Digital engagement and flexible delivery models have long been appealing to many businesses but have historically been seen more as nice-to-haves than must-haves.

That perception changed when the pandemic emerged, forcing businesses to embrace digital transformation as a matter of survival. Now, increased consumer demand for contactless and digital wallet payment acceptance and a decline in cash usage have forced merchants to re-evaluate the types of payments they accept.

To offer additional insight into the state of payments, FIS recently released its Global Payments Report 2021. To learn more about the report’s findings and further explore the implication of cash’s decline for U.S. merchants, PaymentsJournal sat down with Christina Wagner, Head of Global Payments Products for FIS, and Don Apgar, Director of Merchant Services at Mercator Advisory Group.

Consumer demand for digital payments is booming

According to Wagner, COVID-19 ushered in an era of increased demand for digital payment acceptance. “By that, I mean [it ushered in] things such as contactless and digital wallets, which have forced many merchants to re-evaluate and shift their payment acceptance mix and strategy. Digital wallets and mobile wallets are a more modern payment method that allow consumers to securely store payment credentials and payment purchases,” she explained.

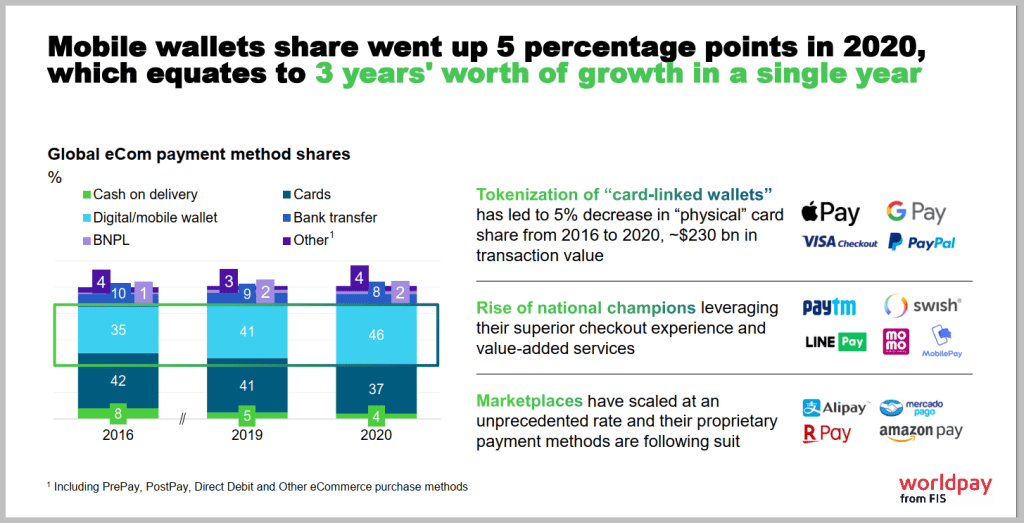

The proliferation of digital wallets—which includes an array of options such as Apple Pay, Google Pay, Samsung Pay, Alipay, WeChat Pay, and Amazon Pay—has led consumers to use them more often at the point-of-sale. This rings true both globally and within the United States, where mobile payment adoption has lagged compared to other countries.

“Even in the U.S., we’ve seen that checkout at point-of-sale using mobile wallets has grown a staggering 60%. And mobile wallets in particular have gained … [as a result of] the decline of cash at the point-of-sale. We’ve seen mobile wallets rise nearly 20% over 2019,” said Wagner.

Globally, mobile wallet’s share increased five percentage points in 2020, which equates to three years’ worth of growth in a single year. This increase, which is highlighted in the graphic below, came at the expense of physical cards and cash:

Looking ahead, it’s fair to expect that this shift to mobile wallets will continue. “No doubt, the pandemic has put a lot of emphasis and raised awareness of the need to be contactless in our face-to-face transactions, and it’s actually given NFC, or near-field communication, a big boost both from card usage and also… from wallet usage,” explained Apgar.

The free fall of cash

The rise of mobile wallets came hand-in-hand with an ongoing decline in cash. While the payments industry has long flirted with the prospect of digital transformation, the pandemic was the catalyst the industry needed to aggressively embrace such digitization.

