The world is evolving at a rapid pace, and payments are no exception. For the fintech industry, this exponential growth highlights the need to address back-office challenges and inefficiencies. To do so successfully, fintechs must take a holistic approach to financial controls.

To learn more about how fintechs should approach back-office modernization, PaymentsJournal sat down with Marc McCarthy, SVP of Sales & Reconciliations SME at AutoRek, and Steve Murphy, Director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group.

Register for the upcoming webinar – Setting the Standard: Borderless Financial Controls in Payments. On September 14th at 1pm EST

The stratospheric growth of payments

Gone are the days when it was frowned upon to use a credit or debit card to make a small dollar purchase. Now, consumers are using their cards for purchases of any value. These small dollar purchases are pushing payments into the future. “Having just gone through and still [being] in the middle of the pandemic, we see there’s a lot more e-commerce [and] a lot more micropayments taking place. And I really do think that’s just an accelerant of what we were already looking at in the past decade, and what we were looking forward to in the coming decade,” said McCarthy.

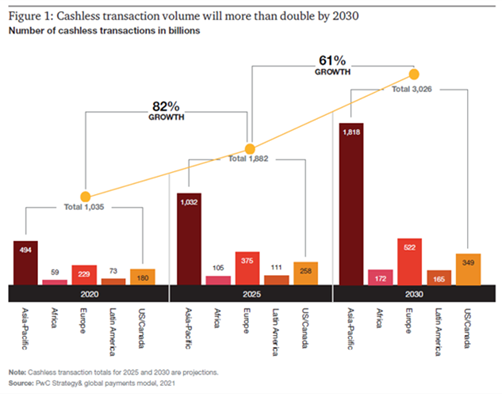

The chart below, provided by AutoRek, displays anticipated cashless transaction volume growth into 2030:

“There’s going to be a proliferation of payments, and I think microtransactions are going to push the way forward. Evidently, we are seeing a reduction in the use of physical cash and becoming more e-money focused,” added McCarthy.

Moving forward, embedded finance and the Internet of Things (IoT) will play a strategic role in microtransactions. For example, EVs, solar panels, and privately owned wind turbines will fuel generation and storage of electrical power by individuals who can make money by selling excess power back to the grid.

The influx of payment types is causing financial services providers to rethink how they manage their financial processes. As fintechs continue to mature, it will become more urgent to address.

questions around their ability to demonstrate controls around payment reconciliations, settlement funding, foreign exchange (FX) management, liquidity management, and interchange fee validation.

It’s time to bid farewell to spreadsheets

The fintech industry has focused, first and foremost, on customer acquisition. This makes sense but has left some gaps in terms of efficiency.

“They need to build their business and they need to have revenue coming in, so it’s an understandable approach. But the reality is that back-office processes tend to still be very much Excel spreadsheet based. We have qualified accountants sitting in these organizations, working their way through complex formulas which are very often error prone,” said McCarthy.

Excel, which Microsoft first brought to market in 1985, is simply not equipped to manage the needs of modern day fintechs. Part of the problem is that many companies, including fintechs, attempt to manage functions like interchange fees at a bulk level rather than more granularly. After all, it’s what Excel enables them to do. However, “the back office is not the money pit that many think,” warned McCarthy. “It’s the actual engine that keeps the lights on. It’s the engine that keeps things moving forward, so fintechs will be well-advised to embrace technology themselves.”

For some fintechs, the knee jerk reaction may be to use in-house engineers to build a back-office tool. But dedicating such valuable resources to non-revenue generating activities makes little sense. Instead, it makes more sense for fintechs to bring in outside vendors to rework back-office processes. That’s a realization that many fintechs are already facing. “The more mature fintechs are already at that level and have already accepted that they need to get expertise from the outside,” said McCarthy.

Don’t let data be a missed opportunity

By relying on antiquated tools like Excel, fintechs are missing out on opportunities to harness the data they have access to. “The challenge here is to actually retain your customer base, and the best way to do that is to feed them back with intelligent information or provide them with additional services beyond just the payment process,” said Murphy.

Missing opportunities to utilize data across an organization puts fintechs at a competitive disadvantage. “Understanding your customers better, their needs, their wants, their product choices, it’s more than just efficiency with that process. It’s potentially better customer relationships and increased revenue as well,” Murphy added.

McCarthy agreed, adding that many fintechs view the back office as a process rather than an opportunity. But that mindset is causing them to miss out on valuable data insights. “Once the payments have been processed, or the interchange fees have been applied, or the sales tax has been applied, there’s much more that you can do with that data, and it really is a golden source for very rich MI [management information].”

Internal processes should reflect company ambitions

CFOs and other financial executives must be aware of their companies’ ambitions when determining how internal processes can be improved. “If the company has ambitions to go across borders, for example, then there are a lot more additional pressures that a CFO has to worry about,” said McCarthy.

For companies relying on spreadsheets, it will be difficult to achieve these ambitions. In addition to being inefficient when it comes to accuracy and problem solving, spreadsheets also have inefficiencies around scalability. “If you’re a company that is working multiple jurisdictions on a micro-transactional level and your volumes are suddenly in the tens or hundreds of millions per day, then spreadsheets obviously are no longer going to cut it,” he added.

Ultimately, specific company goals should determine the best approach to financial controls. “As I said before, the back office is the working engine of the business. So therefore, it does need a bit of TLC. It does need a bit of investment. And without that, it’s very difficult to really move things forward,” said McCarthy.

Sufficient liquidity starts with automation

Today, some fintechs have gone out of their way to build up back-office processes or financial control and operations teams. Others have yet to begin that journey. Every one of those companies should be considering how to embark on that growth path.

When asked how CFOs can know the right actions are being taken to ensure sufficient liquidity to fund customer payments, McCarthy honed in on the importance of automation and technology.

“At the end of the day, most CFOs will be wanting to start looking at how they can automate as much as possible. What can be automated? What cannot be automated? Is it something that a company will want to build in-house, or would it like to hire in through third-party vendors? All of these factors need to start taking shape in the CFO’s mind as they go through their considerations of how to progress their business,” he concluded.