In just five short years, Same Day ACH – Nacha’s faster payments solution – has gained remarkable traction, with the payments community putting it to work in several use cases.

To learn more about the creative ways Same Day ACH is making a difference in the move toward faster payments, PaymentsJournal sat down with Michael Herd, SVP of ACH Network Administration at Nacha, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Same Day ACH turns five years old

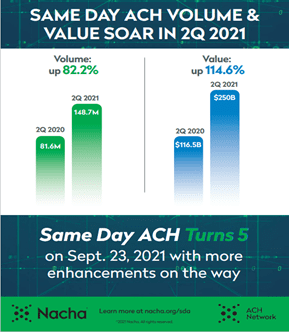

On September 23, 2021, Same Day ACH celebrated five years since its initial launch. Since then, the network has seen immense growth in both the number and value of payments made via Same Day ACH. This volume growth is apparent in the chart below:

“The main thing that these results show is that Same Day ACH has gone mainstream, and that we have entered another high growth phase of same day ACH,” explained Herd. While adoption rates were slower in the earlier years of Same Day ACH, increasingly widespread availability has contributed to its more recent rapid growth. In fact, the ACH Network continued to thrive and evolve even during the pandemic.

New use cases are contributing to this growth. “Same Day [ACH] use cases are built right into a payment processor service and are not an afterthought. And so I think that is a significant contributor to why we’re seeing some of the growth numbers that we are right now,” he added.

Quantifying the growth of Same Day ACH

In the first six processing days of September 2016, there were 1.3 million payments worth a total of about $1.5 billion transferred through Same Day ACH. In the first half of 2021, there were more than 291 million debit and credit Same Day ACH payments worth a total of $439 billion. Those figures are up 86.3% and 123%, respectively, from the first half of 2020.

“It really has had a significant impact and change of trajectory since we first launched it,” said Herd. The cumulative tally since its 2016 launch now stands at more than 1.2 billion payments transferring over $1.5 trillion.

“It’s worth realizing… that Same Day ACH comprises now about 2% of total ACH volume, and that the growth in non-Same Day ACH payments, which you might call standard ACH, exceeds the growth in Same Day ACH in absolute numbers,” acknowledged Herd.

Nonetheless, the growth rate of Same Day ACH is impressive. “It seems like the growth rate is actually accelerating. And I would expect that to start to moderate at this stage of its product lifestyle, but I think Same Day ACH as well as traditional ACH have really just been swept up in the whole overall digitization of payments,” said Grotta.

Continuous enhancements add to the value of Same Day ACH

Same Day ACH has undergone multiple enhancements since its September 2016 launch. “We’ve continually increased the capabilities and the features of Same Day ACH every year, adding debit processing, speeding up funds availability, increasing the dollar limit, and expanding the available hours. So that’s kind of where we are today,” explained Herd.

Up next is yet another increase in the dollar limit, which will go into effect in March 2022. This change will raise the dollar limit for Same Day ACH to $1 million per payment. “To me, the increase in the dollar limit suggests that the organization is very comfortable with the fraud limits that have been occurring thus far, and so you’re feeling more comfortable and allowing higher dollar values to flow through the network,” added Grotta.

Creative ways businesses are utilizing Same Day ACH

In the earliest years, consumer disbursements such as payroll and insurance payouts were the main growth drivers for Same Day ACH. Now, more use cases are emerging. “We’ve really seen a shift in where the growth is coming from, and we’re seeing large scale adoption and transaction types that represent bill payment and account-to-account transfers both for consumers and businesses,” said Herd.

One innovative Same Day ACH use case that has emerged comes from the fintech ExcheQ, which uses the ACH rail to allow its customers to send money by phone. ExcheQ uses Same Day ACH to allow for immediate notification and real-time settlement.

But that’s not all. “We see billers that are adopting Same Day ACH to collect funds more quickly,” said Herd. “The pandemic has driven a lot of additional bill payment activity. Many, if not most, billers provide consumers with immediate credit for bills paid at the biller’s website. So, when using Same Day ACH, they can collect funds more quickly for credit that they’ve already given to a customer,” he continued.

Insurance claims and disaster relief payments can also get to those who need them faster by using Same Day ACH. B2B payments can be made the day they are due, consumers can quickly transfer funds as they are needed, and payroll can be processed immediately. It is also useful in ad hoc emergency scenarios such as payroll errors or for immediate payment of terminated employees.

Even the IRS has benefited from Same Day ACH, using it to pay over 430,000 beneficiaries of Advanced Child Tax Credit payments. “In September, the IRS did use Same Day ACH to pay a small percentage of beneficiaries that they had missed for the September regularly scheduled payment… I think what’s significant about that is that it’s the first time that we’ve seen use of Same Day ACH by the U.S. Treasury at any scale,” explained Herd.

With growing value, use cases, and impact, the future is bright for Same Day ACH. “I still think there’s a lot of strong growth areas for ACH and Same Day ACH in our future,” Herd concluded.