An old sailor’s trick is to find a stable spot, like the horizon, and fix your eyes on it to keep your balance in turbulent seas. The idea is that when your situation becomes uncertain and your control diminishes, finding something dependable and trustworthy is the key to staying on course.

The events since the start of 2020 have truly tested this theory. Ajay Bhalla, President of Cyber & Intelligence at Mastercard, sees trust and transparency as organizations’ horizon point: “We’ve seen upheaval in all areas of life – in our work, shopping, schooling and socializing. We had to put our trust in the digital tools that quickly became central to everything we do.”

Bhalla notes that Mastercard’s data shows that the surge in e-commerce amounted to an additional $900 billion in online retail spending around the world in 2020, and the expectations are that consumers will stick with their new digital habits. Maintaining the essential infrastructure that allowed the digital world to work was crucial, says Bhalla. “Amidst all this change, ensuring consumers, businesses and banks could trust the digital payments that underpinned their world became more important than ever.”

Giving consumers the knowledge they need

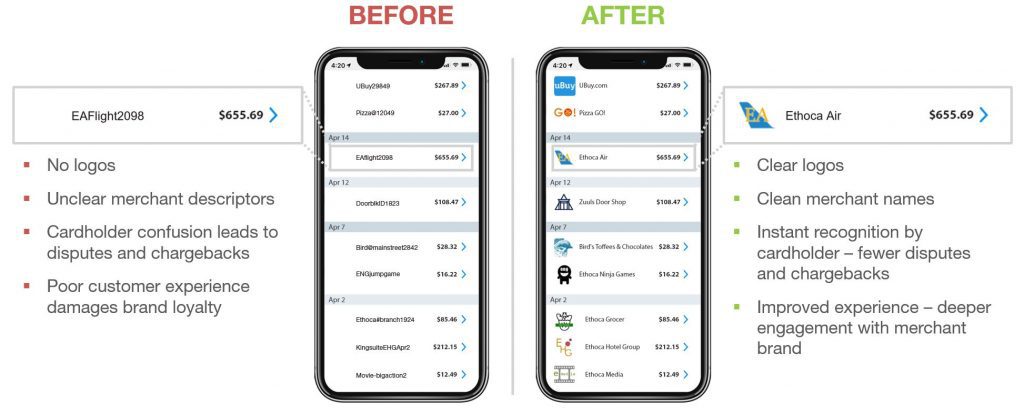

“A significant step in building trust and transparency is removing confusion and making purchase history clearer,” says Bhalla. Thanks to a series of advances that put control in the hands of the consumer, banks and other financial institutions can now infuse their user experiences with detailed purchase information, such as merchant logos and more consumer friendly merchant descriptors.

This is just one example of a consumer-focused innovation that comes from more seamlessly connecting customers with the information they need. Fully digital receipts available in a bank’s online channels also offer a more consumer-friendly experience.

“These connections between merchant and issuers, once made, can fuel further innovations, such as loyalty and reward programs, and further enhance the consumer experience,” adds Bhalla. This is an important point when we consider that 76% of global consumers have indicated that a good omnichannel experience is their top expectation from their primary bank.

Collaboration and industry-wide partnerships will be at the core of the industry’s future. “When we consider the future of payment technology, we’re looking at solutions that function seamlessly across card brands and networks,” says Bhalla. “Regardless of where someone made a purchase or how they made it, providing information to consumers needs to happen across diverse touchpoints. Experiences also need to be in the channels consumers are already using and trust – such as their digital bank statements, whether they’re accessed in-app or online.”

What’s coming next?

The bigger picture, according to Mastercard’s Bhalla, is that trust and transparency will fuel a data-sharing world that will impact almost every facet of our lives. He believes there are a number of key technologies that are core to our collective approach in developing products and services that address consumers’ expectation for great experiences.

Chief among these is Artificial Intelligence (AI). With its ability to digest vast amounts of data, AI is used to spot patterns beyond human capability and provide better insight. “Whether using AI to help detect and stop fraud, score transaction risks, or deliver the most intuitive consumer experience, the technology is critical in helping us connect the dots in an increasingly data-rich environment. It’s the new electricity – powering our society and driving forward progress,” says Bhalla.

In addition to AI, biometrics and digital identity both draw on technologies that help establish confidence and trust when transacting and interacting in the digital and physical worlds. Biometrics, both physical (such as your fingerprint, face of palm) and behavioural (such as how you hold and use your phone), are increasingly deployed to authenticate users as they go about their day-to-day activities, like logging into a device, shopping online or signing into a bank account.

Similarly, enabling people to prove their identity seamlessly and securely, while keeping the individual in control, has a range of benefits – whether establishing a loan, interacting with government agencies and services, booking a medical appointment, and now, when traveling safely.

Whilst society has passed through the eye of the pandemic’s storm, we’ve not yet found the safety of the harbour walls. The disruption to day-to-day life is set to stay for the foreseeable future – so as we navigate it, we must always remember to keep an eye on the horizon. It is through engendering trust in digital technologies that we can unlock future prosperity for all.