With the ambiguity around Forgiveness Calculations and the flurry of reporting over the past week, the industry is preparing for the first wave of applications starting on May 28, 2020. Here’s an excerpt on quotes from the industry, courtesy of two recent articles in American Banker and Bloomberg (Olivia Rockeman).

Valley National Bancorp, CEO Ira Robbins: “Hopefully it doesn’t all come at one time and we can stagger it over a period of time, but I do believe there’s going to be a lot of hand-holding associated with it as you walk through it.”

Head of U.S. operations at Funding Circle Holdings, Libby Morris “The 11 page [PPP Forgiveness Calculation] document is complex, so it will fall to lenders to help borrowers complete it, I would equate this to just as heavy if not a heavier lift to processing the loans themselves!”

Piermont Bank CEO Wendy Cai-Lee, said her bank spent hours deciphering SBA requirements to create a worksheet for borrowers.

What’s required is likely a bit more complicated than what SMBs are prepared to handle, and many will either need professional or bank help to get it right, according to Dan Speight, CEO Planters First Bancorp.

Boss Insights uncovered three key areas that can dramatically affect a borrower’s forgiveness amounts. We’ve outlined them below to demonstrate the challenges ahead. With so much uncertainty, many are waiting for more guidance. With an automated PPP Forgiveness platform, such guidance can be applied instantaneously, and these issues are avoided, enabling a more streamlined borrower experience.

Here are the examples:

- High-Earners Discrepancy

- Safe harbor Case

- Two Calculation Approach

1. High-Earners Discrepancy

With respect to PPP, employees earning more than $100,000 are considered high earners. Previous guidance implied penalties for reducing all employees payroll by 25%, including high-earnings if lowered below $75k, but the calculation method chosen with “Table 2” inadvertently emphasizes the starting salary and incentivizes reducing high earners’ compensation over lower.

| INTENDED RULE | INADVERTENT RESULT |

| Employees are capped to $100,000 annual salary in the PPP forgiveness calculation. | Reducing a high-earner’s salary does not similarly reduce the forgiven amount as reducing a non-high earner’s salary would. |

How this happened:

It’s all in Schedule A, Table 2. Whereas Table 1 looks at salaries below $100,000 and includes the forgiveness amount if their salaries drop below 25% of original levels, this is surprisingly absent from Table 2 which covers salaries over $100,000.

Example:

A borrower has two employees Ron and Olivia. Ron earns $99,999 and Olivia earns $150,000. If both Ron’s and Olivia’s salary are lowered to $50,000, Ron’s salary reduction of $49,999 is not forgiven, however Olivia’s will be.

2. Safe Harbor Case

The SBA wording on safe habor was intended to incentivize employers to get their employees working at original wages before COVID by June 30, 2020. However, the rule allows employers to act against this intention.

| INTENDED RULE | INADVERTENT RESULT |

| Borrowers are incentivized to rehire employees to February 15, 2020 levels by June 30, 2020. | Borrowers will receive the maximum forgiveness calculation even if they rehire employees only on June 30, 2020. If they lower employee hours before or immediately after, they still receive maximum forgiveness. |

How this happened:

Because the SBA guidance for safe harbor is to assess Full Time Employee (FTE) levels or wage reduction levels at June 30, 2020, there is a consequence where the period before and after are not looked at.

3. Two Calculation Approach

| INTENDED RULE | INADVERTENT RESULT |

| Help SMBs complete forgiveness applications by providing a simple and complex approach to based on mathematical complexity. | Using each approach can lead to different forgiveness calculation outcomes. |

How this happened:

First a few explanations about the calculation methods. For the examples below FTE means Full Time Employee.

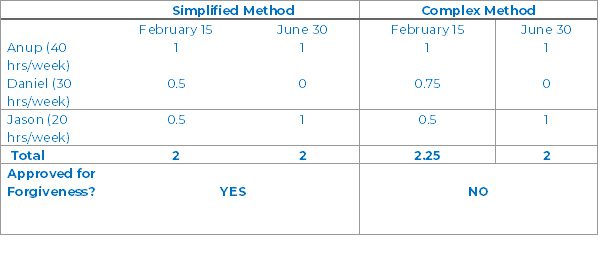

In the simple method:

- FTE = 1 for an employee working a 40 hour week

- Non-FTE = 0.5 for anyone working less than 40 hours a week. They could work 1 hour or 39 hours but would be considered 0.5 FTE.

In the complex method:

- FTE = 1 for an employee working a 40 hour week

- Non-FTE = proportional hours based on anything less than 40 hours per week (example: 30 hours is 0.75 FTE, 10 hours is 0.25 FTE)

These calculation differences lead to different amounts forgiven, sometimes favoring the simple method and other times favoring the complex method. We’ve explained with one example below.

Example:

Anup, Daniel and Jason are all employees. Anup works 40 hours, Daniel works 30 and Jason works 20. In this case, the simplified method will provide the borrower with access to Safe Harbor, but the complex method would not. If Daniel is let go during the loan period and Jason becomes full time. There will be a difference between these two approaches. That’s because under the simple calculation, the total FTE is 2 FTE at February 15 and June 30, so there is no reduction in FTE. In the complex method the total FTE is 2.25 at February 15 and 2 at June 30. This reduction causes the discrepancy.

At best, the process is complex and time consuming. At worst, it’s error prone and will lead to audits. Lenders should adopt a truly automated forgiveness platform and strive to keep manual processes to a minimum by imploring the cloud and APIs for a modern, faster time-to-market solution that delights customers per a Mckinsey report.

How to Combat PPP Forgiveness Calculation Complexity

The complexity in PPP Forgiveness Calculations stems from the manual data collection, iterative manual nature, and detailed level of calculations required. A platform automating this data Intake and forgiveness calculation eases the burden on the borrower by providing instant results. Borrowers can immediately see their forgiveness calculations upon connecting their data, and lenders can instantly generate the 1502 form and obtain PPP processing fees from the SBA.

PPP is an emergency measure. Legislation that normally takes years to pass was passed in weeks. Then, over 5400 financial institutions, one-third of the lenders in the US, supported almost 3 million borrowers in under two months with one lending product that didn’t exist 2 months ago. There are bound to be areas for concern and audit committees have already been formed. For anomaly cases like these, auditors will need transparency on calculations and approaches taken for a full paper trail.

Achieving clarity on forgiveness has resulted in an incredible amount of collaboration between borrowers, lenders, fintechs and advisory firms. Borrowers voice needs and key feedback. Lenders provide the funds. Fintechs provide the functionality. And Advisory firms offer support and guidance to both lenders and borrowers in this ambiguous time. It will take all pieces of the puzzle to make it through the challenges over the next few weeks. Boss Insights’ hope is that this spirit of collaboration will continue, so to best serve our community businesses going forward.