One of the most important elements of a business is not always talked about consistently and directly: cash flow management. Historically, it has been very complicated for smaller companies to forecast cash flow accurately, but true cash flow control goes beyond even forecasting – businesses need simple ways to adjust the levers that impact cash flow based on the insights gained from forecasts.

To learn more about how to comprehensively address cash flow challenges with the proper technology and guidance, PaymentsJournal sat down with BC Krishna, Founder and CEO of Centime Inc., and Don Apgar, Director of Merchant Services Advisory Practice at Mercator Advisory Group.

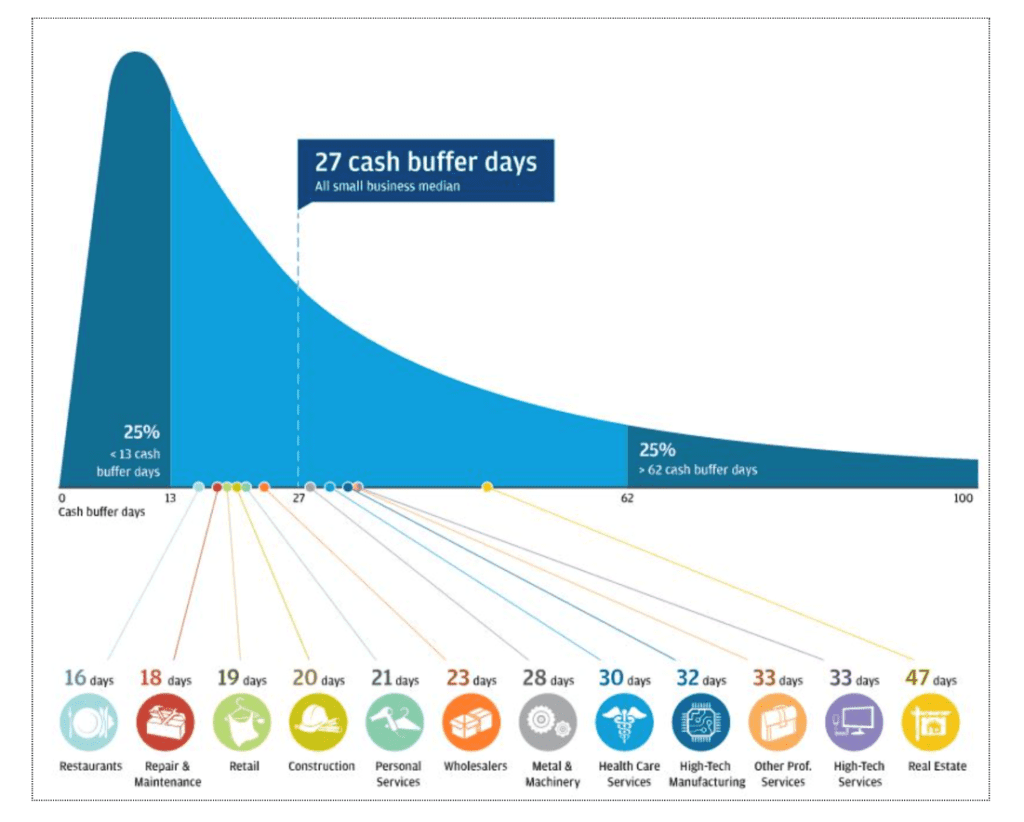

Small businesses live on the edge

Data on 600,000 small and midsize businesses (SMBs) pulled from a JPMorgan Chase Institute report show that the median cash runway for SMBs is 27 days. “In other words,” said Krishna, “if, for these businesses, cash inflows were to stop, they would have 27 days of cash in the bank.” That is how close most businesses live to insolvency. While it varies slightly by industry, with restaurants sitting at 16 days of cash runway and real estate firms at 47, the difference is fairly minimal – a matter of weeks.

“Even small things can be disruptive [to cash flow],” Krishna noted. “Could be a single customer that pays late, it could be seasonality, or heaven forbid, a recession or a pandemic.” The razor-thin margin of survival highlights just how important the PPP loan program was, but businesses cannot subsist on government handouts in perpetuity. “Businesses often just focus on growth and profitability, which are all important metrics to look at,” Krishna continued. “But as they say, cash is the lifeblood of the company, and cash flow is something that businesses need to understand, manage, and control.”

However, businesses may not necessarily be aware of their cash flow limitations. CFOs will often talk about a 13-week cash flow model, which is a gold standard for liquidity reporting. “That’s still only a means to an end,” Krishna pointed out. “What can you do about it? What can you do with that cash flow forecast?”

Three levers to manage cash flow

Most of the time, businesses know what they must do to successfully manage cash flow – they just do not do it systematically enough, and they do not do it in a scalable way. According to Krishna, every business has three levers to control cash flow with forecasting and strategic moves:

- Reduce days sales outstanding (DSO) – Map out how you pull in your receivables and what operational processes you can follow to ensure that you get paid faster. “Something like 50% of all businesses today get paid late,” remarked Krishna, citing a Dun & Bradstreet report.

- Push days payable outstanding (DPO) – Make decisions about payables based on your forecasts, namely who to prioritize paying, how much to pay them, and by what method. The best case scenario is finding a way to emulate Amazon, who has a negative cash conversion cycle where they receive cash before paying their suppliers. “Every business should aspire to be that way,” said Krishna. “But you know not everybody can.”

- Tap into credit – Small and midsize businesses often struggle to get credit access, but when they do, it goes underutilized. “I saw a statistic the other day that something like 30-40% of credit is actually utilized,” Krishna mentioned.

Cash flow management solutions

CFOs looking to improve cash flow for their business need to look in two equally important directions: forward and backward.

Forward-looking questions they might ask themselves include:

- What is our cash forecast?

- How much cash do we have today?

- How long is it projected to last?

Looking back, they might ask themselves:

- Has our past performance met our KPI goals?

- How often do we get paid?

- What is our collections efficiency?

- What is our payables efficiency?

- How many payments are we making on credit cards?

There are also opportunities for banks to package credit solutions more effectively so that businesses see credit as a helpful tool. “Banks’ cash management solutions actually don’t solve any cash flow problems,” Krishna asserted. “ACH and positive pay and cards don’t provide the kinds of visibility around cash flow forecasting and the ability to integrate AP/AR into one holistic capability.”

Offering credit is a central piece of what banks do, but banks have been slow to offer these kinds of services to their business customers. “It seems like this kind of thing would be a huge win for a bank that banked any number of small businesses,” Apgar pointed out. It is only sensible that banks use the opportunity to offer a co-branded private label solution with Centime to optimize cash flow for their customers. “Sometimes the answer is right in front of you, and you don’t really see it because the pieces need to be put together,” Krishna clarified.

The bottom line is that payables, receivables, cash flow, and credit are all interconnected problems. Cash flow forecasting can help connect the dots and inform who to pay, when to pay, how much to pay, and how to pay. “This is why we exist at Centime,” concluded Krishna. “To be able to pull together these pieces in a more integrated and connected fashion… we’re not aware of anybody that has put all those four things [AP, AR, credit, cash flow forecasting] together into one comprehensive solution.”