As fraudsters grow increasingly sophisticated, account takeovers and other forms of payment fraud are becoming more frequent and costly. As a result, the financial services industry has a growing need to bolster its fraud prevention efforts with new solutions and technology.

The need to adopt such solutions and improve account validation is urgent. On March 19, 2021, the WEB Debit Account Validation Rule set by Nacha took effect. Fortunately, account validation solutions can help your organization comply with this Rule and give consumers the frictionless digital payment experiences they demand.

These topics and many more were discussed in-depth in a recent webinar hosted by Early Warning® titled “Account Validation: Implications for Financial Institutions and their Battle Against Payment Risk Mitigation.” The webinar featured two guest speakers: Lawrence Pannell, Senior Partner Enablement Manager at Early Warning, and Amy Morris, Senior Director of ACH Network Rules at Nacha.

Fraud Is on the Rise, and the Pandemic Isn’t Helping

Fraud occurs across different payment types, and the current global environment is making it even worse. “There are a lot of fraudsters out there that are capitalizing on the disruption that the coronavirus has created,” said Pannell. For example, the CARES Act relaxed distribution limits and the early withdrawal penalty for disbursements from deferred compensation plans. While this helped people suffering from unemployment as a result of COVID-19, it also created an ideal environment for sophisticated fraudsters to leverage benefit systems – which often use the ACH Network – to their advantage.

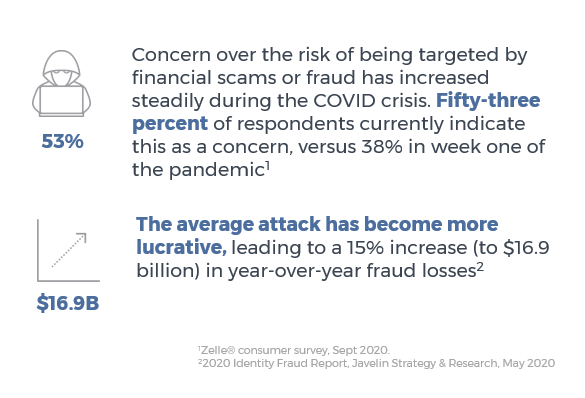

Further, fraud is becoming a more significant concern for consumers. A Zelle® consumer survey conducted in September 2020 found that 53% of respondents were concerned about the risk of being targeted by financial scams or fraud, up from just 38% during the first week of the pandemic. Fraud is also becoming more lucrative for cybercriminals, with a 15% year-over-year increase to $16.9 billion in total identity fraud loss in 2019, the survey found.

These statistics highlight the need for improved fraud prevention and account validation efforts.

What Is the WEB Debit Account Validation Rule?

Nacha created the WEB Debit Account Validation Rule to address concerns of fraud on the ACH Network. Originators of WEB debit entries are already required to use a “commercially reasonable fraudulent transaction detection system” to screen WEB debit transactions for fraud.

The new Rule builds upon this existing guidance to explicitly state that account validation is part of a commercially reasonable fraudulent transaction detection system.

More specifically, the guidance it builds upon states that an essential element of a commercially reasonable fraudulent transaction detection system would be the adoption of risk-based mechanisms designed to confirm the validity of an account to be debited. The Rule intends to help prevent ACH fraud and protect financial institutions from posting fraudulent or incorrect authorized payments.

“What we did, in essence, is take that language out of the guidelines and move it up into that rule,” said Morris. “And so now it explicitly states that account validation must be part of the commercially reasonable fraudulent transaction detection system.”

What Will the Rule Change Actually Do?

The new Rule requires that originators conduct account validation the first time an account number is used to make an online payment. This could be the first time a customer makes a payment or when an existing customer changes the account number to make online payments.

The Rule was created with intentionally neutral language regarding the specific methods or technologies needed to validate account information. Many possibilities exist for compliance, including an ACH prenotification, ACH microtransaction verification, or validating account status and/or commercially available validation service. There is also the potential that new capabilities or services can be used to comply with the account validation Rule in the future.

