Bigger and more diverse.

That’s not the just the world at large but also the payment technology ecosystem. Technology is advancing at a rapid pace and consumer expectations are in driver’s seat when it comes to how, when, and where they pay for things.

New gadgets are always being launched and payment softwares are evolving faster than ever. Executives must keep their companies observant and nimble when it comes to noticing and responding to these new trends in payment technology.

The first step for executives is simply knowing what’s going on in the payment technology industry. The next step is taking action to ensure that your company is offering the right payment solutions for your customers.

To help you with that first step, here’s a deeper look at a few current trends changing the landscape in payment technology that every executive should consider when looking at payments

Common Trends Reshaping Payments Industry (That Executives Need to Know)

For consumers, it’s all about ease, reduced fraud (better security), and increased satisfaction.

For businesses, while the above are extremely important (especially customer satisfaction), there’s also the reality that revenues increase with many new payment innovations.

Here’s a quick look at the trends reshaping the payments industry:

Same-day ACH

Nothing drives customer frustration more than waiting.

Whether it’s submitting a late payroll filing as a business or needing to make a last-minute payment as a consumer, the need to move money quickly comes up often.

As of 2017, SDA debit transactions now allow for same-day payments without the burden of new infrastructure or governance, allowing for virtually universal access to banks and customers. While this is faster, it’s still not real-time and nor does it allow for making payments on weekends or holidays.

Many retailers still reel from the interchange fees imposed by debit and credit card payment processing. As such, same-day ACH is gaining ground as a potential solution that could allow businesses to reduce their processing fees while still offering similar benefits to consumers as credit cards companies do (discounts and rewards).

Digital wallets

With more than one in three consumers saying they plan to use a digital wallet for purchases, the growth potential here is clear.

Consumers are hungry to consolidate and secure their payments. They want to avoid long payment processing times and having to hand over sensitive customer data whenever they make a purchase. Digital wallets reduce that friction at online checkout while increasing security at the same time.

Adoption has slowed on this particular innovation, but businesses stand to win by offering trending digital wallet payments options to consumers as a way to encourage secure, speedy spending.

Peer-to-peer payments

Everyone dreads the hassle of settling up the bill at the end of a nice group dinner.

While that pesky problem hasn’t been completely solved, peer-to-peer payments are extremely popular and increasingly offered as a feature in digital wallets or as standalone applications. Solutions like Paypal, Venmo, and Chase QuickPay (now with Zelle) offer consumers the opportunity to move money within groups and among individuals with relative ease and speed with little to no cost in many cases.

Some solutions (like Zelle) even allow for immediate availability of funds for the recipient while the funds are settled by the banks later.

For consumers looking to step away from paper checks and ATM withdrawal fees, P2P payments are an increasingly attractive payment technology in this shifting ecosystem.

Biometrics

Watch out for biometrics to begin replacing security solutions such as passwords and PIN numbers (which are hard to remember and costly to maintain for companies in terms of security, storage, and support) when it comes to account security.

The bet here is that consumers are willing to sacrifice a little bit more personal information (fingerprints, facial recognition, voice identification, iris scanning, etc.) to allow for great speed and security in payment processing.

With consumers already opening up their phones using facial scans and climbing into cars with touch recognition applications, the future seems bright for biometric security in payment processing and business should take note.

Public cloud

Gone are the days in which businesses had to build huge internal infrastructure to reach peak volume. Now, cloud-based infrastructure can shift outside of core infrastructure and can be built in just weeks.

This means more agility and higher revenues.

Payment providers can now deliver fast and frictionless payments around the world, at scale. Some companies have enabled themselves to bring new products to market in under two weeks by switching to the public cloud.

With consumers hungry for new and better payment products, that kind of lean speed can make a big difference for many businesses.

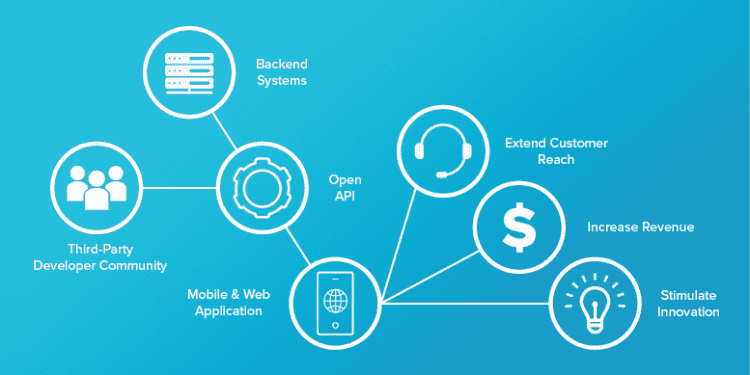

Open API

“Open banking” is all the rage right now.

Customers want the power to enable third-parties (think Mint, Robinhood, Acorns, etc.) to access their banking information so they can use services that exist outside of traditional financial institutions. In some places like Europe, banks are even required to open up for these providers (with protections for consumers and after meeting regulatory requirements for data security).

Banks run the risk of losing customers if they are overly restrictive (even in the name of security) such that customers cannot use nonbank tools adjacent to their banking. On the flip side, banks without adequate data security protocols potentially attract more fraud and can easily lose customers that way of course.

Businesses that allow customers to connect their trusted banking institutions to third-party while also effectively protecting personal financial information will win the day when it comes to the open API trend in payment technology.

How businesses can get payment innovation right

Knowing the payment technology landscape is the first step to nailing payment innovation. While the benefits and convenience of new payment technology are great, the connected ecosystem for vendors presents some unique challenges. A core goal here should be maintaining payments ecosystems that are adaptable and flexible with the right integrated support in place to solve business and customer needs.

Not every new payment solution your business rolls out will go as planned. Vendors rolling out new payment technology for consumers need to have support for handling integrated solutions.

Businesses should evaluate payment tech vendors (from whom they purchase payment tech products) on their ability to provide support for their products and the integrations with other tech solutions.

Another hurdle is keeping track of regulation while moving at the speed of rapid technological changes in the payment technology industry. That’s a tall order on both the payment tech vendor side as well as for the businesses they serve. It’s also very doable and can lead to exciting advancements, as we have seen in recent years.

It’s undoubtedly an exciting time to be innovating in the world of payment solutions.