Companies involved in the payments industry are often in possession of reams of sensitive consumer data. Since the data is so sensitive—containing private details such as full names, addresses, net spend, and the like—companies are often hesitant to leverage the data to create additional revenue streams.

However, while concern over protecting consumer data is warranted, there is a way to safely harness the data without compromising anyone’s privacy, creating additional security concerns, or violating regulatory constraints: Synthetic data.

This refers to data sets that have been aggregated and anonymized such that no personal information is being used, but relevant statistical patterns remain intact. A company can than leverage the synthetic data for a variety of use cases without compromising consumer privacy.

To learn more about synthetic data, how to monetize it, and what typical use cases are, Mercator Advisory Group partnered with ARM Insight to host a webinar on the topic. ARM Insight is a leader in monetizing synthetic data, having helped over 1,000 financial institutions leverage their data for a variety of use cases.

The webinar featured Ryan Koch, CEO of ARM Insight, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

“What if you could monetize your data without worrying about privacy, regulatory, or security concerns?” You can.

The biggest barriers to monetizing data are fear of compromising user privacy, violating regulations, and creating unneeded security concerns. However, Sloane pointed out that all these concerns can be eliminated if a data sharing platform is properly implemented and managed. “Yes, I did say eliminate all of these concerns,” said Sloane.

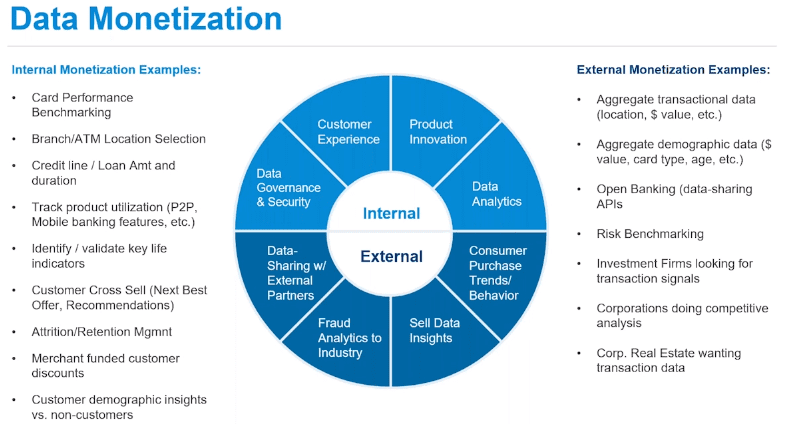

If a company does succeed in properly harnessing its payments data, it can be applied to a lot of revenue driving use cases. These opportunities can be broken down into internal uses and external uses. Internally, the data can be leveraged to provide key insights, help with self-service, validate key life indicators, and provide insights into attrition.

The data can also be used to compare internal customer insights against external non-customer markets in order to better understand if your customers are behaving the way others do, and what you might need to do to shape a solution that can broaden your market opportunity, said Sloane.

There are also a ton of external applications. For example, companies looking to identify locations for new stores might be interested in purchasing your synthetic data. Investment firms are also interested in acquiring more data to better inform their investment strategies.

All of these use cases really add up. It is estimated that the market associated with data monetization is going to be approximately $400 billion by 2023, said Sloane.

Three key themes related to turning your data into a profit center

Koch began by underlining three key themes for utilizing payments data. First, the financial industry has the most valuable data across all the different verticals, yet is often scared about properly monetizing it. These financial institutions need to understand how valuable their data is, and how they can safely use it to drive revenue.

The second theme is that companies can absolutely monetize their data without running into issues with their compliance, legal, or security teams. “I know that sounds crazy right now, but that is absolutely the case, and we’ll show you how that’s done,” said Koch.

Finally, Koch said companies need to better understand their data. Synthetic data has emerged over the past 18 months and many companies remain unfamiliar with what it even is. Once they learn, however, they can start profiting off of it.

What is synthetic data?

