Key Performance Indicators (KPIs) are a set of metrics that are used to measure several things. They can tell retailers about the overall health of their loyalty and payments programs or show business owners where they should invest more of their capital. Knowing how to use the customers’ data to measure the success of certain aspects of a business model enables retailers to identify new opportunities and solve problems, enforce accountability across the organization and ecosystem, and quantify return on investment (ROI).

To further discuss the importance of KPIs in driving the success of a business, as well as how share of wallet can help measure that success, PaymentsJournal sat down with Aaron McLean, Chief Marketing Officer at Stuzo, and Raymond Pucci, Director of Merchant Services at Mercator Advisory Group.

Share of wallet indicates growth in customer lifetime value

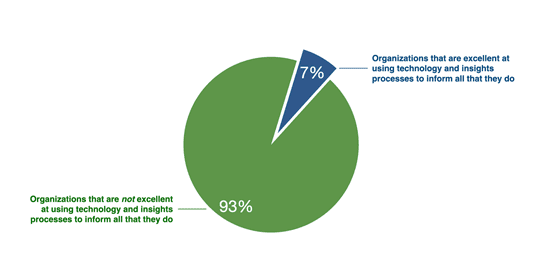

There are a lot of KPIs that retailers can measure, but 93% of organizations do not excel at using technology and insights processes to inform all that they do. Stuzo believes that an 80/20 rule applies to these measurements. That is, 80% of the value can come from measuring the appropriate 20% of KPIs.

There are a few KPI subsets in particular that are important: new member acquisition rates, transaction volume, purchase behavior, engagement rate, and visit frequency. However, perhaps the most important key performance indicator is incremental growth in share of wallet. “This is critically important as growth in share of wallet is a leading indicator for an increase in the ultimate KPI, which is growth in customer lifetime value,” explained McLean.

So, what is share of wallet? Customers have a variety of wallets across categories they shop, whether it be food, fuel, CPG, or household goods. The percentage of any of these wallets that is owned by a specific retailer is that retailer’s share of wallet. On the other hand, wallet opportunity is the total amount of a wallet that is not owned by a specific retailer. Customer wallets are also distributed across retailers that span multiple categories.

Wallet capacity is what Stuzo defines as the upper limit of a particular wallet. For most consumers, the wallet capacity doesn’t fluctuate much month-over-month.

The process of securing a larger share of the wallet opportunity is known as Wallet Steering™. Stuzo has its own proprietary Wallet Steering System, “which is a combination of our Open Commerce® product suite, our Know and Activate Method, and our program management services, all of which are designed to work together seamlessly to help retailers acquire a greater share of their customer wallets at scale and profitably,” concluded McLean.

“The Wallet Opportunity”

There are two key types of data that retailers acquire from their customers to understand the wallet opportunity: zero-party and first-party. Zero-party data is the data a customer gives the retailer proactively, such as responses to a survey, while first-party data is data collected by the retailer and tracked behind the scenes with the customer’s consent. “The key to acquiring wallet data and making it actionable, is having a unified technology that spans payments, loyalty, and the cross-channel customer experience,” explained McLean.

The challenge here is that many retailers have different categories of data stored in separate places, which makes it difficult to build a holistic understanding of the customer, their behaviors, their wallets, and particularly the retailer’s share of wallet and wallet opportunity. Additionally, a non-unified technology stack makes it almost impossible to acquire and activate all the wallet and behavioral data in real time.

“With access to unified data, retailers can then get to work on intelligently activating that data to steer a greater share of wallet to their brand,” added McLean. Similarly, merchants must leverage this data to best understand their customers and sustain customer engagement.

How should retailers prioritize KPIs?

The first step retailers should take in prioritizing KPIs is to align stakeholders to targeted business outcomes. Once there is alignment across the program , the next step is to develop a series of goals and milestones that will drive the business toward the intended outcomes.

McLean offers the following example: A retailer has the goal of growing its program membership by 150% over a certain period of time. To achieve that goal, the retailer needs a set of KPIs that enables them to measure their performance against that goal. The retailer will need the ability to measure their KPIs accurately, as well as a consistent method for reporting on each of their KPIs and how they are driving the retailer toward their goal. Some KPIs may be measured daily, while others may be assessed weekly or monthly. Then, the retailer needs a baseline for performance, or a minimum threshold that needs to be met to ensure they are on track to meet their goal.

“There are a lot of ways to analyze customer data so that you’re really understanding who the customers are, but most importantly, what their buying patterns and behaviors [are],” finished Pucci.

The industry’s only loyalty and payments performance guarantee

McLean then responded to PaymentJournal’s question regarding what was behind Stuzo’s recent money-back Performance Guarantee announcement. “We are so confident in our Wallet Steering System and our ability to drive meaningful business outcomes for our retailer partners, that we’re putting our money where our mouth is. For retailers that make the switch to Stuzo, we guarantee a 1.5X lift in enrolled members and transactions,” McLean noted. For more information, retailers are encouraged to visit www.stuzo.com.

What’s next for Stuzo?

With its new strategic investment from Longshore Capital Partners, Stuzo is doubling down on the unification of loyalty, commerce, and the cross-channel customer experience. The technology company is also focusing extensively on its commitment to delivering business outcomes at scale for all Stuzo retail partners.

“We know that the most value is unlocked for retailers when digital payments, loyalty, and CX are powered by a unified platform, and we can activate data from across the unified stack,” assured McLean. This is the goal that Stuzo is working toward with its new partners at Longshore.

The experts at Stuzo will continue to strive to keep a promise made to its retailer partners: to help them turn their data into dollars.