Following last June’s acquisition of the largest provider of gift card solutions in the U.S., Gift Card Impressions (GCI) by InComm, the leading payments technology company, PaymentsJournal sat down with GCI’s founder and CEO, Brett Glass.

GCI was the latest acquisition by InComm, who last January announced it added to its catalog brands such as Barnes & Noble, Carrabba’s Italian Grill, Outback Steakhouse, and Sephora The GCI team brings knowledge from their research and experience in the consumer packaged goods industry. By keeping the company’s management intact and located in their original Kansas City headquarters, InComm hopes to “drive the growth of physical and digital gift card sales,” according to a day-of-purchase press release.

For GCI, which is “bringing the gift back to gift cards™,” the next big thing is micro gifting, or “a gift that’s under $20,” says Glass. “We estimate that about 26% of all gifting is in the form of a micro gift. Today we think the gift card industry is very underserved in this segment.”

Getting the concept of micro gifting off the ground obviously requires an angle that’s both consumer-friendly and business-savvy. Personalization and Engagment is the name of the game, according to Glass.

“How do you give a gift that’s worth $7 or $12 but still make it exciting? You’ve got to change the game in the way you deliver that, and so our vision is to make it more product- or item-focused.”

Glass provides the examples of two movie tickets or a Cosmo cocktail at the giftee’s favorite restaurant. That level of customization personalizes the gift and improves the experience compared to the denomination-focused gift cards as they stand today.

According to a 2017 Mercator report, the concept of gift cards is alive and kicking—with gift card loads growing by 6% in 2016 and expected to reach $100.6 billion by 2021.

The report points out that closed-loop gift cards continue to be popular for retailers and their customers and indicates that the closed-loop gift card market has opportunities to continue to grow as retailers learn new ways to make use of their branded currencies in omnichannel commerce.

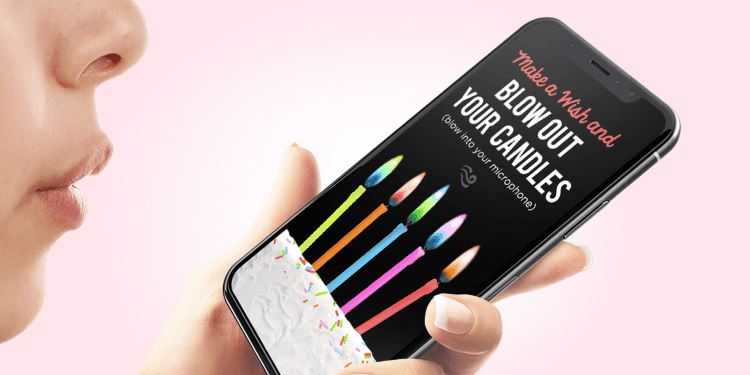

One example of an innovation provided by GCI: an iPhone-delivered virtual birthday cake with virtually burning candles. Glass explains: “We’ve created an algorithm that converts the decibel level recorded at the microphone to the equivalent of wind speed. So you literally get to blow out the birthday candles by blowing into the phone’s mic.”

Once the giftee finishes blowing out the virtual candles, a personalized micro gift is delivered, in the form of a drink, an appetizer, or movie tickets, Glass says.

This example of extreme personalization has another benefit: fraud reduction, according to the CEO.

“A highly personalized transaction that gets delivered with some of [GCI’s] haptic capabilities has virtually no fraud compared to just the delivery of a gift card code today.”

GCI customized gift cards are delivered via the Gift Tokens app, which Glass calls a “white-label solution” and which offers another innovation: no more rectangular cards. “We make them round,” says Glass, which consumers will notice over the card’s denomination. And Glass as mentioned earlier, GCI cards are expanding beyond the days of the traditional $25 or $50 gift card: “It’s a cup of coffee, or two movie tickets, or a milkshake. Those types of marketing techniques still function like a gift card.”

The monetary value remains the same, which allows customers to exchange their gift for something of similar value. Glass gives the example of a personalized Chipotle card. “Say I send you a burrito. If you want to go in and use it on a bowl and not a burrito, you certainly can. We work with each brand to have a default value.”

The gift card app also allows personalization in the form of various haptic delivery capabilities. These can be demonstrated by clicking on the menu button in the upper-right-hand corner of the app, and then on the demo button.

If micro gift customization is important, then consumers’ reactions—yea or nay—are the ultimate “report card,” says Glass. In GCI’s attempts to earn an A grade, the company measures how a giftee responds on social media—namely, whether the micro-gift is “shareable” and/or worthy of a five-star review.

“Should it be object- or product-marketed versus denomination-focused offers and coupons?” ponders the CEO. “All of these forms of stored value will be used interchangeably, and one thing they all have in common is they’ll get delivered in a much more engaging and personalized manner that our technology can drive.”

GCI currently holds 96 patents and has “dozens still pending. These patents on the physical side can be everything from paper engineering techniques that can help make the gift card the star of a physical package, to 3D, pop-up boxes that deliver the Gift Card” says Glass.

Another example of the company’s innovation: a virtual beer. GCI’s patented technology allows a giftee to receive a virtual beer via text on their phone. The recipient tilts their phone, just like they were drinking a real beer and after they finish the virtual beer, they receive a Gift Card good for a real beer at leading restaurants. “There’s a whole host of patents that really talk about user-generated content in a personalized gift card. That content then can be delivered via touching and swiping and shaking and tilting and blowing into your microphone,” says Glass. The stored value is then delivered, allowing the receiver to use it at that moment or sometime in the future.

Because of InComm’s reputation as a an innovative payment technology provider, the CEO is enthusiastic about the acquisition. “GCI is well known for really driving innovation, but we’re seen as not a very big company. And so you join the very innovative and significant number of issued patents that GCI has with the scalability and breadth of market presence that InComm has, and it’s a natural fit.”

Down the road, Glass sees expansion for both companies: “[The acquisition] will now allow us to really accelerate adding value to our clients in third-party, but also in first-party and also in the B2B channels.”