The concept of the digital wallet has been around for about 20 years, but it took until recently for digital wallet use to become commonplace. COVID-19 has fast-tracked changing consumer lifestyles, leading many to embrace a digital-first approach to payments and accelerating digital wallet use. Financial institutions should meet these preferences by making it simple and secure for their customers to utilize their cards in digital wallets, rather than turning to competitors’ cards.

To discuss the advantages of digital wallets and reasons why all financial institutions should enable easier access to this technology, PaymentsJournal sat down with Steve Kent, Senior Director of Digital Strategy at CSI, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

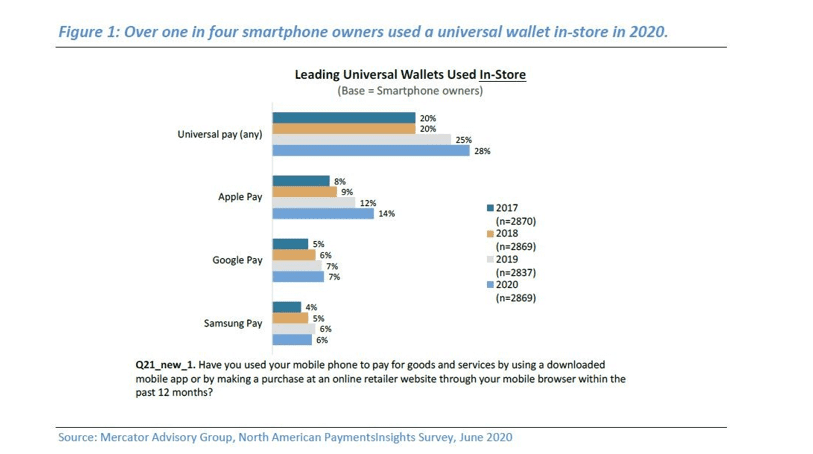

Smartphone owners use universal wallets in store

The global pandemic has significantly affected the use of mobile wallets. The chart below shows that the growth rate of in-store universal pay users from 2017 to June 2020 increased eight percentage points, from 20% to 28%. And the rate of change is only growing. “We’re running our next North American Payment Survey, and we expect to see that to be north of 30% by quite a bit,” Sloane added.

Beyond the significant growth of adoption during the pandemic, financial institutions should also consider the demographics taking part in that adoption. It’s not just millennials or Gen Z who are using these payments wallets. People over age 60, who have a substantial amount of savings, are also broadly using mobile wallet technology.

Additionally, many barriers to adoption have fallen away since 2014, when Apple released Apple Pay. “Back then, the process of adding a card to a digital wallet was really cumbersome, and not all advisors or financial institutions were even allowing their cards to be used in those wallets,” Kent said.

The lack of point-of-sale (POS) systems equipped to accept digital wallets created another hurdle for the widespread acceptance of contactless payments. Now, financial institutions are more accepting of digital wallets, and the emergence of new merchant processing players has finally made in-store contactless payments a more universal practice.

Push provisioning simplifies digital wallet use

To keep pace with growing digital wallet trends, companies like CSI are investing in technologies that reduce friction on the consumer end. Push provisioning is one natural method, as the feature empowers customers to seamlessly add a financial institution’s card to their digital wallet.

With push provisioning, consumers log into mobile or online banking and select to add their card to their Apple Wallet or Google Pay Send. “It makes it very simple and top of mind for that financial institution’s customers to add their cards to those digital wallets and start using those cards more frequently for purchases made with those digital wallets,” Kent explained. The whole process can be done from a smartphone if the consumer so chooses.

In terms of the customer experience, push provisioning is all about simplicity. It allows banks to take advantage of their own digital channels and mobile apps to encourage customers to use that financial institution’s card. Simply put, banks are prompting customers to use their card when finances are top-of-mind, while being proactive in offering added convenience.

“Identifying those customers that are ready to use a mobile wallet is next to impossible. It needs to be an offering [through push provisioning],” Sloane said.

Why add push provisioning to digital banking?

There are many advantages to adding push provisioning to digital banking, but first and foremost is the improved user experience. People expect their experiences across all industries to be fast, intuitive and simple. Banking is no exception, and as a result, digital payments continue to increase.

“A seamless payments experience shouldn’t be viewed as separate from the rest of the customer’s digital experience,” Kent said. “If [a bank’s] customers can’t easily add [their] financial institution’s cards to their digital wallet, they’re likely to add another card from a financial institution who can support it.”

CSI has found that banks offering push provisioning gain higher usage and interchange rates. This trend illustrates that push provisioning makes it more likely for those financial institutions’ cards to become the default card. This top-of-wallet status is crucial because accessing the primary card on a phone or wearable payment device can be nearly instantaneous.

Alternatively, it can be slower, even awkward, to switch to a different card in the wallet while in a checkout line. Consumers increasingly expect simple, secure and convenient methods to transact in both the physical and digital realm. Therefore, every measure to place a bank’s card at the top of the digital wallet leaves a significant impact.

Security benefits and concerns

Some consumers harbor wariness concerning digital payments. However, there are many misconceptions regarding the security of mobile payments and payments via digital wallets. Digital payments are actually more secure than physical cards, and the increased usage has resulted in less fraudulent activity.

Since these digital transactions are tokenized versions of the account holder’s payment information, the actual card number never leaves the device or enters merchants’ hands. The fewer locations that store the real card information, the greater the security. As Kent noted, Visa has reported over 2 billion tokens issued since 2014, which have actually reduced online fraud by 26%.

Tokenization also renders merchants a less enticing target for bad actors because the data they receive has no value. Issuers can rest assured that the security breach of a merchant who has received tokenized data will not impact the safety of the actual card information or put them at risk for future fraud.

Lastly, biometric authentication via the smartphone device is required to complete a purchase, which adds a layer of security at the point of transaction, should someone other than the owner gain access to the device itself. “The mobile device is about as secure as it can get, and that’s not where criminal activity is likely to take place because the software is in a trusted, secure environment,” Sloan concluded.

The digital payment takeaways for banks

As consumer demand for digital expands, contactless payments and online pay stand to do the same. Setting aside the contactless boom and recent global events, digital wallets are quick, secure and efficient. Making them more accessible for customers is therefore a win-win.