“We’ve been talking about digital engagement and digital payments and digital transformation for a long time in the payments industry. And before the pandemic, I think there was interest in it, there was movement in that direction, but I don’t know that all merchants really saw that [transformation] as an imperative for their business to survive. And I think that has been a pivotal shift for us,” said Wagner.

Consumers around the world had nearly every aspect of their lives uprooted due to the pandemic, and how they shop is no exception. Brick-and-mortar locations shuttered their storefronts due to stay-at-home mandates and widespread health concerns, causing consumers to flock to online shopping channels. Unsurprisingly, this led to an acceleration in the decline of cash. After all, how many consumers use cash in an e-commerce environment?

“The Global Payments Report really showed that our decline of cash exceeded a three-year trajectory. So, our decline in cash in 2020 alone exceeded the projection we had for 2020. And cash in 2020 was used for roughly 20% of global point-of-sale volume, and that was a 32% reduction from 2019,” explained Wagner.

Whether or not COVID-19 fades away, this decline is unlikely to reverse. “Regardless of the ultimate trajectory of COVID-19 and the pandemic, we’re expecting another 38% decline between now and 2024, and so it’s just a dramatic change for us and a cashless future I think is appealing for merchants,” she added.

This decline is good news for merchants looking to reduce costs and streamline operations. Certain types of merchants, including retailers, quick service restaurants (QSRs), and grocery stores, will need fewer resources dedicated to storing, circulating, and securing cash.

The costs associated with the manual labor involved in counting, transporting, and depositing cash can add up quickly. Human error, security risks, and physical risks all compound to make managing cash inefficient. With less cash to manage, these inefficiencies will decrease, which can tip the scales for merchants toward higher profitability and productivity within their businesses.

“The whole pandemic environment has really brought about a reawakening, if you will, of the value that electronic payments bring to businesses of all sizes,” noted Apgar.

“The paradox of payments”

While those in the payments industry may struggle to relate, most consumers are not thinking about payment method availability as they shop. For consumers, it’s all about convenience.

Therefore, even as payment methods bring a level of convenience that lets consumers shop on autopilot, payments should continue to be top of mind for merchants. In other words, as payments are becoming more visible and relevant to merchants, they are becoming more invisible and behind-the-scenes for consumers. This contrast is what Apgar refers to as the paradox of payments.

“As payments get more complex technologically and consumers have more options on how to pay and merchants have more options on how to collect payments, the payments themselves are fading into the background and instead of being a separate workflow, the payment is becoming embedded in the workflow,” he explained.

One example of this paradox can be found at certain Whole Foods stores, where consumers can enter the store, shop, and leave with their merchandise without having to stop at a register to checkout. This serves as a strong example of how a retailer can enhance their payment acceptance strategy without introducing unnecessary friction to the customer experience.

Payment strategies should center around the customer experience

It has been said before but is worth repeating: consumer payment preferences are changing. In response to these changes, merchants must offer payment optionality and flexibility through alternative payment methods such as ‘pay by’ links, contactless and digital wallets, and ACH.

How merchants should frame their payment strategy depends on who their customers are and what services or products they offer. For example, a consumer purchasing a service from a law firm is a far cry from a consumer heading into Target for their weekly shopping trip. These two consumers likely have very different payment preferences and needs. Even so, the customer experience should always remain at the forefront of payment acceptance strategies.

“If digital innovation is now the primary focus, I think that merchants and brands are really in a race to create the ideal customer experience amid these new consumer expectations. I think omni-channel experiences are going to be critical to the buying journey,” said Wagner.

Merchants want more from their payment providers than simply processing payments. “I think there’s a real revolution going on in the way that merchants are utilizing payments and recognizing the power of the payment technology to play a real active role in customer acquisition and retention,” noted Apgar.

Now, they are looking for ways to engage with existing customers, drive new customer acquisition, and grow brand loyalty all while streamlining operations and creating an elegant and seamless customer experience.

“To enable a true omni-channel solution, merchants will have to invest in modernizing their tech stack. They may have to look at reducing the number of payment providers they have. They may have to look at their engagement models and whether they’re leveraging data appropriately to drive loyalty in that consumer experience that they’re really after,” Wagner concluded.