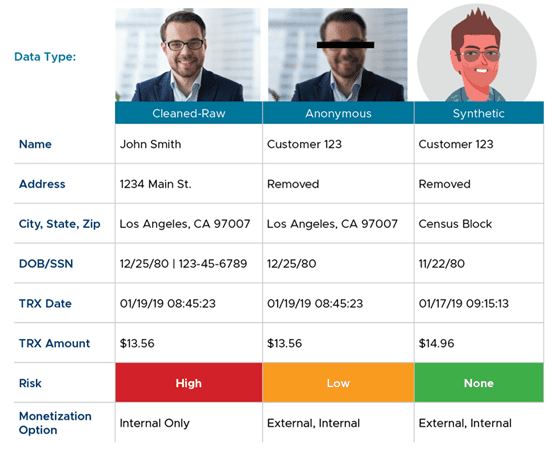

To understand what synthetic data is, it helps to look at other data types. First there’s raw data, which is exactly what it sounds like. It contains all the personal and exact information pertaining to a transaction. Since it contains all the personal information, this type of data has a lot of risk associated with it.

The next type of data is anonymous data. This is similar to raw data but with all the personal information removed. What’s left is the exact transaction information. It’s safer than raw data but still not the safest type of data.

Synthetic data is the safest. It’s a new datatype that is created when each data point is altered in such a way that a new, fake dataset is created. Crucially, the new, fake dataset still retains the statistical patterns of the real data set. As a result, synthetic data can never be traced back to the original consumer, and, as a fake dataset, it does not fall under regulations such as GLBA and PCI.

Because consumer privacy is protected and regulations are not violated, companies can then make the synthetic data widely available, both within the company and without. Koch stressed that only “fake” data will ever leave a company’s firewall; all the real data remains safe and secure within.

Internal use cases for synthetic data: Security & top of wallet spending

While ARM notes that there are many internal use cases for synthetic data, Koch went into depth on two of them.

- Data security & data governance: Many organizations face the challenge of limiting who has access to certain raw datasets. With synthetic data, however, this concern is removed because the data is scrubbed of any sensitive personal data. Therefore, synthetic data can be utilized by a wider portion of employees, while the raw data can be accessed only by those who need it. Koch said this had two major benefits. First, companies can drastically reduce security threats by minimizing the number of people with access to the raw data. The second benefit is that everyone else can leverage the synthetic data to build internal products, such as analytic tools.

- Top of wallet spending: Many of ARM Insight’s clients want to make their cards more top of wallet. To help, ARM ran relevant synthetic datasets—encompassing billions of transactions—through machine learning algorithms and detected patterns that drove card spend. For example, ARM found that card use at a drug store was a strong indicator of top of wallet spending in other segments. Armed with these insights, clients can plan campaigns and promotions around drug stores, thereby driving revenue.

External use cases for synthetic data: Selling data to third-parties

Koch stressed again that sending synthetic data to external parties is completely safe. It’s also lucrative.

Many companies are willing to pay for aggregated synthetic data. “We’ve seen three buyers that love to monetize synthetic, anonymous data, and that’s retail brands, commercial real estate, and investment firms,” said Koch.

In terms of retail brands, many companies are looking to use the data to better understand the market and how to compete with rivals. For example, Koch recounted how ARM partnered with Starbucks to better understand how the company was performing across different zip codes in Chicago. After crunching the numbers, ARM discovered that McDonald’s was outperforming Starbucks in all but two zip codes in the Chicago area.

But in those two zip codes, Starbucks was significantly outcompeting McDonald’s and also Dunkin’. This allowed Starbucks to do a deeper analysis into what these locations were doing to be so successful.

Since analyses like this can increase revenue, companies are willing to spend heavily to acquire the necessary data. This is why financial companies have a clear opportunity to monetize their user data.

Conclusion: Data is valuable, monetize it, but do so safely

The financial industry possess very valuable data, but many companies are afraid to monetize it. Koch encourages companies to explore monetization options, but through safe avenues. Synthetic data is the safest way to monetize data, as it removes the security risk completely.

Companies interested in learning more should listen to the webinar, which can be found accessed by filling out the form below. Additionally, ARM Insight created a roadmap to safe data monetization that breaks the process down into four simple steps. You can download the resource here.