There are several factors that buyers of identity verification services need to consider in order to select the service that best meets their needs. Even so, a ‘one size fits all’ identity verification approach is still largely being promoted, despite not meeting evolving complexities surrounding the online economy and digital onboarding.

Whether a buyer needs a single-point solution that covers one jurisdiction or a holistic solution that covers multiple jurisdictions, product offerings, and use cases is dependent on their unique circumstances. Simply put, it is crucial that organizations hoping to successfully manage identity risk clearly identify the problems that need to be solved before choosing a solution.

To further discuss why it’s important for organizations to determine their goal before choosing an identity verification solution, and what factors contribute to the type of identity verification solution an organization needs, PaymentsJournal sat down with Zac Cohen , COO at Trulioo, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

Identity Risk Solutions Need to Reflect the Risk Level and Complexity of a Problem

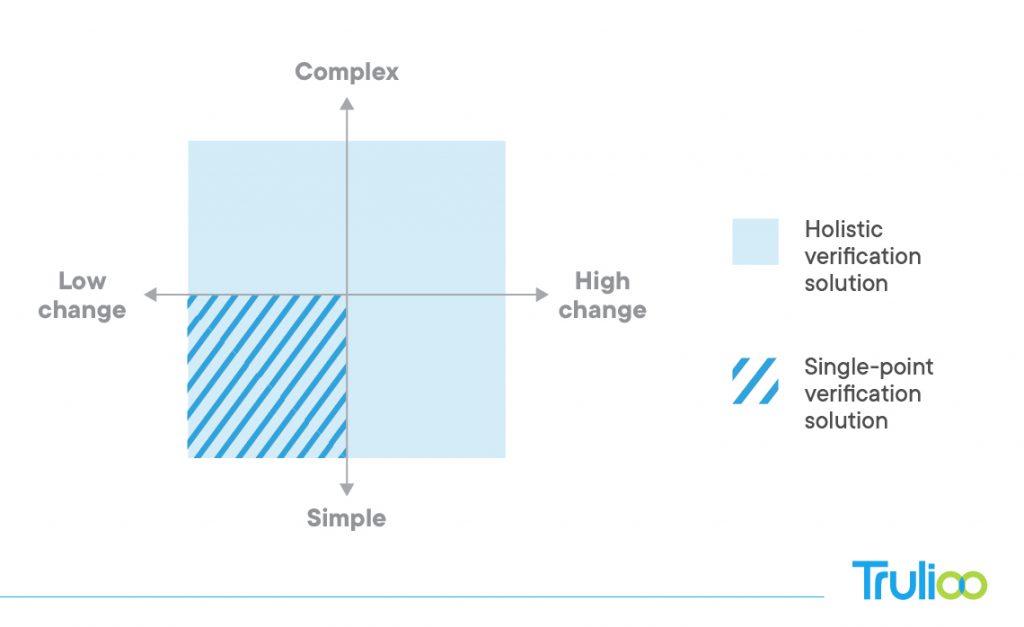

Broadly speaking, situations that are high-risk or continuously changing require a more holistic identity risk approach than straightforward problems. It’s also important to ensure that appropriate technology is deployed to mitigate fraud risk during onboarding, as data provided by Trulioo shows that new account fraud and account takeovers have risen 79%.

The circumstances of a particular application determine whether a single-point solution or a comprehensive holistic solution is needed. There are a breadth of options available for organizations looking to satisfy onboarding and verify individuals correctly in a digital environment.

