The past few years have seen substantial growth in the peer to peer (P2P) payments market, with payment apps replacing cash and checks. Friends and family members who want to split the cost of a ride share, dinner, rent, or utilities are enjoying the convenience and speed of these mobile apps.

To discuss the growth of P2P payments and real-time payments strategy for financial institutions, PaymentsJournal sat down with Derek Swords, Vice President, Product Management at Fiserv and Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Recent Growth in the P2P Marketplace

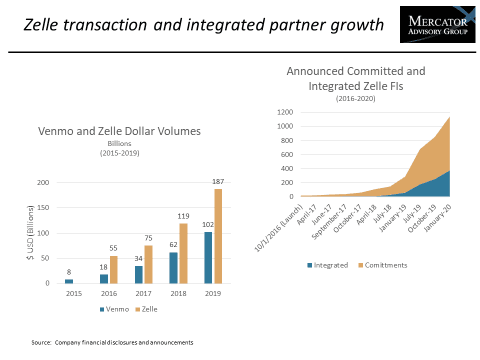

“There’s been some really pretty amazing growth in the P2P space, something that I don’t think we’ve seen [since] the beginnings of debit cards,” reports Grotta. The graph below reflects the rapid growth of Venmo and Zelle, the largest two P2P apps, over the past three to five years.“This tells me that P2P is really solving payment issues for its users, and it’s offering an incrementally better option over alternative forms of payment,” observed Grotta.

Accompanying this growth in P2P payments has been considerable growth in the number of financial institutions that are integrated with Zelle or have announced planned partnerships. While recent years have seen dramatic growth, transaction growth is expected to continue at a slower pace as most of the largest financial institutions are already on board and new integrations are in the mid and smaller sized financial institutions.

Recent bank branch closures and pandemic related concerns over the use of cash have accelerated the growth in P2P payments. “First time users and new app downloads have really increased in the last couple of months,” noted Grotta. The expectation is that once these new users become comfortable with the technology, many will continue to use P2P payments permanently.

Driving Forces Behind Mobile P2P Payment Adoption

As Swords outlined, a number of factors have contributed to the wide scale adoption of P2P payments over the past several years.

- Growth in mobile: Consumers are becoming increasingly comfortable making mobile payments.

- Speed: The majority of consumers want and expect to send and receive money in real time.

- Cross generational appeal: P2P use is expanding beyond the younger, more tech savvy early adopters across every generation from teens to seniors.

- Marketing: National marketing by P2P networks, as well as participating institutions, contributes to brand recognition.

Real-Time Payments (RTP) are a Must for Financial Institutions

In an increasingly fast paced digital world, consumers have come to expect instant gratification when sending or receiving money. Using a mobile app to pay people in real time meets those expectations.

Financial institutions recognize the need to compete on customer experience with both banks and nonbanking entities. This means they must constantly evolve in response to the changing needs and expectations of their customers. If their needs are not met, customers will take their business elsewhere. Banks that fail to address real-time payments are at a disadvantage as faster payments are becoming essential to provide a top notch customer experience. “From a long term play, it’s really important for institutions to start to put their toe in the water on real-time payments,” stated Swords.

Real-time payment capabilities will help enhance the customer experience, reduce attrition rates, and even contribute to monetizing customer engagement. “By offering a high value ability to send money, it makes customers come back again and again to the website, to the mobile app, and as a part of that, financial institutions can cross sell,” explained Swords.

In addition, financial institutions benefit from cost reductions by replacing more expensive cash and paper checks transactions with P2P payments.

Finding the Right Partner

A leading global provider of payments and financial services technology, Fiserv has a long history in the P2P market. It partners with thousands of clients in the P2P space, and is continuing to expand its reach, as demonstrated by its recent partnership with Redstone Federal Credit Union. Partners benefit from Fiserv industry experience and fraud prevention tools made available to them.

Fiserv makes it easy for clients to onboard and participate in the real-time payments market by helping them connect to, and take advantage of, the Zelle network. By partnering with Fiserv, clients get the benefit of being part of both the Fiserv and Zelle networks.

With 743 million transactions totaling $187 billion processed in the 2019 alone, Zelle is an industry leader that partners with a large number of banks, credit unions, and other financial institutions. Zelle transfers money directly into and out of bank accounts in real time, without the use of third-party apps. Users can access funds immediately. The settlement between financial institutions is processed using an ACH each night, but there is no credit risk for the participating institutions because the network verifies that the funds are there and secured at the time of the transaction.

Furthermore, Zelle is offered through the same banks where customers are already conducting their financial business. Swords suggests, “Consumers perceive these transactions to be safer than going through a nonbank app. When it comes to financial transactions, safety is a concern and a factor in choosing to go through trusted financial institutions.”

The Takeaway

The growth of P2P payments over the past 3 to 5 years has been extraordinary. To meet consumer demand and expectations, financial Institutions must offer P2P payments. Fiserv provides a fast, safe, and easy way to transfer funds between accounts in real time using the Turnkey Service for Zelle.

When financial institutions partner with Fiserv, they are connected with, “the NOW network that we support,” noted Swords, “which allows them to, in the future, build on that investment and offer new use cases for real-time payments. Whether that’s account to account transfers or potentially bill payments or disbursements, it opens the door to a lot of other possibilities. It’s an investment in customer experience for a particular product, but also more broadly, a capability.”