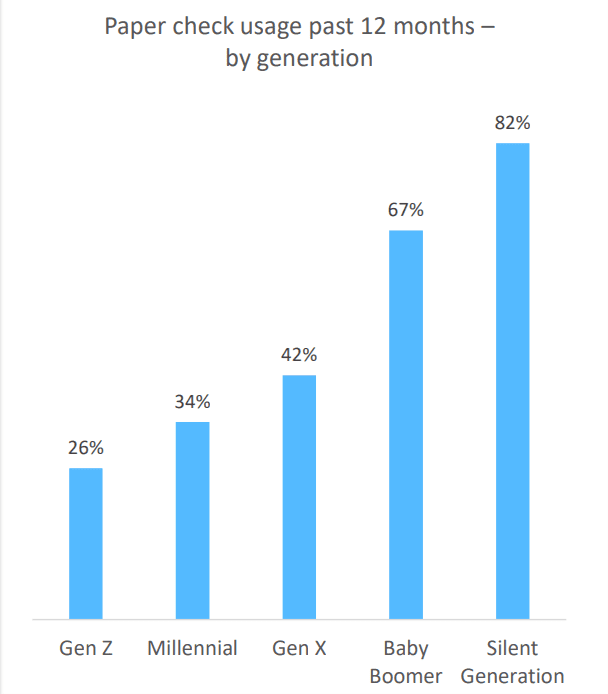

Americans may not make it a habit to carry around a checkbook anymore, but paper checks still have their significance. Many have replaced paying back their friends by check with utilizing mobile apps such as Zelle and Venmo. However, the matter depends on which friend you are paying back. The Silent Generation is more likely to appreciate a personal check than a millennial.

According to an article posted to AOL, a recent GOBankingRates survey discovered that 45% of respondents have not written a single paper check in the last year, followed by 23% of respondents who only wrote one check per month.

It is clear people are not using checks for everyday spend anymore—such as paying for groceries. However, checks are still important and have their place in society. Of the 23% of respondents writing one check per month, that single check is most likely for a rent or mortgage payment, which are a lot more expensive than a grocery store purchase. It is possible to make a rent or mortgage payment using a card, but the cardholder is subject to around a 2.85% fee that they must cover. With current dynamics, it simply does not economically make sense to use digital payment forms to pay for rent and mortgage bills.

Rent and mortgage may not be the only use case for check payments. Mercator research found that when card payments are not an option, 47% of respondents utilize paper checks. Electronic checks tie with paper checks at 47% of respondents using electronic checks when card is not an option. With the death of paper checks in question, it is interesting to find that electronic checks tie with paper checks. Perhaps paper checks are not dying as quickly as originally thought.

With the usage of electronic check in jeopardy, it will be interesting to see if personal checks follow the trend. Unless major changes are made to the way payments can be made for popular check-payment purchases, such as rent and mortgage, paper checks are here to stay.

Overview by Sophia Gonzalez, Research Analyst, Debit Advisory Service at Mercator Advisory Group.