Similar to what has been happening in the consumer realm over the past decade, traditional financial institutions have seen a growing number of small-to-medium sized businesses (SMBs) flock to fintechs and digital neobanks to meet many of their financial needs. One major reason for this exodus is that the legacy technology infrastructure inherent in many banks and other traditional financial providers does not allow for quick and easy development of new digital products and services.

How this problem can be overcome was part of a broader discussion about what kind of technology SMBs want when it comes to managing their finances in a recent PaymentsJournal webinar titled “SMB Banking Disruption and Innovation: What SMBs want, how their needs shift and how to win using a customer first approach.” The webinar featured a lively discussion between Brian Riley, Director of Credit Advisory Services at Mercator Advisory Group, and Scott Johnson, the Head of Strategic Expansion at Galileo Financial Technologies, an API-based card issuing and payments platform.

SMBs Look Beyond Traditional Providers

A major part of the discussion was around how SMBs are looking beyond the traditional financial providers to meet their banking and payments needs. One sobering statistic that was shared, which came from a survey of small businesses done by consulting firm 11:FS, is that only 18% of small businesses say they “completely agree” that banks are providing the services they need to effectively run the financial side of their business.

“Overall, SMBs are not happy with the services that banks provide,” said Johnson, adding that with about 33 million small businesses in the U.S., this is a very large and potentially lucrative market.

SMBs are increasingly looking for one single platform to manage their entire financial lives; currently many small businesses use multiple different providers for different financial products and services.

“Businesses want to be able to manage their cash flows and make day-to-day business decisions based upon their entire financial health,” said Johnson. “And then they want that lending component, or a credit component as needed to help them build their businesses.”

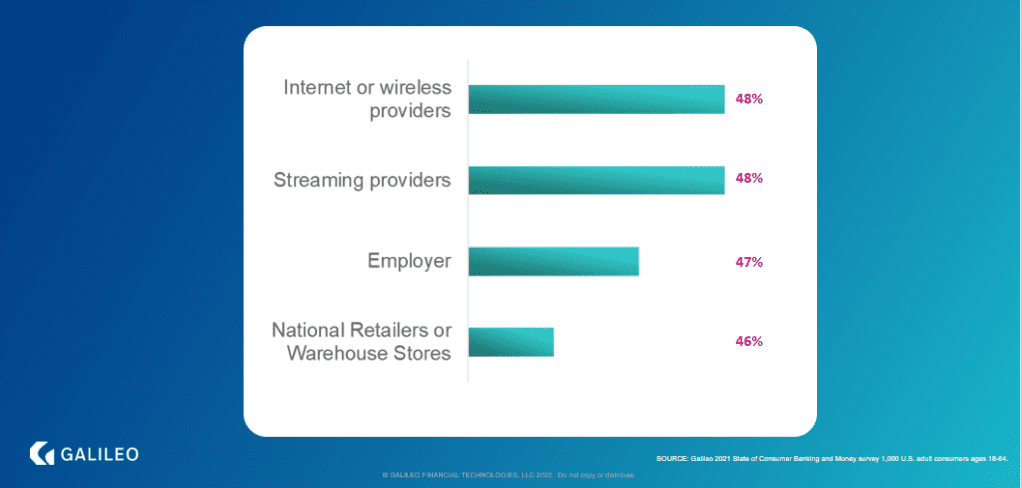

Both panelists noted that this trend mirrors what is happening in consumer banking, where many are turning to digital-first upstarts for services like BNPL, budgeting, and embedded finance that banks do not offer. In one poll shared during the webinar, nearly 50% of consumers reported they would use an internet or wireless provider, or a streaming service, for financial needs. About as many said they would use a national retailer or even their employer for financial services.

“Small business owners are consumers too, and they want those same types of experiences they’ve come to expect from challenger neobanks,” said Johnson. Small businesses also want flexible access to credit when they need it, mirroring the rising popularity of BNPL platforms among consumers.