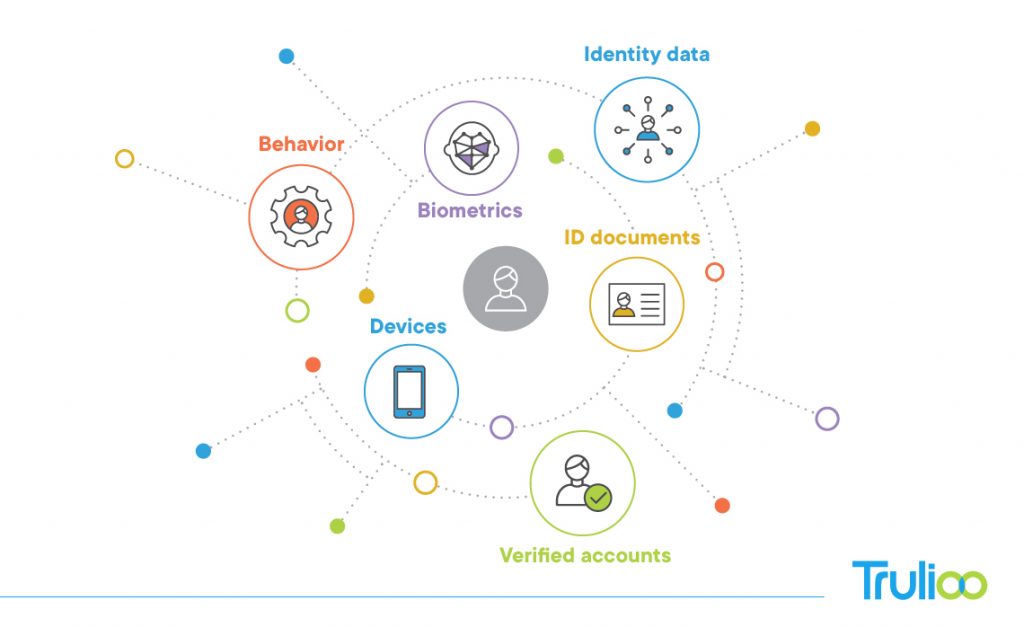

“The number of [identity risk] tools becoming available are unbelievable, from early biometrics, device fingerprints, and other solutions that identify a user as soon as they touch a website to solutions like Trulioo’s that are in-depth, capable of looking at documents presented by an end user, and can meet regulatory requirements,” said Sloane.

Organizations are Facing Unique Problems Regarding Identity Verification

Organizations aren’t all solving for the same problem or use case when it comes to identity verification, which is why the ‘one size fits all’ approach simply doesn’t cut it. Depending on what market an organization is in and where they’re located geographically, they could be solving for one or more of many prevalent identity verification use cases in the marketplace.

Here are a few of the most common identity verification solution use cases:

- Compliance: Compliance driven solutions, such as adhering to know your customer (KYC) or anti-money laundering (AML) regulations, can be built as part of a risk-based approach. Whether a legal entity or individual is attempting to open a new bank account, join an investment platform, or become involved in online gaming, a very specific risk-based solution is needed to satisfy compliance and regulatory obligations in the given market.

- Trust and safety: Ensuring that impersonators, bad actors, and synthetic identities aren’t polluting an ecosystem requires a bit of a different approach than a compliance-driven solution.

- Multi-country or global reach: It’s rare for an organization today to launch a product or service in a single market; rather, most companies have global aspirations and aim to reach an international customer base. To do so successfully, attention must be given to multiple risk levels, unique populations, and user experience requirements across markets.

Knowing the Goal Helps Determine the Best Identity Verification Solution

By working backwards from the problem and asking themselves certain questions, organization leaders can choose and deploy the most effective identity risk solution. Such questions include: What are we trying to achieve? What problem or problems are we trying to solve? What are the biggest aspects we want to be successful in?

For example, a challenger bank targeting a young demographic would deploy a drastically different solution than a traditional bank implementing a global payment solution to attract a wide range of demographics and age ranges. By identifying the desired outcome, a solution that satisfies these goals can be selected and implemented.

Organizations that evaluate the multitude of available identity risk solutions and build that flexibility into their final products see significant increases in revenue, and even more importantly, are able to evolve the solution as the changing environment alters their needs (such as a new regulatory standard being introduced).

One of the basic problems organizations have is that they won’t always know what problems will arise in the future, making it critical to partner with a technology provider that can adapt and evolve alongside businesses, regulatory markets, and consumer and end user demands.

The Buyer’s Guide to Digital Identity Verification

A strong identity verification solution ensures compliance, reduces fraud risk, and increases trust and safety. The Buyer’s Guide to Digital Identity Verification explores in-depth how organizations can effectively determine and implement the ideal digital identity solution, explaining determining factors like use case variation, prevalence of fraud, customer profile and demographics, and ongoing regulatory change.

To learn more, download the Trulioo Buyer’s Guide by filling out the form below: