We’re continuing our journey down the path of decoding what Digital-First card experiences really mean for Issuers.

In the first two parts of this four-part series, we discussed What Digital-First experiences are and Why they must be embedded into a customer’s digital life to drive value. This article will discuss Why and How Issuers should build bespoke card offerings for unique customer segments.

The Past – One card program for millions of customers

The success of the Ford Model T was a watershed moment in the history of modern consumerism, resulting from a standardized production line that minimized production delays and standardized quality. Henry Ford famously said, “Any customer can have a car painted any color he wants, so long as it is black.”

A 100 years later, 100s of millions of cards issued in the US today reflect the same philosophy Henry Ford propagated in the 1900s.

The only variables that typically differentiate these cards? Color of the Plastic, APR, and Rewards.

This worked till recently, as customers had no real options and had not seen better. As a result, if 100,000 customers enroll in a card program, they will always have the same experience.

Image Source: Zeta

The Future – A million card programs for a million customers

In the last decade, customer expectations have moved away from standardized to hyper-personalized experiences.

Interactions with big tech platforms, such as Amazon and Netflix have dramatically shifted what customers want, i.e., more personalization and curated experiences. For example, when Netflix users open their app, they are greeted with specific recommendations as Netflix has analyzed the shows or movies they watch to create a unique user experience. Similarly, Amazon displays products they believe would interest the consumer based on their purchases.

It should be no surprise that customers expect the same in all their interactions, including with card Issuers. According to McKinsey[1] – 71% of consumers expect companies to deliver personalized interactions. And, importantly – 76% are frustrated when this doesn’t happen.

It is not that Issuers lack the desire to build better experiences, but the technology they use to run their programs continues to be a letdown. Two significant deficiencies exist. First, there are limitations on the number of variables an issuer can configure. Second, those variables can only be configured at the program level.

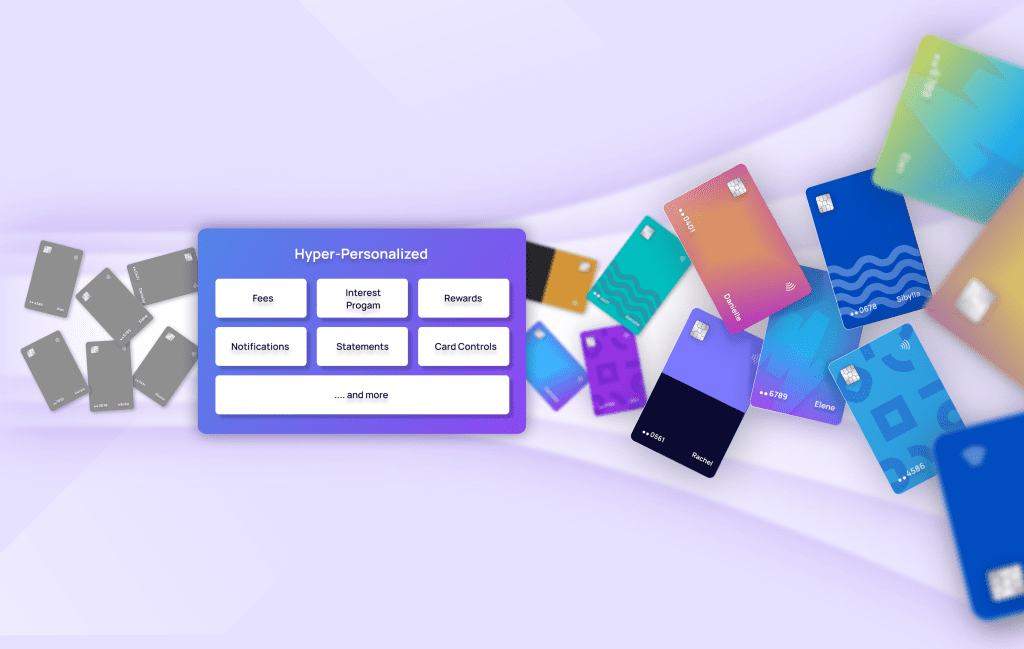

We argue that true personalization can be achieved only when the form factor, APR, fees, rewards, statements, transaction policies, notifications, card controls, and 10s of other variables are personalized in real-time for millions of such customers.

