The global pandemic paved the way for the acceleration of digital payments. Now, adoption of this technology has been expedited. Businesses are both considering and implementing a variety of ways to deploy digital payments at a higher rate than ever before.

To further discuss how businesses can utilize digital payments and how to overcome any obstacles they may face during the adoption process, PaymentsJournal sat down with Chris Clausen, Executive Director, Digital Payment Solutions at Deluxe, and Steve Murphy, Director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group.

Top use cases for businesses looking to utilize digital payments

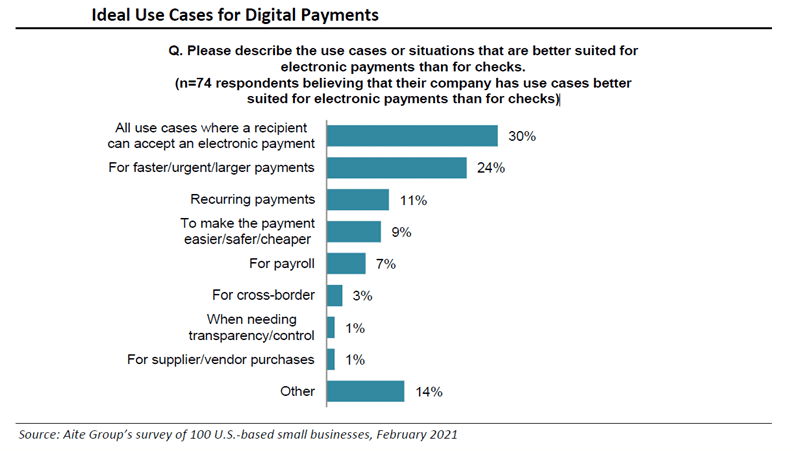

The utilization of digital payments is a topic that is top-of-mind for many It is evident from an adoption standpoint that digital payments are gaining some traction with recurring payments, with 11% of respondents believing they are better suited for electronic payments than checks (see chart below). Recurring payments are especially popular between a payer and payee who already have an established relationship.

The pandemic has impacted all other digital, non-recurring payments, which has been a major driving force in terms of accelerated adoption. There are many use cases, such as the need for rush payments or lack of access to an office space for payroll, that contributed to this increased digitization.

“The best part about it is that the industry continues to adapt its solutions,” said Clausen. “To solve for these business cases, we’re seeing usage across a wide variety of market verticals: medical claims payments, supplier/vendor relationships, payroll services…pretty much you name it, small [or] large-sized businesses, just about everybody has use cases at this point.”

Even businesses that are at an advanced point on the adoption curve and consider themselves more mature regarding digital payment uses have not yet leveraged the full capacity of digital payments. There are a lot of different use cases that are now in the game, and the technology is beginning to catch up.

Checks are still being used

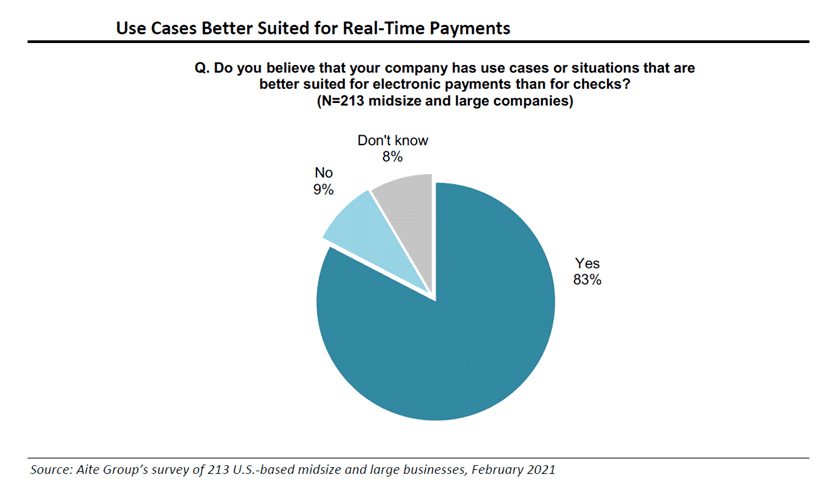

Real-time payments solutions can truly flex their muscles when there is a well-established relationship between the payer and payee. However, there is still a tendency to rely on checks for non-recurring or less frequent payments.

