PSCU, the nation’s premier payments credit union service organization, has updated its weekly transaction analysis from its Owner credit union members on a same-store basis to identify the impact of COVID-19 on consumer spending and shopping trends.

To provide relevant updates on market performance, experts from PSCU’s Advisors Plus and Data & Analytics teams today released year-over-year weekly performance data trends. In this week’s installment, PSCU compares the 20th week of the year (the week ending May 17, 2020 compared to the week ending May 19, 2019).

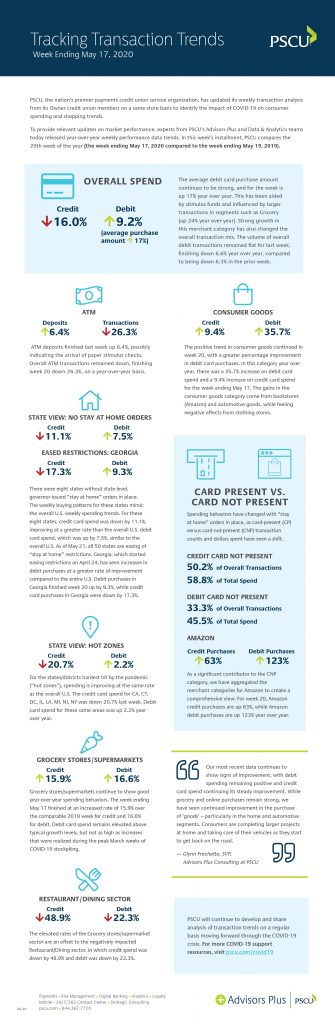

- Overall credit card spend was down 16.0% compared to the same week last year, and overall debit card spend was up 9.2% year over year. For credit, it was the fifth consecutive week of strengthening results. For debit, it is the fifth consecutive week of year-over-year positive growth.

- The average debit card purchase amount continues to be strong, and for the week is up 17% year over year. This has been aided by stimulus funds and influenced by larger transactions in segments such as Grocery (up 24% year over year). Strong growth in this merchant category has also changed the overall transaction mix. The volume of overall debit transactions remained flat for last week, finishing down 6.6% year over year, compared to being down 6.3% in the prior week.

- The positive trend in consumer goods continued in week 20, with a greater percentage improvement in debit card purchases. In this category year over year, there was a 35.7% increase on debit card spend and a 9.4% increase on credit card spend for the week ending May 17. The gains in the consumer goods category come from book stores (Amazon) and automotive goods, while feeling negative effects from clothing stores.

- ATM deposits finished last week up 6.4%, possibly indicating the arrival of paper stimulus checks. Overall ATM transactions remained down, finishing week 20 down 26.3%, on a year-over-year basis.

- Spending behaviors have changed with “stay at home” orders in place, as card-present (CP) versus card-not-present (CNP) transaction counts and dollars spent have seen a shift.

- In week 20, credit CNP transactions accounted for 50.2% of overall credit transactions and credit CNP purchases accounted for 58.8% of the total spend, up significantly from 32.1% and 45.9%, respectively, year over year.

- Debit CNP transactions accounted for 33.3% of overall debit transactions and debit CNP purchases accounted for 45.5% of the total spend, up significantly from 20.1% and 33.3%, respectively, year over year.

- As a significant contributor to the CNP category, we have aggregated the merchant categories for Amazon to create a comprehensive view. For week 20, Amazon credit purchases are up 63%, while Amazon debit purchases are up 123% year over year.

- As of May 21, all 50 states are easing of “stay at home” restrictions. Georgia, which started easing restrictions on April 24, has seen increases in debit purchases at a greater rate of improvement compared to the entire U.S. Debit purchases in Georgia finished week 20 up by 9.3%, while credit card purchases in Georgia were down by 17.3%.

- There were eight states without state-level, governor-issued “stay at home” orders in place. The weekly buying patterns for these states mimicked the overall U.S. weekly spending trends. For these eight states, credit card spend was down by 11.1%, improving at a greater rate than the overall U.S. debit card spend, whichwas up by 7.5%, similar to the overall U.S.

- For the states/districts hardest hit by the pandemic (“hot zones”), spending is improving at the same rate as the overall U.S. The credit card spend for CA, CT, DC, IL, LA, MI, NJ, NY was down 20.7% last week. Debit card spend for these same areas was up 2.2% year over year.

- Grocery stores/supermarkets continue to show good year-over-year spending behaviors. The week ending May 17 finished at an increased rate of 15.9% over the comparable 2019 week for credit and 16.6% for debit. Debit card spend remains elevated above typical growth levels, but not as high as increases that were realized during the peak March weeks of COVID-19 stockpiling. These elevated rates are an offset to the negatively impacted restaurant/dining sector, in which credit spend was down by 48.9% and debit was down by 22.3%.

“Our most recent data continues to show signs of improvement, with debit spending remaining positive and credit card spend continuing its steady improvement,” said Glynn Frechette, senior vice president, Advisors Plus at PSCU. “While grocery and online purchases remain strong, we have seen continued improvement in the purchase of ‘goods’ – particularly in the home and automotive segments. Consumers are completing larger projects at home and taking care of their vehicles as they start to get back on the road.”

PSCU will continue to develop and share analysis of transaction trends on a regular basis throughout the COVID-19 crisis.