Across all aspects of the payments industry, legacy payments infrastructure and services are continuously reviewed by financial institutions and corporations for modernization projects. The motivation behind doing so is simple: modernizing payments infrastructure makes it possible for products to meet rising customer expectations and for organizations to remain competitive in an increasingly digitized market.

Reliable but aging wire transfer payment capabilities need to be part of the mix. By modernizing traditional approaches to payment processing for wire (Fedwire and CHIPS) and ACH, banks can offer more competitive and efficient processing and a wider variety of corporate payment services.

To further explore wire transfers as a key aspect of payments modernization, Volante Technologies sponsored a Mercator Advisory Group executive brief titled Modernizing Wire Transfers.

Wires remain foundational in the United States…

Today, there are two wire transfer systems in the United States. The first, Fedwire, is operated by the Federal Reserve. The second is the Clearing House Interbank Payments System (CHIPS), operated by The Clearing House (TCH).

Both systems are used for high value, non-commerce funds movements in a slew of domestic transactional use cases, including B2B commercial payments, bank reserve account requirements, Fed Funds, repurchase agreements, trading account obligations, corporate client deposits and liquidity needs, and payroll.

Wires are also the predominant choice for initiating cross border payments, filling the same use cases as they do for domestic payments. Wires represented 85% of all value transfers in 2019, and have seen year-over-year growth even amid the COVID-19 pandemic, during which there has been a sharp decline in check usage. Clearly, wires remain a critical payment method.

… But there are notable areas for improvement

Despite their obvious staying power, wire payments simply do not deliver the same convenient experience as latest generation real-time systems like The Clearing House’s RTP, Nacha’s Same Day ACH, and the eventual arrival of FedNow, The Federal Reserve’s forthcoming real-time rail. As a result, it is time for a new approach to Fedwire processing. By reimagining overall delivery methods and leveraging technology partners and cloud services, banks can successfully incorporate wires into their comprehensive modernization plans.

“Banks across all asset classes should be including their mission critical wire transfer systems and operations” in their modernization efforts, noted the executive brief. Legacy infrastructure improvement, migration to ISO 20022, the Fed’s expansion of operational hours, and other competitive modernization efforts are covered in more depth within the report.

Options for effecting change

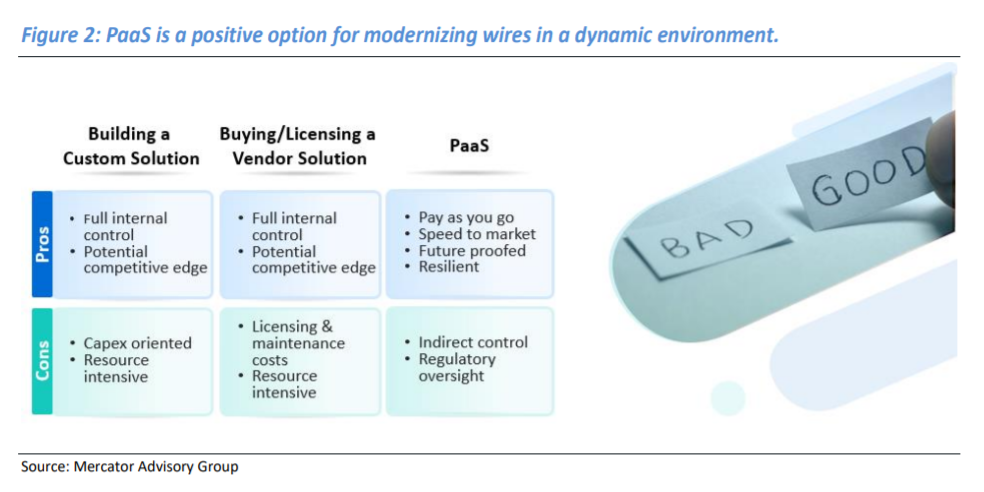

There are multiple methods available to corporations and banks to accomplish the much-needed modernization of wire services.

First, banks can offer wire services to clients through their own direct connection to Fedwire and CHIPS through an in-house software interface. A more popular option is to buy or license a third-party service provider as a gateway connection. Typically, these third-party service providers offer additional services such as core systems and e-banking platforms which can be accessed through private or hybrid clouds.

In recent years, more banks have become interested in the platform approach, which can range from overall bank experiences at scale to the provisioning of an entire product capability via a cloud Payments-as-a-Service (PaaS) environment.

The following chart, provided by Mercator Advisory Group, outlines the pros and cons of the different approaches to providing wire services:

First American Trust FSB, a provider of banking solutions in the escrow and real estate industries, is one example of an organization that opted to enable wire processing through a cloud PaaS environment. In June, the company announced that it will replace its legacy Fedwire processing solution with Volante’s US Wire Payments as a Service.

“Volante’s payments as a service (PaaS) in the cloud meets our business requirements, supports our growth, and ensures that we will be able to quickly roll out new payment services in the future,” said Robert Lawson, SVP of Strategic Initiatives at First American Trust FSB, at the time of the announcement.

To learn more about why wire transfer capabilities are a key aspect of payments modernization, access the Volante-sponsored executive brief, Modernizing Wire Transfers, by filling out the form below.