Even before COVID-19, contactless payments were experiencing significant growth. While the United States has been slow to adopt contactless compared to other nations, COVID-19 has contributed to new efforts by consumers to adopt contactless. Other markets, such as Latin America, serve as a growth bed for new payments opportunities and fintechs. By working with the right partner, organizations can offer consumers contactless payments that provide them with convenience and speed during these times and beyond.

To talk more about the adoption of contactless payments before and during COVID-19 and why many consumers will never turn back, PaymentsJournal sat down with Scott Johnson, SVP at Galileo, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Even Prior to COVID-19, Contactless Adoption was Growing

The COVID-19 pandemic has served as a major catalyst for the adoption of contactless payments in both the United States and globally, which is largely due to heightened fears that touching cards, paper, or point of sale (POS) terminals could be unsafe. Even so, there was substantial contactless adoption before the pandemic began.

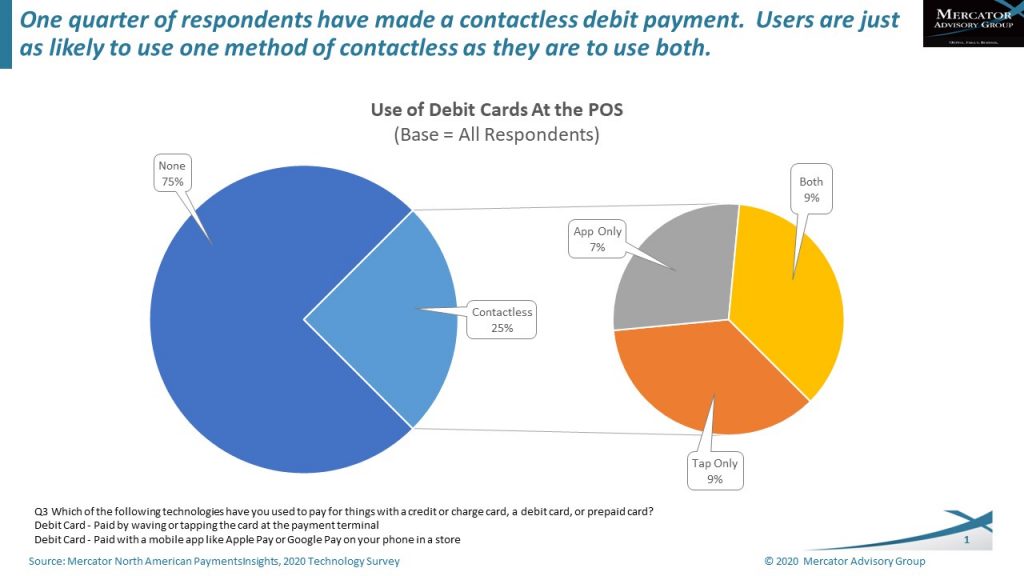

The following chart, provided by Mercator Advisory Group, comes from a survey conducted prior to the pandemic of over 3,000 U.S. consumers who were asked about their use of contactless payments. More specifically, survey respondents were asked about their use of contactless debit payments.

At the time of the survey, 25% of consumers said they had conducted a contactless payment with their debit card. Among those who had adopted the use of contactless debit cards, the highest portion were using a combination of contactless card transactions and mobile contactless payment apps, though others reported using just one of these contactless methods. Since then, COVID-19 has had huge impacts on consumers’ lives and buying habits.

COVID-19 is Accelerating Changes in Consumer Behavior

Previously, consumers in the United States were relatively slow to adopt contactless compared to those in European countries, but this is changing. A Mastercard study recently found that contactless transactions in the United States grew twice as fast as non-contactless in the grocery store and drugstore categories from February to March 2020, pointing to overall contactless growth. Meanwhile, Visa has announced that the United States now has the most contactless cards of any market globally.

“The current environment created by COVID-19 is accelerating consumers changing their payment habits, as the idea of being able to make an in-person payment without touching the POS device has a lot of appeal”, explained Grotta. The accelerated use of contactless “could be a competitive consideration for financial institutions that don’t yet have contactless issuance on their roadmaps,” she added.

These Changes Aren’t Limited to the United States

With the pandemic serving as the catalyst to accelerate contactless in the United States, other markets in the world are ripe for contactless payment growth as well. Latin America, in particular, still relies heavily on cash payments.

“Looking at Mexico as an example, 85-90% of transactions are still in cash,” said Johnson, highlighting plenty of room for contactless growth in this market. Because Latin American countries have populations that skew to a younger consumer demographic, who tend to be more comfortable using mobile devices, it’s likely that an increasing number of mobile wallet programs will emerge in the region. Further, an emerging broader acceptance of fintechs will make it possible for a greater number of consumers to access mobile wallets.

Latin and South America are seeing a broader acceptance of fintech as a whole, creating greater access to mobile wallets and similar types of programs. People will start looking at this saying, “I like the way I can do this transaction now.” It’s convenient and secure and the return to cash post-pandemic is not likely.

Push Provisioning: A Major Area of Contactless Growth

In the last six to twelve months, there has been astronomical growth in one particular area that supports the use of contactless: push provisioning. Push provisioning is technology that allows consumers to add a credit or debit card to mobile payment wallets. Push provisioning reduces friction on the consumer side by adding cards to a mobile wallet directly from an issuer’s app, eliminating the need to input the card information manually.

Galileo is an innovator in this space. Galileo’s one-click push provisioning for mobile wallets allows organizations to onboard customers quickly and provision cards with a one-button tap through Apple Pay, Google Pay, or Samsung Pay. This easily accessible and frictionless payment experience results in higher customer satisfaction and convenience, with the bonus of reduced fraud risk compared to magnetic stripes or card payments. Push provisioning for real- time funding has the capability to help those in times of need in the form of emergency assistance, insurance money, or even future government-issued stimulus checks.

Conclusion

COVID-19 has been the catalyst for widespread contactless payments adoption by consumers both in and out of the United States, and has opened up opportunities for mobile wallets in multiple markets. Push provisioning is a growing capability that addresses existing challenges in getting funds to consumers, while offering them a touch-free experience that minimizes contact with others amid lingering health concerns. Even after the pandemic, the convenience and other benefits of contactless payments make it unlikely that customers will revert back to their old ways of paying. “Once consumers get comfortable with these transactions, they’ll look at it and see there’s no reason to do a full contact transaction,” concluded Johnson.