Despite the pandemic and subsequent recession, debit and credit card payments are recovering and other trends are emerging. As consumer behavior shifts, new business growth arenas are coming to light.

To learn more about these trends and what businesses can do to capitalize on them, PaymentsJournal sat down with Melissa Jankowski, SVP and Division Executive for Debit, Credit, ATM, and Software at FIS, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Debit and credit performance since 2019

According to Jankowski, the past three years have been transformative for the payments industry. “We’ve seen a multitude of new payment activity and practices in the last couple of years, driven a lot by the pandemic and some other variables in the economy,” she said.

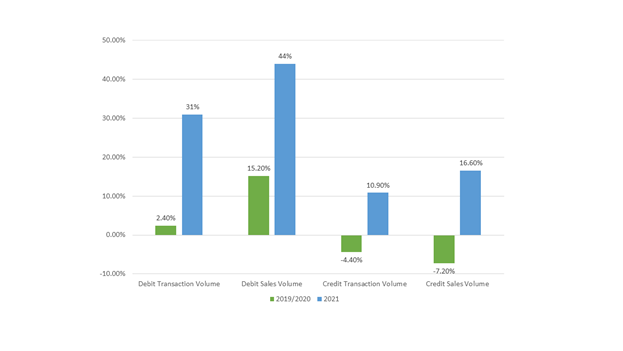

Our PaymentsEdge Advisory team tracks card payments growth and industry trends to use internally and to inform advisory clients. Their tracking shows FIS 2020 debit transaction volume rose 2.4% year-over-year and sales volume was up by 15.2%. In comparison, credit transaction volume decreased by 7.2% and sales volume was down 4.4% in the same timeframe. In 2021, debit transaction volume is up 31% year-to-date from 2020 and sales volume is up 44%; credit is up 10.9% and 16.6%.

“At FIS, we’re also seeing credit card revolving balances decline in line with Mercator’s reported decline in 2020 by 10.8%,” added Jankowski. Mercator Advisory Group predicts a three-year recovery period for recapturing credit card revolving balances, which are still trailing 2019 levels.

As travel and entertainment returns, there will likely be an increase in credit activity. Knowing this, it will be interesting to see how credit usage develops in the latter half of 2021 and beyond.

Another interesting trend is the shift away from cash and check payments. For years, the payments industry has been attempting to shift away from these payment methods in favor of a contactless, cashless environment. Now, in part thanks to the pandemic, that shift is finally gaining traction. In fact, Visa’s 2021 Spring Review is predicting a 12% decline in compound annual growth rate (CAGR) for cash and check payments in between 2019-2024.

Debit and credit usage by generation

To gain a deeper understanding of American banking and financial habits over the past 12 months, FIS surveyed more than 1,000 consumers in its annual PACE Pulse Study conducted February 2021. The U.S. study reveals that there are some generational differences pertaining to card usage. For example, only 70% of Gen Zers ages 18-24 carry a credit card, with 40% saying that they participate in loyalty programs. These are the lowest participation numbers of any age cohort, as demonstrated in the following chart:

In comparison, 85% of Gen Xers (ages 41-55) have a credit card, with 67% participating in loyalty programs. Low or no fees are important to both generations, but rings truer for Gen Zers than Gen Xers. Meanwhile, Gen Xers value cash back programs most.

Below are FIS’ takeaways regarding the generational use of loyalty programs and credit cards:

But why does this behavioral data matter? According to Jankowski, it provides organizations with actionable insights into offering solutions and value propositions that drive customer loyalty.

“We’re really focusing on things like digital experience through digital issuance strategies, Buy Now, Pay Later options, the enhancement of loyalty solutions for all products, including debit, and value propositions and how you can encourage the consumer to get engaged with a loyalty program. Those are really the things that are going to drive preference for that solution and get the top-of-wallet status that most financial institutions are looking for,” she explained.

Data shows that loyalty programs drive debit use. A McKinsey and Company analysis of a large portfolio of checking accounts found that average annual debit spend increased by 54.9% within 12 months of introducing debit rewards programs, increasing from an average of $8,520 to $13,200. Meanwhile, voluntary attrition dropped by 16.2%.

“The displacement of cash is really driving how consumers are wanting to spend. I would put less focus on the generational differences between loyalty programs that drive adoption of that product, but [more] on how their experiences are. That’s going to create the convenience that the financial institution needs to generate that loyalty and top-of-wallet status,” noted Grotta.

Capitalizing on the shift to e-commerce

Another impact of the pandemic is the shift toward e-commerce and m-commerce purchases over brick & mortar shopping. Merchants providing solutions that give customers payment convenience and purchasing power are well-positioned to thrive moving forward.

“I think those are the variables that have to be considered in all [commerce] environments, which is one of the reasons we’re focusing on digital issuance, Buy Now, Pay Later, and loyalty solutions and specifically… on the growth trends we’re seeing around debit,” said Jankowski.

Buy Now, Pay Later (BNPL), which has experienced widespread adoption since the onslaught of the pandemic, provides consumers with that purchasing power. BNPL is a short-term point-of-sale lending option that allows customers to make purchases at a retailer without having to pay the full amount upfront. Instead, they pay off their balance in installments. It can be implemented in brick & mortar as well as online or mobile retail environments.

By integrating a Buy Now, Pay Later option at the point-of-sale and offering post-purchase installment options, many consumers are more open to making bigger purchases than they would on their traditional debit or credit product. This may be particularly true for younger consumers.

“When you think about Buy Now, Pay Later, we are seeing some trends where the adoption seems to be [higher] within the millennial grouping. They are less likely to adopt a credit card, so in this group, the Buy Now, Pay Later solution is really acting as an entry point for them into feeling comfortable with a credit product,” explained Jankowski.

The takeaway

Despite the devastating impact the pandemic had on consumers’ finances, card payments are recovering and experiencing growth in 2021 over 2020 and 2019 levels. Data around consumer trends including loyalty and rewards program participation, BNPL adoption, and the move toward e-commerce, can provide insight to banks and merchants on how to drive consumer purchases and remain competitive in the new world.

For debit cards in particular, the future appears bright.

“It’s not just looking at the return on the debit card transaction, but looking at it a little bit more holistically around the [customer] relationship, looking at the opportunity to capture more of the overall transaction activity, maybe keeping a few more transactions away from the fintechs, if you will, and also just keeping more balance within the financial institution,” said Grotta.

Interested in speaking to the PaymentsEdge Marketing and Advisory Team directly about growing your Debit or Credit Card portfolio? Email: PaymentsEdgeFI@fisglobal.com