The Rise of Embedded Finance

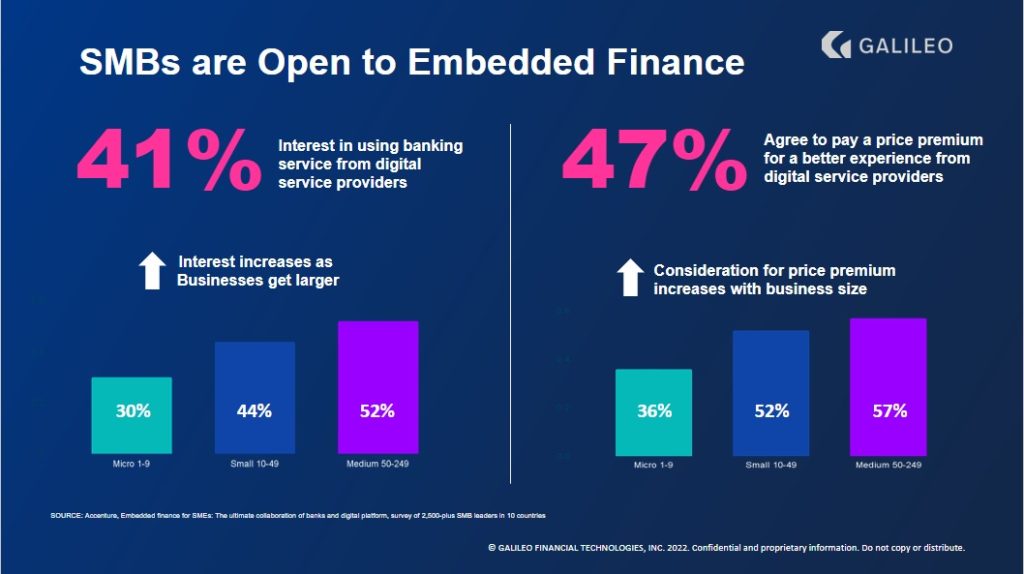

One area of particular interest for small businesses is embedded finance and embedded payments. Nearly half of small businesses even said they would be willing to pay a price premium to a digital provider for such services.

Riley noted how the embedded payments experience in a service such as Uber is seamless and intuitive for the user, who doesn’t even have to think about the payment.

“Embedded payments are somewhat of an elusive word, and you probably already experienced them without even knowing it, whether you’re arranging a car service, [or] really [doing] anything in the gig economy,” said Riley.

Small businesses want to be able to offer these embedded experiences to their customers but are often unable to since their banking provider may not offer these digital capabilities.

Johnson mentioned Toast – a point-of-sale hardware provider mostly serving the restaurant industry – as an example of a company doing a good job providing embedded finance to its business clientele.

“They do an amazing job of not only providing an incredible experience for the restaurant to be able to manage everything they need to at the restaurant, but they’re able to now integrate payments holistically into that experience,” he added. “They are able to get so close to their customer that they can even offer a lending product to a restaurant owner because they’re seeing how many sandwiches were sold.”

Johnson continued: “That’s why now they’ve embedded everything within their platform and their product offering. And that’s where we’re seeing these types of really cool embedded finance solutions start to grow, because, again, these solutions are so tied in you don’t even think about it.”

Ultimately, small business owners want to manage the whole continuum of their financial lives – from lending and savings needs, to asset protection to running the business and embedded finance – all from one provider.

How Banks can Overcome Legacy Systems

Banks are well positioned to be that sole provider, since they have a long history with their business customers and are generally seen as more trusted when compared to digital startups. But banks can struggle to offer the embedded digital services their small business clients want due to legacy infrastructure.

“A lot of the infrastructure and plumbing has been around for nearly 40 years,” said Riley, adding that the different data silos internally at banks make it difficult to innovate.

“I think of the days when I was at [a Big Four Bank] a couple of decades ago, and it was easier to get information from a credit bureau about what other relationships the customer had than to look at one internal system that passed through all those silos,” he said.

Ripping and replacing entire core systems is a risky and cost prohibitive solution to this problem for the vast majority of banks. But they can innovate despite legacy infrastructure by adopting an open API infrastructure, according to Johnson. APIs can be layered on top of legacy systems and be used to integrate with various third parties to quickly deploy new products and services. This is especially important considering the pace of digital innovation.

“What’s sexy 3-4 years ago is just OK now,” said Johnson. “But with an open API approach, when the next great feature comes along you can respond quickly without needing a massive tech rebuild or a massive reengineering effort.”

Johnson noted that digital habits that were beginning to be adopted by consumers and small businesses in recent years were accelerated during the Covid-19 pandemic. It is now table stakes for banks to offer the digital products their customers want.

Ultimately, banks don’t have to transform overnight, but can use an open API architecture to begin to meet the digital needs of their SMB clients.

“It doesn’t mean that you have to be all things to all people on day one,” said Johnson. “But I think you need to have this vision of how you grow your product over time.”

Learn More About the Future of Banking for SMBs

In the recent webinar hosted by PaymentsJournal, Johnson and Riley discuss several other key details of SMB banking, including:

- Data on trending interest in banking services from non-financial companies

- Insights into the growth of the embedded finance market

- Specific small business banking use cases