It’s undeniable that the health crisis of 2020, which was followed by the economic crisis, has materially altered retail banking and consumer payments. The questions now are how much of the change experienced will continue long term and where do we go next?

To gain insight on how consumer banking has changed and what the future holds, PaymentsJournal sat down with Mark Monaco, Head of Enterprise Payments at Bank of America, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

COVID-19 has greatly impacted the ways consumers pay…

To understand where consumer banking is headed, it’s important to dig deeper into what ways the pandemic changed consumer payment preferences and behaviors. Mercator Advisory Group’s North American PaymentsInsights 2020 Payments Survey did just that.

“We really wanted to take a look at changes in payment types from two particular angles. We were interested in understanding [if] consumers [are] using certain payments more or less than they did before the pandemic,” said Grotta. “Secondly, we wanted to take a look at [if] they [are] using payment types during the pandemic that they’ve never used before.”

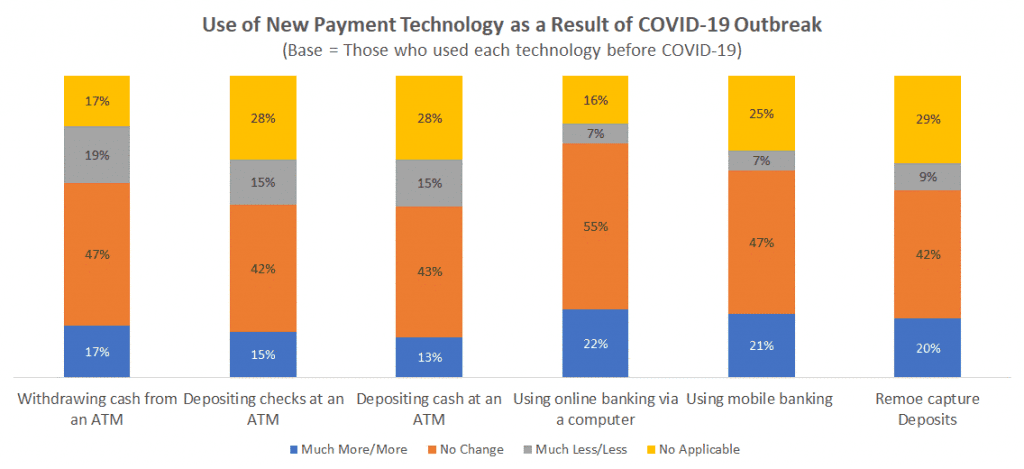

Mercator found that the global health crisis is impacting different consumers’ use of technology in different ways. For example, 15% of consumers reported that they deposited checks at an ATM more or much more as a result of COVID-19. Interestingly, however, another 15% reported depositing checks at an ATM less or much less:

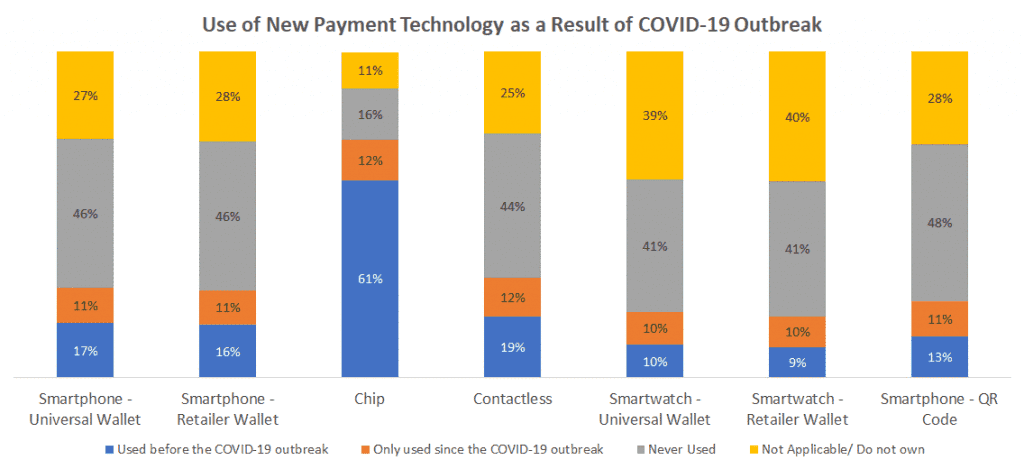

“We’re also seeing sustained growth of new point of sale purchasing habits,” explained Grotta. “So consumers are finally starting to latch on to universal payment apps like Apple Pay or Google Pay—much more than they did in the past—and also retailer wallets and contactless cards.”

Monaco agreed, adding that “the [Mercator] data presented resonated clearly within [Bank of America’s] customer base. The digital trend has been going on for a while, and [the banking industry] has been investing heavily in digital capabilities for many years. But necessity is also the mother of invention.”

…Amplifying the need for digital banking options

Consumers’ pandemic-triggered behavioral shift to digital banking is largely here to stay. This is because customers who turned to digital capabilities like mobile check deposit, P2P payment apps, in-app purchasing, order ahead, and contactless payments see the value in their new digital habits. “As people have positive experiences and interactions, and it makes their financial lives better, there’s no reason for them to not continue it,” said Monaco.

For the banking industry, this has translated into a need to digitize quickly and put a greater focus on open banking, data sharing, real-time payments, and other digital functions. Of course, many organizations in the industry were already investing ample resources into digital capabilities.

“I get the sense that the banking and payments industry was actually very well prepared in many ways. We have all of these digital capabilities, the opportunities to do banking and make payments, in a [way] that really fits well with all the social distancing,” said Grotta. “It’s just that we saw this incredible progression and compression of the adoption timeframe.”

While other companies rushed to digitize, Bank of America has been investing in digital payments for years. Its longstanding commitment to provide digital experiences to its customers left it well-prepared to respond to the shift driven by the pandemic.

“Our roadmap hasn’t changed in terms of delivering these tools—all of these tools were either in place or on the roadmap before—but it certainly has increased utilization,” explained Monaco. “That means we should see the benefits of [digitization] accelerate as well, and those benefits are in the form of customer satisfaction, customer loyalty, and deepening [relationships] with customers, operating efficiencies, and all those things,” he added.

Up next for consumer banking: Real time payments

When asked about the vision Bank of America has for the future of digital innovation, Monaco brought up the importance of innovative solutions surrounding real time payments.

“We started in real time payments with the launch of Zelle… almost two years ago now, and that has been a tremendous success and [offered] tremendous value for customers,” he said.

But there are far more use cases for real time payments than the P2P money transfers the Zelle app is known for. “There are exciting new use cases for real time payments around Requests for Payment, bill pay, around B2C disbursements, earned wage access—gig economy payments—so the promise of real time payments is among us,” Monaco concluded.