This is the second article in a series of four articles. These articles discuss the impact of the growing shift towards digitalization on US card issuers. In the previous article, we covered Digital-First experiences – what they are and why they are important. Card issuers must seamlessly embed card experiences into customers’ digital lives.

Legacy distribution: Let the customer come to you

Till recently, physical touchpoints were the primary medium of interaction between a customer and their bank. From opening accounts, to withdrawing cash, or to making payments, customers relied almost exclusively on branches, ATMs, or call centers to access banking services.

As a result, scaling organically limited an issuer’s ability to grow. It also limited the ability to build a meaningful footprint across those channels. Every new distribution channel (e.g., branch, ATM, or call center) required an upfront investment. This inhibits the ability to maximize economies of scale on existing infrastructure.

Platforms did not ‘embed’ banking into customers’ lives outside the financial ecosystem. For example, to finance a new purchase, customers had to reach out to their financial provider to arrange a loan. Then they worked separately with the merchant to receive the product. As a result, the financial industry largely operated in its own silo. The customer experience at the merchant and with the bank was disjointed. And interactions were fragmented & time-consuming.

This trend was consistent for cards – issuers were limited by their scale, leading to slow Go-To-Market and long innovation cycles. And, growth was always limited to issuers’ ability to expand and scale distribution networks independently.

Next-gen distribution: Take your product where your customer is

Today, customers want greater integration across industry platforms to help them manage their digital engagement, shopping experience, and financial lives. For banks, how and where they engage with customers is as important as what they offer. According to EY[1], 3 in 5 US customers choose a better integration of financial services as a key consideration while deciding on their primary bank.

Customer interactions have been truly revolutionized in the digital age and moved away beyond banks’ physical-only channels. At the same time, forward-thinking issuers have expanded the scope of their distribution beyond just their own channels. They are partnering with non-banking players, such as telcos, retailers, and big tech, to complement and expand their distribution networks.

The trend is even more pronounced in payments – customers expect to be completely frictionless and invisible.

To achieve this truly – banks must expand the scope of their payment channels to integrate non-bank players. This creates a cohesive network of relationships that transcend traditional channel boundaries. This will unlock tremendous value. Customers will get the seamless payments they need. While issuers will have a clear path to the top-of-the-wallet and increased usage. Thereby generating higher spends and income as well as reducing acquisition costs significantly.

How card issuers can become embeddable-banking ready

To become truly embeddable-banking ready, issuers need to address the following areas.

A. A Technology Stack Built with Partners as First-Class Citizens

The technology available to issuers to launch card programs today was built decades ago. It was built with a fundamental premise that products will be created by issuers and distributed via traditional channels. The concept of an external & synergistic external partner entity being part of an issuer’s ecosystem to drive distribution did not meaningfully exist. Therefore, embeddability, even if offered, is merely an afterthought in such legacy systems.

As issuers look to expand their reach through partnerships and make inroads into embeddable banking, they need to consider technology which natively model external partners as integral components in the issuer ecosystem. The platform must also natively provide APIs, control panels, workflows, & other rich capabilities for these partners to achieve true success.

B. Frameworks to Manage & Mitigate Risk

One key issue that limits issuers’ ability to participate in the embedded banking revolution is the lack of adequate controls for risk and compliance – after all, the buck stops with the issuer. An issuer is responsible for all products originating on their platform, irrespective of the distribution channel used. Therefore, clarity on roles, responsibilities, and control between the issuer and the distribution partner is critical.

Issuers need to consider how technology can help them build controls and empower them to define what a partner can and cannot do. For example, issuers need to ensure that limitations can be placed on which fields a partner can change in a credit card application schema or which elements of a product configuration the partner can or cannot modify.

C. Drive Innovative Product Usage through their Partners

To support true embeddability in the context of what a customer needs in 2022 (anywhere, anytime, real-time, omnichannel, etc.), an issuer’s technology stack must enable real-world use cases that allow granular definition of where/how/when their product can be embedded.

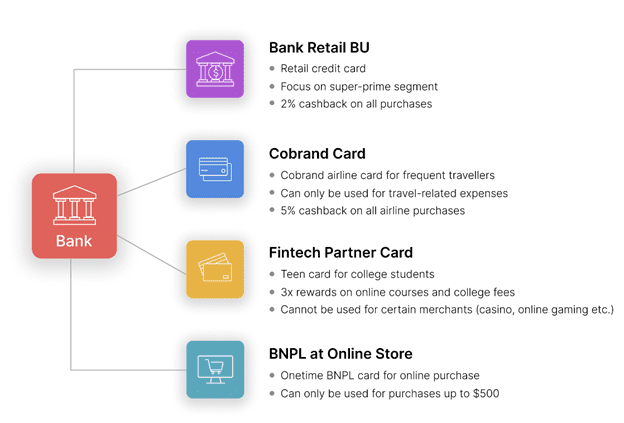

A state-of-the-art solution would allow different partner specific configurations in the context of an individual product line, for a customer, for one or more payment instruments (i.e., a specific card), or even each transaction. For example, a customer’s credit card account may have an add-on travel card issued with American Airlines and a BNPL originated at Amazon during a payment flow of a purchase.

Legacy technology is not built to support complex use cases as it often presumes a customer, account, and instrument as one. But, if issuers are to make payments truly embedded, they should consider upgrading to technology that supports programmable and configurable constructs to allow them and their embedded banking partners to innovate on product constructs in response to consumer needs.

Conclusion

With customers demanding faster, differentiated, and cost-effective products that offer seamless interactions, the trend toward ecosystem-based distribution will accelerate in the card industry. Partnerships with next-gen card processing platforms, like Zeta, will help issuers meet customer expectations on embeddability.

Zeta natively supports onboarding digital distribution partners such as co-brands and fintechs through a multi-level multi-tenant construct called Virtual Bank Operators (VBOs) – enabling issuers to participate in the Embeddable Banking revolution.

With Zeta’s unique VBO model, issuers can delegate certain aspects of product management, such as customer onboarding, customer management, and customer support, to 100s of partners while maintaining control over key aspects of the program, including product configurations, application schemas, and product limits. In addition, to allow VBOs to manage their programs seamlessly, Zeta enables them to self-serve through access to their very own control panels & API catalogs.

In the next part of this series, we will look at the need for hyper-personalized experiences and how issuers can leverage technology to build deeply personalized customer offerings.

[1] https://www.ey.com/en_gl/banking-capital-markets/how-can-banks-transform-for-a-new-generation-of-customers