The financial services industry is constantly evolving, and the way financial data is stored, shared, and used is no exception. To meet the expectations of consumers who want to streamline financial management, data traditionally stored in siloes is being aggregated. This data aggregation, along with data sharing, is crucial for a seamless customer experience.

To learn more about the trends and issues of the data industry, PaymentsJournal sat down with Justin Jackson, VP of Product Management at Fiserv, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

The importance of financial management

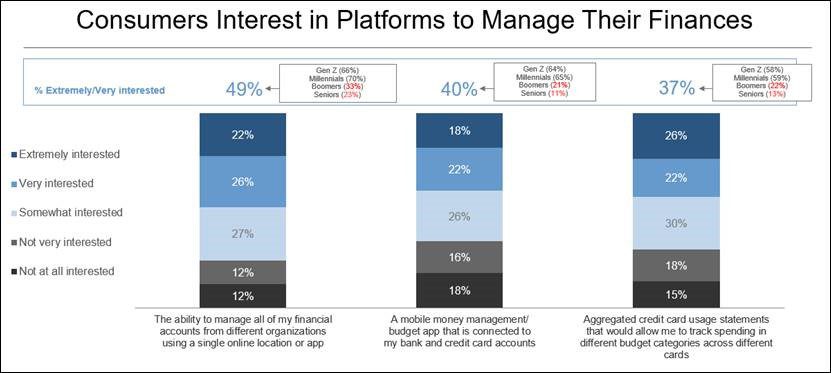

Consumers, and in particular those in younger demographics, want to have better insight into and control over their finances . A lot of consumers have fragmented financial lives. “Initial research shows that your average American consumer has many banking relationships—as many as three, four, or even five—and they want to manage all of those in one app where they can,” explained Jackson. Being able to see all of their accounts, cards, and budgets across bank relationships in one place gives consumers better insight into their finances.

The chart below, provided by Fiserv, highlights the interest level among consumers of consolidated financial management capabilities:

“What it’s really telling you is that people care about their financial picture, they care about their financial wellness, and they want to stay on top of it,” added Jackson. “But it’s particularly difficult because of that fragmentation, so they’re looking for solutions or providers that can help manage this.” This is especially true amid the ongoing COVID-19 pandemic, as Americans remain heavily impacted by unemployment, loss of income, and other budgetary constraints.

Being able to access data across different banking relationships is fundamental for consumers looking to better manage their financial lives. However, for a variety of reasons, including the industry’s efforts to maintain data security, data has historically been stored in siloes. For the consumer, this can result in the inability to access their own financial data when and where they want.

Data aggregation relies on a consumer-centric approach

Historically, there has been a belief that there is a trade-off between security and the customer experience. However, maintaining high levels of security and compliance does not have to be paradoxical to a customer-first approach. Secure data aggregation enables financial institutions to put the consumer first while protecting their financial data.

To understand how, it is important to distinguish data aggregation from open banking. “The divergence in the two topics is who sits at the center of the landscape,” noted Jackson. Open banking puts the financial institution at the center, bringing together data from thousands of account holders, transactions, balances, and other information through a set of APIs.

Data aggregation, on the other hand, puts the consumer at the center. It’s about one particular consumer who has a lot of different relationships with service providers and about “bringing that data together for the consumer to use in some particular use case or application they’re working with,” said Jackson.

By making data and APIs available, financial institutions of all sizes can enable account holders to work with financial providers of their choice and aggregate data across sources.

Liability hinders data sharing

Despite data sharing’s clear benefit to consumers, many financial institutions are hesitant to use it. Why is that the case? Oftentimes, concerns surrounding liability are to blame.

According to Sloane, “liability is frequently the brakes that stop innovation.” Financial institutions are wary of sharing data given the ambiguity surrounding liability in certain scenarios. For instance, how should liability be assigned if a consumer chooses to share their data with a third party and a security breach occurs? Due to a lack of universal standard, the answer to this question ends up being different from bank to bank.

Initiatives are underway that may address standardization. For example, the Consumer Financial Protection Bureau’s (CFPB) Oct. 22, 2020 issuance of its advance notice of proposed rulemaking (ANPR) asks the public to submit comments and information to assist the CFPB in developing regulations surrounding consumer access to financial records.

The ultimate creation of such regulations needs to be done with the consumers’ interests in mind. “If we think about [consumers] as being the center of all this, I think we’ll land at the right answer,” said Jackson.

Data must be shared securely

It’s been said before but is worth repeating: security is a critically important component of data aggregation. Part of securely sharing consumer data is transparency. “Security is paramount. Transparency with the consumer is paramount, making sure that they understand what’s happening and why,” explained Jackson.

Financial organizations need to be very clear with consumers about how and why they are sharing their financial data. Lawsuits filed surrounding data aggregation have largely centered on the alleged lack of transparency from institutions and consumer confusion about which of their data is being shared, who it’s being shared with, and how it’s being used.

Tokenization is another crucial component of data sharing security. Many financial institutions are moving to tokenize data to make it more secure when it is stored and shared, and are beinge more transparent with consumers about which companies have access to their data. “That transparency helps provide confidence and enables a financial institution to maintain a trusted relationship with the accountholder and protect that accountholder’s data,” said Sloane.

Data aggregation is made easier through a single access point

While financial institutions of all sizes are trying to move to APIs, it is often more difficult for smaller financial services providers to do so. At the same time, it’s important for them to empower customers to securely share their data and connect their accounts to third-party providers.

Secure portals, such as those available via AllData® Connect from Fiserv, enable consumers to consent to sharing financial data for third-party application activity. This simplifies the experience of staying on top of the expanding data aggregation market for banks and credit unions.

Fiserv helps its clients “understand the APIs [they] should use, the data [they] should collect, and the things [they] should stay away from, and helps them understand the pros and cons, risks, and problems they might set themselves up for down the road if they don’t think about those kinds of questions,” concluded Jackson.