, the majority of respondents to FIS’ Performance Against Customer Expectations study said their bank could do a better job rewarding them for their business.

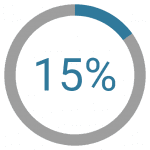

The J.D. Power number is particularly interesting when you consider the attrition rate in U.S. cards. In this Mercator study on credit card acquisitions, we found that 15% attrition rates were common to U.S. Bank cards. In short, we found that issuers placed 60 million new accounts in the market but volumes still held flat for open number of cards, at slightly more than 400 million. You lose an account to another issuer; then you book a new one. That means your cost of acquisition was spent covering an account loss, rather than adding new volume.

Right now, issuers just seem to throw money at the problem. As AI develops there will likely be better targeting strategies. As a consumer, I often find that a good targeted merchant funded reward might be more attractive than just 2% cashback. 2% cashback versus “buy this, get that” at a local merchant might yield 20%.

- As we see more real-time redemption programs come to market, financial institutions and retailers who use artificial intelligence are positioned to emerge as the new loyalty program leaders.

- This use of AI will help them to intimately understand customer behavior and purchase decisions, so the exact right reward appears for potential redemption at the exact right time.

The fickle consumer is a reason we think that rewards are not sustainable. They are effective, for a short period of time at the top end. Chase puts out a 75,000 reward point bonus. American Express responds a week later with an 80,000 offer. Citi has to do something, so perhaps it brings an 85,000 offer.

The reward wars continue. It still costs about $250 to acquire a new account. Throw in an incentive worth $750, and that new account costs $1,000. Ironically, if they are really a strong credit account, this type of cardholder will not likely revolve their balance. The fallback position is that you will make it up on interchange.

But assuming the interchange is 1.8%, quick math says you will need to put $55,555 a year, or $4,629 per month on the card to break even. That’s a lot of coin and at least double what I put on all of my personal cards each year. And, I put just about every non-mortgage expense I have on my plastic.

To make this win, you need to invoke some accounting tricks. Amortize the acquisition cost out 7 years to level out the cost is one way. It becomes a bit fuzzy but at least the math works.

The bottom line is this. Just like love, you can’t buy loyalty. You can lease loyalty if you want, but that is not cheap.

Just as important as new account acquisitions is account retention. It is cheaper to retain an only account than replace it with a new one.

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group