The Russian e-commerce market has already attracted numerous large international companies–from the high-tech visionary Microsoft to video game industry pillars Sony PlayStation and Nintendo, and to retail giants such as AliExpress and ASOS. Yet there’s still enough room for smaller foreign businesses as the market is far from oversaturation. Many Chinese, Korean, European, and American companies are working to satisfy the growing demand of buyers from Russia and the CIS countries. Payment provider Yandex.Checkout analyzes the reasons why this market is worth a fight.

Russian e-com: threefold increase by 2023

Russia’s e-commerce market is constantly growing: in 2017, the Association of E-commerce Companies (AKIT) estimated its volume at about $18 billion, which is 13% more than in 2016. According to Data Insight, in 2017 the industry volume amounted to about $14.4 billion with the exclusion of ready-made food delivery, cross-border trade, and digital content–and almost $30 billion if we take into account the aforementioned categories.

In a recent study by Morgan Stanley, bank experts predicted a nearly threefold growth in the e-commerce market in Russia over the next five years. According to the analysts, the electronic market for physical goods will grow to $31 billion by 2020 and will probably reach $52 billion by 2023.

At this time, despite the high degree of Internet penetration (about 80%) and smartphone use (66%), e-commerce accounts only for 3% of purchases in Russia. However, Yandex.Checkout’s experience shows that in 2018, the number of payments in online stores significantly increased as more and more people prefer to make purchases online (82.8% of Internet users made at least one purchase at an online store in the first half of 2018, according to Mediascope research company). Morgan Stanley also suggests that the Russian market is about to experience a “radical change”: “We believe in Russia we are reaching a critical mass of “mature” internet user increases, which is driving a rise in the number of transactions online as users become more accustomed to them .”

Cross-border: foreign players on the Russian e-commerce market

The cross-border trade segment of the Russian e-com is growing in tandem with the global trend of increasing cross-border trading. According to AKIT, by the end of 2017, the cross-border sales in the online retail sector reached 36% of the market, or almost $5.5 billion, which is 3% growth compared to 2016. The number of shipments from foreign stores in 2017 (380 million) increased by 63% compared to numbers from 2016. By the organization’s estimate, at the end of 2018, the cross-border segment of e-commerce will reach $6.3 billion showing a 12% growth.

90% of overseas shipments to Russia come from China, yet in monetary terms, purchases of Russians in Chinese online stores make up 53% indicating a low average purchase check. Generally, by AKIT calculations, most orders (61.4%) in foreign online stores do not exceed $25 dollars. 3% of purchases are made at the EU stores (22% in monetary terms), 2% at the USA stores (12% of Russians’ spending on online purchases from abroad).

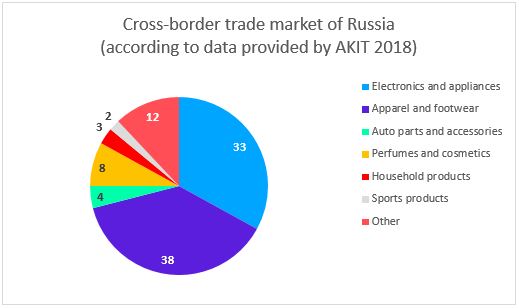

The most popular product categories among Russian customers buying online from abroad include apparel and footwear (38%), household appliances and electronics (33%), perfumes and cosmetics (8%). The “Other” category (11%) includes products for pets, office equipment, building materials, decorations, food, books (data provided by AKIT).

The Morgan Stanley’s statement about “the absence of a dominant online retailer” is easily refuted: for several years, the largest player in the Russian e-com has been AliExpress, which has the largest audience, 20 million people, and occupies 18% of the market (AKIT). However, according to the Yandex.Checkout experts, the number of key players will increase in the future: the world is moving towards consolidation, and joint ventures are likely to become new pillars of Russian e-commerce.

Morgan Stanley suggests that joint ventures established with the participation of the largest domestic Internet companies, Yandex and Mail.Ru Group, are likely to conquer the Russian market. According to Morgan Stanley, the leader can take up to 60% of the e-commerce market in Russia. The cost of such a company could reach $9.8 billion.

Market trends and growth factors: key insights

- The role model for the Russian e-commerce market is China. According to KPMG, 17% of Russians buy at Asian online stores, most of which are Chinese. Their sales and promotion mechanics and marketplace model have successfully taken root in the Russian market. The issue of logistics is very important due to the low population density in Russia: according to analysts at Morgan Stanley, it makes sense for online companies to co-operate with offline networks that have a large number of retail outlets that can provide customers with products ordered online. As demonstrated by Yandex.Checkout’s experience, in addition to logistics, foreign companies entering Russian market also require marketing and distribution, for example, an offer platform with promotional deals provided by partners.

- The cost of goods continues to be a key factor in selecting an online platform. KPMG analysts believe that a customer selects an online store based on price (24%), brand (15%), and peer influence (9.8%). Thus, Asian online stores with their unprecedented low prices have great chances of success in the Russian market. However, according to Yandex.Checkout’s analysts, in a number of categories, buyers are more focused on quality, and that’s where the pre-existing image comes into play (Korean cosmetics, European children’s goods, etc.). This can be a new “entry point” for brands with the generally recognized high quality.

- Mobile retail is growing. According to Data Insight, in 2017, 13.4% of customers made purchases from smartphones via the store’s website, and 12.3% made orders via the mobile app. For young adults under the age of 25, a smartphone is the primary device for online shopping. KMPG estimates that in the coming years, the share of purchases from mobile devices in Russian e-com is expected to double its share, in line with the global trend.

- According to Morgan Stanley, in the coming years, investments in the Russian market could reach $1 billion, while over the past ten years, private companies in the online retail segment received only $800 million. According to the investment bank UBS, the fastest growing segment in Russian online commerce for the next five years is food delivery. Bank’s analysts say that this sector will be the main goal for investors who intend to invest in Russian online commerce in the coming years.

- According to Yandex.Checkout, Russia’s online trading market is an audience ready to accept new products from foreign markets. According to analytics of search trends and payments, Russians show increasing preference towards offers from world leaders in various product categories. Therefore, the Russian market might soon have new leaders of Turkish or Korean origin.