While the Rule officially took effect on March 19, 2021, Nacha will not enforce this Rule for an additional period of one year from the effective date with respect to covered entities that are working in good faith toward compliance, but require additional time to implement solutions.

How the Account Validation Rule Will Impact Originators

Commercially reasonable fraud detection for WEB debits can impact businesses in many ways. It could result in a retooling of ACH originators’ fraud detection systems. However, for originators not currently performing fraud detection for WEB debits, it could mean implementing an entirely new system, resulting in increased costs of originating WEB debits.

“But we do feel that these costs can be offset. One, in the reduction in exception processing: the returns that are coming back, the collections that have to be dealt with, [and] customer service issues; and also, in … [Originators] understanding exactly what does need to be validated and what doesn’t,” said Morris. “If you’re setting somebody up for recurring WEB debit…, it is only before that first time that you will process that payment.”

The benefits vastly outweigh these potential hurdles. Ensuring secure account validation reduces the number of questionable, invalid or fraudulent WEB entries submitted into the ACH Network and limits the potential impacts of fraud events.

“Nacha… is introducing a rule change that really limits the ability for fraudsters to get access to funds to which they’re not entitled, or get services for which they have not paid, and it’s imperative for financial institutions to implement authentication and fraud detection technology that limits the burden to [their] customers,” said Pannell.

Early Warning’s Account Validation Solution

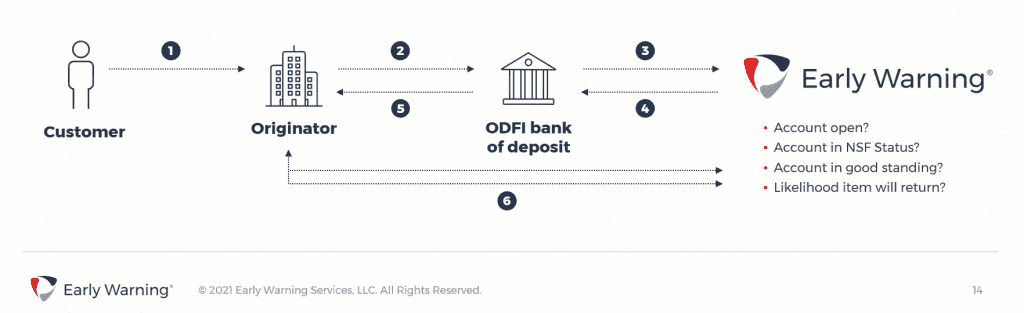

Early Warning’s real-time, behind-the-scenes account validation solution is an effective way for organizations to prepare for Nacha Rule compliance without adding friction to the customer journey.

The solution works by identifying valid accounts at the point of transaction, providing immediate notification of high-risk payments and specific conditions of that account, and identifying accounts currently returning transactions.

The customers aren’t aware that we’re actually performing a validation, but the originator has comfort that the bank account involved in the transaction is being verified.

The solution has use cases far beyond bank account verification, including payments for HELOCs or other lines of credit, WEB debit account validation for billers, credit card payments, ACH payment enrollment, disbursements via ACH or wire, online new account funding, and external account linkages for money movement.

The Takeaway

Nacha’s WEB Debit Account Validation Rule will better protect originators and consumers in a world with increasingly common and lucrative fraud attacks. Organizations such as Early Warning have solutions to comply with the Rule and benefit companies and consumers in numerous ways.

In the webinar, Pannell and Morris also provide insights into:

- Early Warning’s integrated model approach to authentication

- Validating high-risk transactions in real time

- Commercially reasonable fraud detection for WEB debits case study

- New account opening use case

- How organizations benefit from adopting such a solution

Click here to access the complimentary webinar: “Account Validation: Implications for Financial Institutions and their Battle Against Payment Risk Mitigation.”

Zelle and the Zelle related marks are property of Early Warning Services, LLC.