Across all ages and income levels, there are significant numbers of people who are not satisfied with their financial health. Practically speaking, that can coincide with living paycheck to paycheck and feeling like managing finances is a burden.

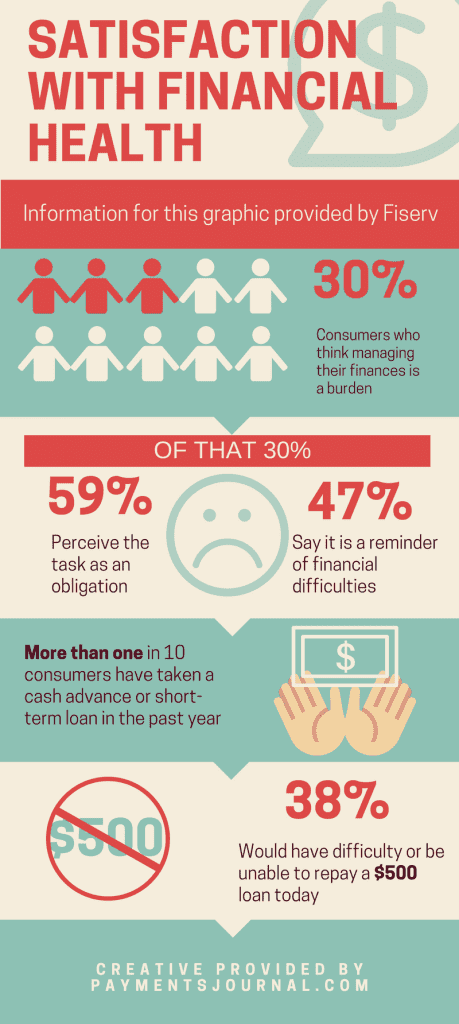

Expectations & Experiences: Household Finances, a quarterly consumer trends survey by Fiserv, found 30 percent of consumers consider managing money to be a burden – and 47 percent say “it reminds me of my financial troubles.”

A significant number of consumers also appear to have difficulty making ends meet. Thirty-eight percent of consumers – and half of millennials – say that would be difficult or impossible to pay back a $500 loan if they had to do so today. No wonder just 37 percent of consumers say they’re satisfied with their financial health, well behind their satisfaction with other areas of their lives.

People want moving and managing money to be easier, secure and in step with the way they live – and they’re likely looking to their financial organizations for help. While financial management remains a challenge for many consumers, the survey findings also underscored an openness to tools that offer consolidation and real-time access, including online or mobile apps that track spending and aggregate information from multiple accounts.

Conducted online by The Harris Poll on behalf of Fiserv, Expectations & Experiences is one the longest-running research studies of its kind and builds on years of consumer survey data.