In the past few months, there has been a whirlwind of change in how people conduct their commercial and financial lives. As COVID-19 began to rapidly spread, strict lockdown measures disrupted normal life, forcing stores to close and consumers to migrate to online channels. What was once a gradual transition towards digital payments and shopping methods has become a full sprint.

For community banks, the digital-first nature of today’s world represents an opportunity to forge deeper connections with existing customers, reach new consumers, and drive revenue. But to capitalize on the opportunity, community banks must understand the key trends occurring in digital payments and develop a comprehensive digital strategy to accommodate their customers’ shifting needs.

Contactless payments are on the rise

One of the most important trends since the pandemic’s onset has been the stunning growth of contactless payment methods. Although the full impact of COVID-19 on contactless payments is still coming into focus, the evidence of staggering adoption so far is compelling.

Visa, for example, reported that 31 million Americans used a VISA contactless card or digital wallet in March, up from 25 million in November 2019. The same report found that overall contactless card usage in America grew 150 percent since March 2019, with 175 million contactless cards now in circulation. This means the U.S. has the most contactless cards of any market globally.

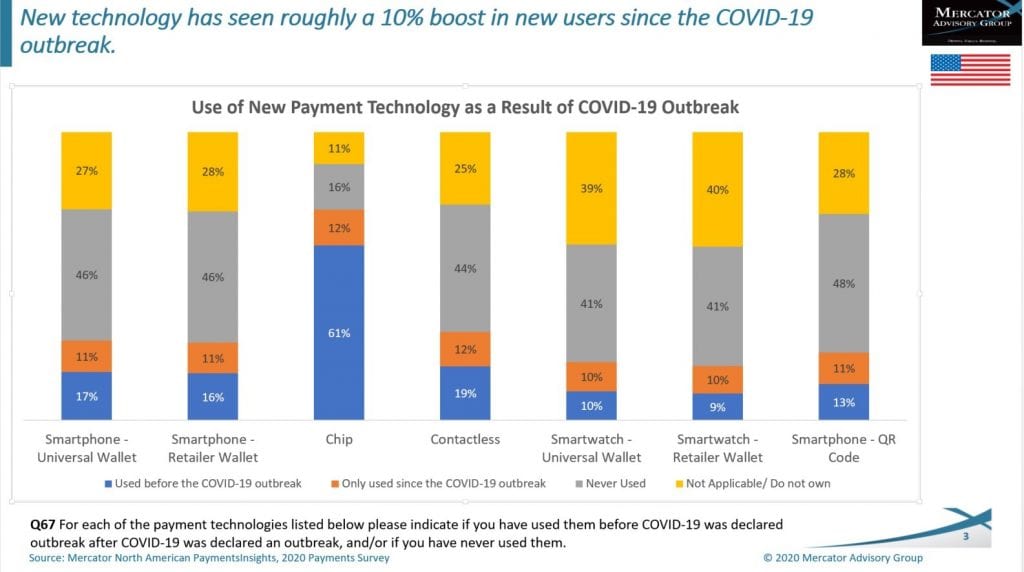

But contactless cards are only one contactless payment method; digital wallets and other mobile payment apps also provide consumers with a touch-free means of transacting. Since the pandemic began, 11 percent of consumers reported using a universal wallet through their smartphone for the first time, according to a Mercator Advisory Group survey. And as the following chart reveals, consumers are using other contactless options, including QR codes and retailer wallets, at similar levels.

With many consumers turning to these methods for the first time—and with those who were already using them reporting to do so at an increased frequency—overall contactless growth is even more notable. In fact, over half of Americans (51 percent) are now using some form of contactless payments, according to a survey from Mastercard.

Consumers have flocked to contactless payment methods for a variety of reasons, including health-related concerns. The Mastercard survey found that half of consumers worry about the cleanliness of signature touchpads and 72 percent prefer to skip signatures altogether, making tap-and-go or touch-free payment methods more desirable.

Moreover, this expanded use of contactless payments is expected to continue beyond COVID-19, with 56 percent of U.S. consumers reporting that they will continue using contactless after the pandemic. And with 9 of the 10 largest U.S. issuers actively rolling out new contactless cards, it appears that the market is starting to adjust accordingly.

Growing demand for delivery and online ordering

The pandemic has also impacted the food service industry with restaurants and groceries, in particular, relying on delivery and online ordering like never before.

Since March, 42 percent of restaurants have added delivery services, often through partnerships with delivery firms. Overall, sales across the food delivery industry have increased by 51 percent since early March.

Online grocery sales and delivery are also on the rise, with more than 10 percent of U.S. grocery sales expected to come from online channels, by year end (double 2019 levels). It’s important to note that while grocery delivery has increased, many consumers now Buy Online Pick up In-Store (“BOPIS”).

Grocery stores are not alone in seeing a surge in BOPIS. Many retailers have embraced BOPIS and have even started curbside pickup options. By the end of 2020, curbside pickup is expected to become a $35 billion sales channel.

With consumers flocking to digital channels like never before, it’s no surprise that e-commerce is skyrocketing. In September, Amazon’s online sales increased by 43 percent year over year, reaching $60.4 billion in just that month. But it’s not just e-commerce behemoths like Amazon that are seeing remarkable growth. By the end of 2020, overall e-commerce sales are expected to grow by nearly 20 percent.

The striking growth of e-commerce has accelerated the shift away from physical stores to digital shopping by roughly five years, according to data from IBM’s U.S. Retail Index, and the fastest growing segment is baby boomers.

To seize the opportunity, community banks should go digital first

Consumers’ increased reliance on digital solutions presents an opportunity for community banks to attract new customers and strengthen existing relationships by offering the digital experiences that consumers desire.

For instance, “70 percent of consumers who are getting payment services or payment solutions elsewhere would prefer to use their community bank for those services if they were available,” explained Tina Giorgio, president and CEO of ICBA Bancard.

Part of the appeal is that consumers largely trust community banks to handle their financial data. “Community banks are seen as safer and more secure at protecting customer data. Whereas with the technology companies that offer digital services, consumers question what they are doing with their information; what they are doing with their data,” said Giorgio.

Survey work conducted by Mercator Advisory Group backs up the idea that consumers are eager to adopt digital banking solutions from their trusted financial institution. A survey from June found that if a consumer’s financial institution offered a mobile app that allowed the consumer to control when and how their credit card could be used (based on factors such as location, spend amount, and shopping category), nearly 41 percent of respondents reported they would be very likely or likely to use it. (Notably, nearly 60 percent of consumers reported that their financial institution does not currently offer such a service, or if they do, they’re unaware the service.)

Community banks not currently offering such a product should consider implementing one and their digital wallets should include more than just card controls, Giorgio advised. Transaction alerts, dispute resolution capabilities, the ability to pay your credit card bill, and financial management assistance should all be features that community banks include in their digital offerings, she explained.

The primacy of customer experience

Consumer expectations for convenient, simple, and seamless experiences are central to understanding the trends noted above and how community banks should develop their digital offerings.

Contactless payments illustrate this quite clearly. In addition to viewing touch-free payment methods as being safer, most consumers also regard them as being more convenient. For example, according to the Visa survey cited earlier, 69 percent of users find contactless transactions more convenient than those involving paper money.

Considering that contactless payments are up to 10 times faster than traditional payment methods, it is not surprising that consumers find them to be more convenient. Online shopping and beefed up delivery options offer similar levels of ease and convenience. Being able to order and receive goods without entering a store helps consumers conduct commercial activity on their own terms.

As community banks transition to digital-first strategies, the customer experience should remain front and center. As Giorgio put it, “the customer experience is the most important thing.”