Understanding customer attitudes and where you stand in comparison to your competition is essential for any business. Having an accurate grasp of how customers, and potential customers, view your brand, products, and competitors allows you to determine your company’s strengths and weaknesses, and where improvements should be made.

But understanding customer and potential customer attitudes is easier said than done. Companies that try to gather this information themselves often run into difficulties. For example, those answering the survey may not be representative of the target user. Or they may be less candid because they know who is conducting the survey; telling someone their product is bad to their face can be daunting. It can also be hard to gauge how customers view competitor brands.

This is why many companies turn to consulting and advisory firms to conduct independent competitive assessments. To learn more about how competitive assessments can help companies, PaymentsJournal sat down with Pete Reville, Director of Primary Research Services at Mercator Advisory Group. Reville described how Mercator approaches these assessments and in what ways this approach benefits companies.

Taking your competitive assessment to the next level

A common approach to competitive assessments is known as competitive intelligence. This means “gathering the information that you can on product features and specifications, maybe pricing, maybe distribution channels, market share, all that quote unquote ‘hard’ information,” said Reville.

These factors are certainly important; it’s helpful to know what products the competition is offering, the amount they’re charging, and how much market share they command. However, Mercator’s approach to assessments goes even deeper than merely hard information on pricing and specific features in product offerings. “What we’re talking about here is taking your competitive assessment to the next level, which is understanding what your customers and customers of your competitors feel about your brand and the brands they’re using,” said Reville. In effect, Mercator’s approach enables a company to better understand its competitive environment.

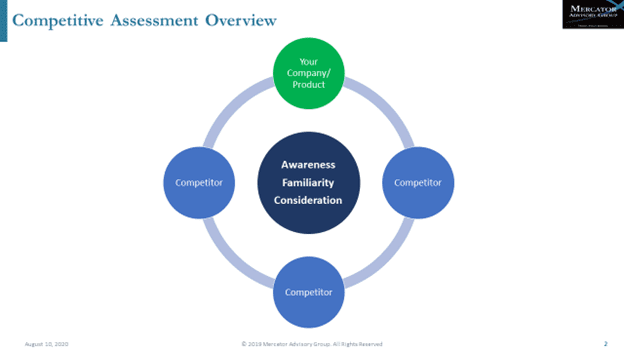

As the graphic above depicts, Mercator will determine the awareness, familiarity, and consideration target customers have not just for one company and its products, but also that company’s competition and their offerings as well.

“If you don’t understand how you are viewed in the marketplace relative to your competition, you’re really working in a vacuum,” said Reville. This understanding can then influence a company’s sales strategies, marketing tactics, product development, and customer service considerations.

Talking to the people that matter

Surveying the right people is key to Mercator’s approach. This is especially true for companies operating in the B2B space. “What’s critical here is that you’re listening to the actual buyers in the wild,” said Reville.

Instead of interviewing just the CFO or other top personnel at a company, Mercator seeks out those who are actually using the product on a day-to-day basis, often at the EVP and SVP level. It is these people “who can give you a real understanding of the pros and cons of your product and your competitors’ products,” said Reville.

In addition to surveying the people who actually use the products, Mercator can also reach a broader customer base that may not be familiar with that specific company and its products, but are the type of customers that company wants to target. Reville pointed out that this is important because many companies have no way of reaching out to people who don’t use their products, thereby undermining the company’s ability to understand the broader market.

The importance of an independent review

Since Mercator is an independent consulting company with years of experience conducting competitive assessments, it can get the unvarnished opinions of the relevant stakeholders. Mercator’s approach to asking questions also improves the quality of responses.

“It’s a completely blind survey, such that they have no idea who the sponsor is. It has been proven that this is the best way to get candid, open feedback from people you’re actually talking to.”

Peter Reville, Director, Primary Data Services at Mercator Advisory Group

Gathering the right information

Mercator’s competitive assessment can help answer a variety of important questions. For example, Mercator will determine the levels of awareness among potential customers for a company’s brand or products, specifically in relation to the company’s rivals.

The survey will also reveal how satisfied the users of a product are. For instance, Mercator asks, “What do you like about it? What do you dislike about it? What would you change about the product?” explained Reville.

Mercator will also identify if there are any emerging companies that are perceived as being cutting edge by customers. “Maybe they don’t have a lot of market share right now, but they’re getting a lot of buzz,” said Reville. The survey will help unearth what makes customers view these emerging companies as being so innovative.

All this information empowers companies to determine their strengths and weaknesses and respond accordingly. Armed with a clear understanding of what works and what doesn’t, a company can then refine its products and develop offerings that better meet the needs of clients. It can also adapt its sales collateral and thought leadership messaging.

As Reville put it: “What are the key selling points that you need to amplify in order to get your message across, to get potential buyers to understand your value proposition and its benefit over your competitors?” Mercator’s competitive assessment allows companies to answer these questions.

While working with one major client last year, Mercator discovered that the company had a problem. The company was a very large organization and had assumed that due to its sheer size and familiarity, people knew about its major product enhancements. Moreover, the company had assumed that it was one of the top companies offering that type of service.

However, when Mercator conducted its assessment, it found that there were a few up and coming fintechs that were generating considerable buzz among potential buyers, so much so that they posed a credible competitive threat to the company in question. Notably, prior to the survey, this company had no idea that these emerging fintechs even posed a threat.

Stories like this underscore the utility of competitive assessments like those offered by Mercator. But this information is only helpful if a company is willing to act on it. “You have to listen to the feedback that you’re getting, understand it, absorb it, and craft the necessary changes to make your product or your brand better and stronger and more competitive in the marketplace,” concluded Reville.

Those interested in learning more about Mercator Advisory Group’s approach to competitive assessments can register for an upcoming webinar on the topic. You can register by filling out the form below.