“What really needs to happen for the industry to solve this holistically is to bring a suite of solutions to the table that allow for business payments to actually navigate across a wider range of relationships,” explained Clausen. He believes that, with partnerships forming between FedNow and RTP and other industry players, solutions for non-recurring payments are beginning to form. By getting both sides of a transaction onto a digital payment infrastructure, it becomes much simpler to set up the entire industry for a full migration.

Early on in the development of digital payments, there was the school of thought that one rail or a single set of solutions could solve the majority of use cases, but the industry is now showing that rail agnosticism is the way to address any pain points. Payment platforms that enable a variety of payment rails to address different strengths and weaknesses will certainly have an advantage in terms of accelerating the adoption of digital payments.

“By effectively leveraging those different solutions into an end-to-end platform that brings choice that really I think is what’s going to separate out those who are ultimately successful in moving this industry,” concluded Clausen.

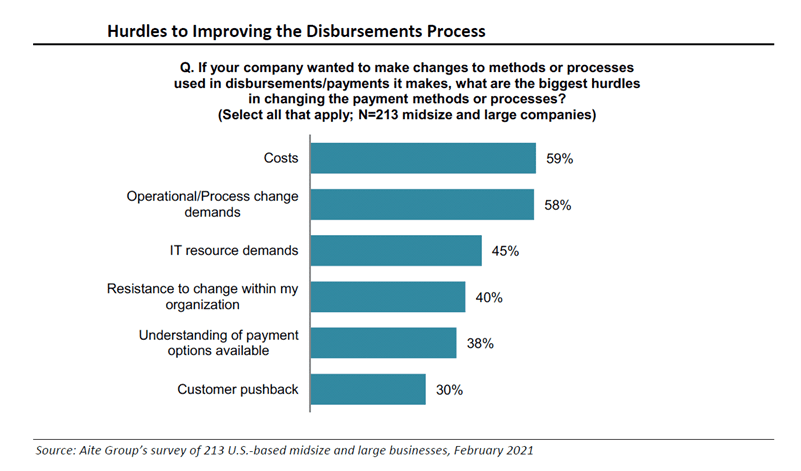

Businesses face hurdles when looking to digitize

When sending out payments, oftentimes one of the biggest hurdles payers face is trying to adhere to the preferences of the payee. In some instances, the payer has a lot of influence over the payments that a payee will take, but in other scenarios, they have none. The result is that many businesses on the paying side of the equation are forced to prioritize the payment solutions they want to implement before they know what their payee base wants. When speaking to both parties in the equation, it regularly comes down to uncertainty because there is such a wide variety of options, but neither party is sure where to send the funds.

“What we try to do is understand that angst around the ultimate decision point. We’re trying to get them to leverage existing processes, existing interfaces, and existing payment outputs to allow them to integrate into electronic payment solutions,” said Clausen. If this is possible within the framework of a payment that has already been issued versus an obscure future payment, then a business has a greater chance for an increase in adoption.

The digitization process 101

Deluxe partners with about 5,000 financial institutions, and they all have the same question: What should I be asking myself and vendors when it comes to the digitization process? Clausen provides a few straightforward answers.

The first answer addresses concerns regarding a business’ ability to leverage existing API infrastructure to begin the process. Unless there are solutions on their roadmap that allow them to leverage existing interface, ERP capabilities, and payable processes, the business will most likely need to do more research.

The second solution involves the wide array of startups that are currently operating in the digital payments space. It is crucial that businesses look for a provider with a robust operational infrastructure that can support and maintain a true digital environment. “It’s more than just bringing cool new technology to bear,” offered Clausen. “It’s being able to support from a regulatory standpoint, a fraud suppression standpoint, and an operational standpoint, models that are going to scale quickly enough.” The best solutions often involve partners with innovative technology that ensures they can power through the challenging elements that true payments origination requires.