In today’s fast-paced, digital age, the most amazing thing about paper checks is that many businesses are still writing them. It is not just the expense of writing a check—measured in employee time and processing costs—that argues against their persistence. It is the uncertainty associated with them. Once a check is in the mail, issuers never know exactly when it will arrive or when it will be cashed. When organizations issue large volumes of checks, the impact of uncertainty on their available cash can be significant.

Even more significant are checks’ vulnerability to basic forms of abuse. According to the 2018 AFP Payments Fraud Survey[1], checks were subject to more payments fraud than any other method. Just under three-quarters of finance professionals report that their organizations’ check payments were exposed to forms of check manipulation such as forgery, counterfeiting, and alteration.

For all of these reasons, it is in the best interest of companies to minimize their use of checks and adopt digital payments. At Capital One, we have worked closely with companies across the middle market who are moving to digitize their payments processes. To gain a broader picture of the progress of this transition and the challenges companies are facing, we sponsored a research report from Harvard Business Review Analytic Services, which surveyed 159 middle-market executives about their payments practices.[2]

Digitization Is Under Way, but There’s More to Be Done

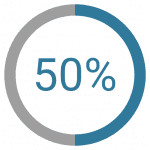

The good news is that almost all mid-sized companies—defined here as those enterprises with annual revenues of at least $25 million but less than $2 billion—have digitized at least some of their B2B transaction stream. About half have digitized roughly 50% of total payment value, while a smaller group, 36%, has digitized between 70% and 100%.

The survey also demonstrated that middle-market executives believe that digitization, which includes electronic funds transfer (EFT), virtual card, and payment portals among other methods, is delivering its hoped-for benefits. Fifty-five percent of executives surveyed reported greater finance department efficiency, while 47% reported lower costs as a result. Forty-three percent pointed to real-time visibility into incoming invoices and outgoing payments as a benefit, while another 43% pointed to faster transaction processing speed.

Despite these benefits, 20% of executives say their companies have as yet digitized less than 29% of their payments, and 15% do not know how far digitization has progressed, suggesting that they have not embarked on the process in a sustained way. In other words, mid-sized companies, even the most digitized of them, are still finding that they need to write checks in some circumstances.

Obstacles to Moving Beyond EFT

To understand the obstacles that are preventing middle-market companies from increasing their percentage of digital payments, it helps to understand the typical path to digitization. The survey revealed that middle-market companies typically begin by digitizing internal transactions, such as employee payroll and benefits, where they have oversight of the entire process. As they gain confidence, they institute digital payments for external transactions like supplier payments. Overwhelmingly, they turn to the simplest of these technologies, electronic funds transfer (EFT), for this purpose.

In this light, EFT can be seen as a replacement for checks, providing cost-savings, convenience, and enhanced security while eliminating uncertainty. EFT is of limited use, however, in capturing the intelligence that can be gained from more sophisticated digital payments systems.

The survey also highlighted two major reasons why the more powerful digital methods have not been more widely adopted. The first is supplier acceptance. Thirty-six percent of survey participants reported that too many suppliers are not using or are resisting more advanced digital payment systems methods. The second is standardization and interoperability, which 35 percent said was a barrier.

These issues help explain the low rate of adoption by middle-market companies of payment portals and virtual card. Payment portals, whether part of an enterprise resource planning (ERP) system or a third-party portal, help companies exert control of spending by enforcing business rules and requiring approvals for exceptions. Portals also provide sophisticated tracking tools and dashboards that help companies better monitor their key performance metrics as well as artificial intelligence tools that can benchmark a company’s performance against its peers, consolidate spending, and offer suggestions for improvement.

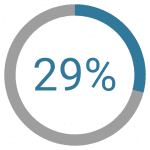

The challenge for mid-sized companies is convincing suppliers to join the portals. Currently, there is no commonly accepted, industry-wide process for posting an invoice to a portal nor a standard method of integrating billing systems with portals to automate these posting. When their customers belong to different portals, suppliers fear that the resulting complexity might jeopardize the efficiency and accuracy of their invoicing process. Supplier resistance is an important reason that only 29% of middle-market companies use portals.

Similar impediments are delaying adoption of virtual card, which has been implemented by only 13% of companies surveyed. In a virtual card system, one-time credit card numbers are issued directly to vendors for individual transactions for a predetermined amount, greatly reducing opportunities for fraud. The financial benefits of virtual cards are straightforward as well. In addition to eliminating the cost of checks, organizations benefit from the extended float associated with credit cards and typically enjoy a 1 percent rebate. Virtual cards give buyers payment certainty and enhanced control of their cash flow.

Although lower interchange fees than typical credit card transactions and faster payments are an inducement to suppliers, organizations can sometimes encounter resistance from suppliers who may not have accepted credit card payments in the past and see no reason to do so now.

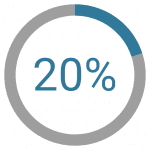

The survey found, however, that not all the barriers identified by middle-market executives to a digital payments future were in fact barriers. An important finding of the survey was that concerns about costs may be unfounded. Cost was cited by almost a quarter of the participants as the biggest deterrent to launching B2B digital payments systems, but the survey revealed that 20 percent of those who adopted digital payments said the project paid for itself within a year.

A Matter of Time

Ultimately, for companies in the middle market, the question is not whether they will be using digital payments for the vast majority of their B2B transactions, but when. The momentum behind B2B digital payments from all sectors of the economy is so great that there is an incentive for banks, portals, and payment providers to focus on making digitization as seamless as possible and overcoming the obstacles businesses have identified. At Capital One, for instance, we now include application programming interfaces (APIs) and standardized file formats in the digital payments projects we develop to ensure compatibility and ease of integration. We also work closely with our virtual card customers to develop sequenced, customized supplier acceptance strategies

Knowing that greater digitization is inevitable, mid-sized companies should align themselves with banks and payment providers with the insight and expertise to help them make the most of the digital payment options available today. Equally important, they should find partners who are working on the cusp of payment innovation. Digital payments themselves are in the midst of a rapid evolution, fostered by new regulations that promote faster payments and the introduction of new mobile delivery and real-time services. To navigate this future, companies must partner with forward-looking providers who can also serve as trusted advisors.

[1] https://dynamic.afponline.org/paymentsfraud/p/1

[2] https://hbr.org/resources/pdfs/comm/capitalone/digitalb2bpayments.pdf

About the authors

Phil Beck, Head of Treasury Management at Capital One

Rajsaday Dutt, Head of Commercial Card Product and Delivery at Capital One