And it’s not just about providing choice. Beyond addressing what customers want, the ability to deliver contextual offerings based on a customer’s unique experiences can help Issuers offer their customers more reasons to use their cards, which can significantly expand cross-sell opportunities and help to grow revenue.

How can Issuers achieve Hyper-Personalization?

As Issuers look to hyper-personalize offerings, they must consider how next-gen technology can help them address existing gaps in their legacy tech stacks.

Truly understand customer expectations

One of the key roadblocks for Issuers today is not having a detailed perspective into what their customers want.

The data available through legacy technology is often derived via clunky standard reports with limited dimensions – under-representing and often missing out on key aspects of an individual customer persona.

With a next-gen platform, Issuers can address these gaps and access granular data across 100s of variables and attributes. This helps them understand customer expectations in different ways.

Issuers can access APIs, event streams, data marts, and reporting dashboards that provide them with granular, reliable, and real-time data about their customers and programs. Then, using these rich insights, Issuers can build targeted offers. And they can update program features to meet the expectations of their customers. This allows them to deliver a highly personalized experience.

Deliver personalized outcomes seamlessly

A truly Next-Gen platform can help Issuers parameterize and configure programs at an individual customer level or at an individual card level. This unlocks unparalleled customization where every single transaction (if so desired) – can be uniquely treated. Through this, Issuers have infinite flexibility to configure programs for the needs of a specific customer. For example,

- Fees: Fees which are traditionally set at a program level, could now be personalized based on the needs of an individual customer or using any transaction attribute – allowing Issuers to offer several unique product constructs, such as

- The card program: $2 for every ATM transaction

- Each individual customer: Special ATM transaction fee of $1

- Each transaction: Zero ATM fees for withdrawals during the holiday season between November – January, if total spends are >$2,000.

- Interest: Legacy platforms typically have static interest buckets created for broad MCC categories such as retail, cash, balance transfer, and promotions. In contrast, the infinite configurability of a next-gen system allows Issuers to build unique interest programs. For example, the customer could get a discounted APR for transactions at:

- A chosen retailer, e.g., Amazon

- On a particular day, e.g., their birthday

- For specific expenses, e.g., a child’s education expense

- Rewards: Rewards can be configured to meet each customer’s unique persona and preferences than be offered as a one-size-fits-all. For example,

- Avid traveler: 5X reward on their next holiday,

- Frequent car user: 3x rewards on fuel spends

In addition to fees, interest, and rewards, modern processing technology can help Issuers configure statements, notifications, and card controls best suited to the preferences of a specific customer – an immense advantage that is not available with legacy systems. The result – bespoke card experiences for each card holder that would resemble the image below.

Image Source: Zeta

Deliver these experiences at scale

In a legacy platform, any update to a program configuration is a complex engineering project. It requires multiple rounds of iterations and often 100s of lines of code before something meaningful can be created. Typically, any program update would take months to fruition – leading to lost opportunities and dissatisfied clients.

With Next-Gen processing technology, Issuers can overcome all these challenges. Using no-code paradigms and intuitive web interfaces, Issuers can configure and reconfigure programs and products in real-time and at scale. They can do this with zero support from the engineering team. This allows them to accelerate time-to-market and results in rich, delightful, and contextual offerings.

Conclusion

To expand the scope of their personalization capabilities, Issuers need to ditch clunky green-screen-based legacy technology. They need to invest in next-gen platforms like Zeta.

Zeta Tachyon’s Hyper Personalization Policy Engine (HPPE) allows defining of dynamic product policies based on any attributes of a customer, account, card, or even a specific transaction. This enables Issuers to offer personalized experiences and offerings. Rich reporting capabilities provide access to customer insights across 100s of variables. This will help Issuers understand customer expectations and behavior like never before. And, web-based interfaces ensure that Issuers can manage programs and iterate in days vs. months and quarters in the case of legacy platforms.

In the final article of this series, we will discuss how Issuers can simultaneously embrace and respond with velocity and intention to myriad market changes.

[1]https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-value-of-getting-personalization-right-or-wrong-is-multiplying