Since the start of the pandemic, the ACH Network has worked diligently to support changing and growing needs of the payments industry. With an uptick in Direct Deposits and the volume of per day transactions ACH payments thrived in 2020 and show few signs slowing down.

To further discuss the “new normal” of ACH payments and what the future of the payments industry will look like for both businesses and consumers, PaymentsJournal sat down with Michael Herd, Nacha SVP, ACH Network Administration and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

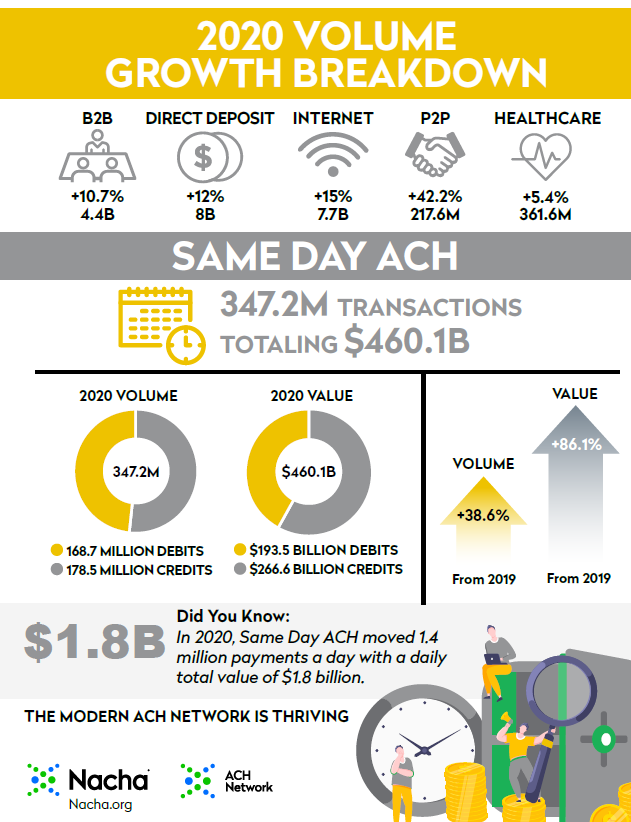

ACH Payments on the rise

2020 was a record setting year for the ACH Network. For the first time ever, payment volume increased from one year to the next by over 2 billion payments, with a total of nearly 27 billion payments for the 2020 calendar year. To put that figure into perspective, it equates to about 81 payments per each U.S. citizen.

“ACH has been in a high growth phase over the past five years or so, even before the events of 2020.” Normally, the impact on the economy directly correlates with the impact on the payments system. For example, if unemployment rates are high, there will be fewer payroll payments and purchases. But this is not what the payments industry saw from 2020.

“Unemployment benefit payments, economic assistance payments, and other types of assistance payments to the economy more than made up for the loss of payments due to the impacts on payrolls,” explained Herd. Distributing many of the first-round stimulus payments via checks through U.S. mail proved to be highly problematic, leading to a greater initiative by the government to find new ways to make payments electronically and remotely. This initiative certainly gave the payments industry an additional boost in its already thriving transaction ratio.

Are pandemic payments trends here to stay?

While there are numerous COVID-19 related reasons for the swift changeover of many to electronic payments, experts don’t expect the payments industry to go back to its pre-pandemic methodology once the virus is under control.

“Part of the challenge over the years is [getting]…consumers, businesses or small businesses, or government agencies or nonprofits to change practices,” said Herd. “This is what we spend a lot of time on [educating] the industry, trying to convey and quantify the benefits of making the change [to ACH]. But you still have to convince parties [that] it’s in their interest to make the change.”

While there is still a future for in-person business, a lot of the changes are expected to be lasting. Both merchants and customers have become accustomed to new practices, such as e-commerce and contactless payments. Additionally, the majority are having a better experience in relation to the way they make and receive payments.

“I’m optimistic that those types of changes will be longer term,” concluded Herd.

Same Day ACH payments are thriving

It appears to be yet another strong year for Same Day ACH, and the ongoing adoption of it doesn’t seem to be slowing down any time soon. “We had nearly 350 million Same Day payments on the ACH Network in 2020, moving about $460 billion,” said Herd. “And there the interest is still in expanding the capabilities.”

In 2020, the ACH Network saw its first dollar limit increase for Same Day ACH payments, the allowable limit increasing to $100,000, four times the previous allowance of $25,000. “We saw an immediate impact of that change where the average amount of a Same Day ACH payment increased by about 40% in just one month,” explained Herd, leading to a quite large dollar volume increase for the calendar year.

On March 19, 2021, the ACH Network is set to implement some additional positive changes. It is expanding the operational hours for Same Day ACH, available on every business day. “And then looking further out into the future, we just closed out a public request for comment on further increases to the Same Day ACH dollar limit,” added Herd. Nacha received over 100 responses from various parts of the industry, a sign that there is interest in Same Day ACH. Herd is hopeful that it is possible for an increase to be approved during the first half of the 2021 calendar year and go into effect in 2022.

2021 outlook for the ACH Network

The ACH Network became the primary source for which the federal government made stimulus payments and provided assistance to individuals, homes, businesses, and hospitals, with a lot of aid flowing through the ACH after the passing of the CARES Act at the end of March 2020. There was an additional round of assistance approved in December (and distributed in January 2021) , which combined produced about 225 million economic assistance payments made by Direct Deposit, just in those two rounds alone. Most of the second round payments occurred via Direct Deposit over the course of one day, adding an extra day’s volume to the ACH Network.

“It really shows the industrial strength of the ACH Network to move massive volumes of payments to virtually any bank or credit union account, in a very, very short period of time,” admired Herd. And the experience was an overall success for nearly every American receiving funds, as well as those distributing them.

“We’re tracking what might happen with a new administration and a new Congress. They seem inclined to continue to provide assistance to the economy and to individuals with additional EIPs being one form,” added Herd. With their 2020 experience, the ACH is ready to take on similar challenges in 2021.