Today, many leading financial institutions are striving toward successfully and efficiently delivering real-time payments across their enterprise. Of course, that’s easier said than done—enabling real-time payment networks and all use cases is without a doubt a daunting task. Fortunately, certain experts in the payments space can provide useful advice on the decision-making processes behind real-time payment modernization.

To answer some of the complex questions surrounding real-time payments, PaymentsJournal sat down with Tim Ruhe, VP of Real-Time Payments at Fiserv, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

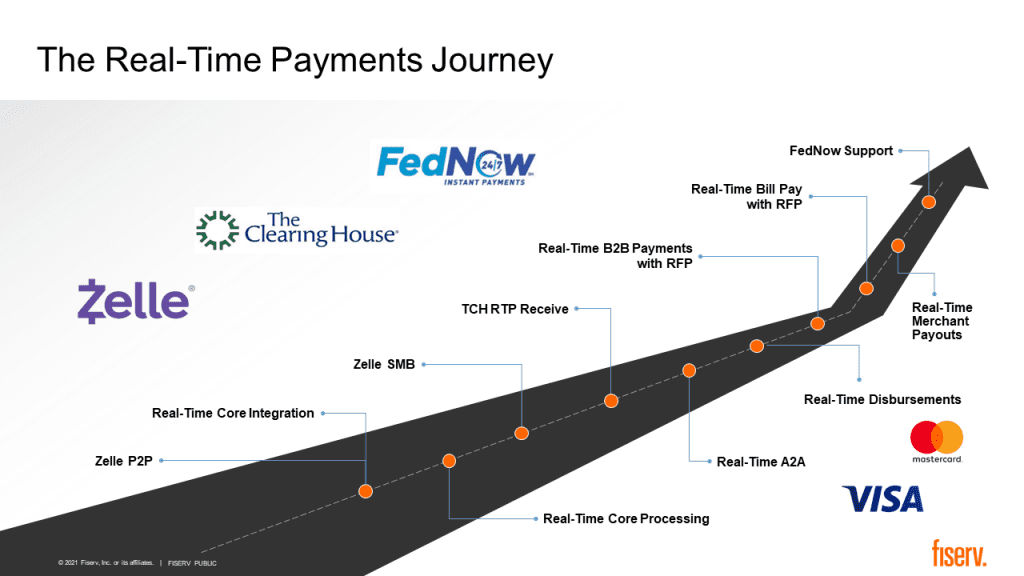

The road to real-time payments is a multi-stage journey

One of the biggest misconceptions surrounding the adoption of real-time payments is that it has to happen all at once. In reality, that could not be further from the truth.

“You don’t have to, if you will, boil the ocean all at once,” said Grotta. “You can be really thoughtful about this and get an understanding of what your competitors are doing [and] understand the makeup of your client base to get a better understanding of which aspects of real-time payments they might be interested in,” she added.

Because real-time payments cover a variety of use cases, networks and operations, financial institutions can pick where they want to start and proceed with the modernization journey from there.

In other words, “there are a lot of different components to real time. It is really a journey—a multi-year journey—that FIs are now starting on,” explained Ruhe. “There’s different networks, there’s different applications… [and] there are many other [real-time] services that customers want to enable across many different networks.”

The role of FedNow and The Clearing House in real-time payments

As those in the industry already know, The Clearing House’s RTP network was launched in 2017. Meanwhile, the Federal Reserve has announced the development of FedNow, which is expected to launch in 2023.

Because it is so early in the process, the relationship between The Clearing House and FedNow real-time payments remains unclear. “At this point, it’s not exactly clear how these two networks are going to work together, and that’s something that the market is going to need to solve for,” said Grotta.

In the meantime, solution providers such as Fiserv will have a role to play in bringing ubiquity to the marketplace. “We’re not counting on interoperability directly from the two operators, so we’re going to support routing both,” said Ruhe. “If interoperability comes along, terrific, and in the meantime we’ll enable clients by routing them both.”

FIs and customers alike benefit from real-time payments

Fiserv has already worked with over 550 banks and credit unions to launch real-time payments, and the results speak for themselves. These offerings “have been consistent in driving increased usage [and] driving increased digital engagement,” said Ruhe. In the wake of COVID-19, it is important for banks to be engaging digitally with their clients, as opposed to exclusively in-person.

In addition, both adoption and repeat users have been higher than anticipated. “And that’s a very positive outcome, because you’re not sure until you do it,” Ruhe added. In fact, Fiserv has plans to add roughly 500 more financial institutions and credit unions to its list of real-time payment launches in the next year.

Part of the broad appeal of real-time payments is the sheer number of use cases surrounding them. “Businesses are finding just a tremendous amount of utility in these faster and real-time payment solutions, so that has a lot of growth potential in the next several years,” said Grotta.

From P2P transactions to business to consumer disbursements, loan disbursements, merchant deposits, account transfers, and bill payment solutions, there is no shortage of ways that real-time payments can benefit those that adopt them.

Fiserv is uniquely positioned to deliver real-time bill pay with its large network of billers. “Part of delivering the real-time payment experience for bill pay is delivering information to and from the billers, so you need a large number of connections to billers,” explained Ruhe. “And that’s something that is a strength of Fiserv; we have a lot of biller integrations and we think we can help drive the industry forward in that particular area.”

Beyond the new capabilities themselves, real-time payments can bring the perk of improved operational efficiencies. “Financial institutions that have those solutions in place are really starting to see some real internal operational efficiencies,” Grotta added.

Payments modernization begins with building an internal consensus

For financial organizations thinking about adopting real-time payment capabilities, it is important to start by building an internal consensus about the priorities of the organization. When that’s done, decisions can be made on where to start. “I’d start by making sure you take the opportunity to educate yourself and learn. At Fiserv, we have a number of tools to help with that,” said Ruhe.

Becoming educated about real-time payments and building an internal consensus involves answering a few questions as a team:

- What are the top customer demands?

- What are the top use cases for real-time payments?

- What should the roadmap look like to establish those use cases?

Above all, it’s important to take action. “You’re not going to plan perfectly. The key is to start somewhere, adapt, and grow,” concluded Ruhe.