As a treasury tactic proven to deliver significant workflow efficiency and clear cost savings, intercompany netting is far less commonly implemented than its advantages merit.

With a netting process, payables and receivables between multiple entities are no longer handled one at a time, but all at once. For an example: take three subsidiary companies that each send invoices to the others in their home currencies. Company A invoices B and C in USD, Company B invoices A and C in EUR, company C invoices A and B in GBP. In this scenario, company A would have to buy EUR and GBP to handle payments to companies B and C, and so on.

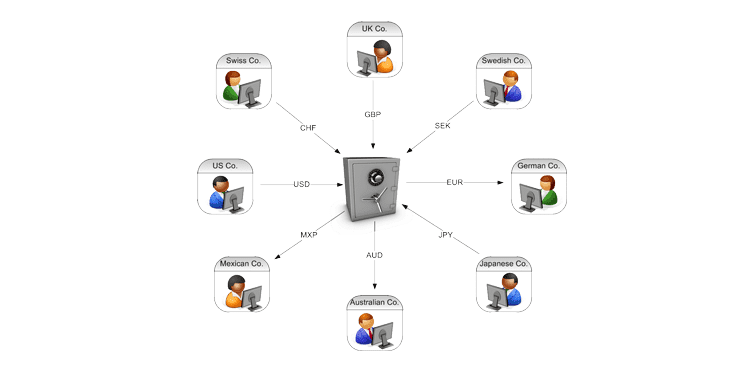

With intercompany netting, all the transactions between the subsidiaries are replaced with singular transfers between a Netting Center and each subsidiary, in the home currency of the subsidiary. Each subsidiary uploads AR and AP data to the Netting Center, where the transactions are matched and disputes resolved. All FX trades are also centralized and performed by the Netting Center, significantly saving costs. In most netting use cases, collected invoices and necessary payments are addressed monthly according to a set calendar, introducing a new level of consistency and efficiency to intercompany payment settlements.

Can all businesses benefit from intercompany netting?

Companies with numerous entities or subsidiaries, and particularly those that operate in multiple countries, leverage multiple currencies, and perform regular transactions between subsidiaries, have the most to gain from netting.

Intercompany netting is clearly advantageous if two or more of the following factors apply:

- Entities and subsidiaries total in the double-digits

- Intercompany payments top $20 million per year

- Foreign exchange (FX) activity is necessary for greater than 20% of the intercompany payments

- The company uses three or more currencies.

On the other hand, netting won’t have as much to offer if entities/subsidiaries are three or fewer, if intercompany payments total less than $5 million per year, FX is less than 10% of intercompany payment activity, and only one or two currencies are used.

If your company falls in between these ends of the spectrum, ask these two questions to determine if netting is a good fit:

- ‘Is my organization becoming more complex?’

- ‘Are manual, decentralized approaches to intercompany settlement becoming cumbersome to my treasury operations?’

If the answer is yes to either of those questions, setting up an intercompany netting system is likely to make sense sooner than later.

For those using netting, what is driving adoption?

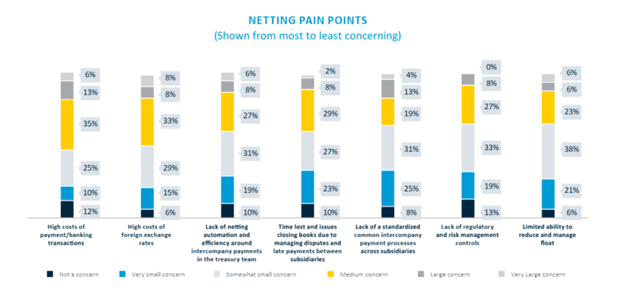

A recent global survey identified the key pain points that are leading organizations to consider intercompany netting strategies. Among respondents, the high costs of payment and banking transactions, and the high costs of FX spreads, were the top two pain points driving netting implementations. The need to save time in processing these payments and avoiding late payments was a highly cited frustration as well, making it clear there are advantages to netting beyond the budget.

It’s worth noting that a lack of consistent intercompany payment processes across subsidiaries was also rated as a large concern, especially by smaller organizations. Additionally, many cited a lack of netting automation and payment efficiency, lack of regulatory and risk management controls, and limited ability to reduce and manage float as further drivers of netting adoption.

Netting benefits there for the taking

For companies that put a modernized netting strategy in place, the benefits are wide ranging. With intercompany payments carefully tracked and accounted for, forecasting accuracy and cash flow management become that much more accurate and seamless. Banking transfer costs, FX costs, and FX hedging costs all undergo meaningful reductions. Intercompany banking activity is thoroughly supported, and that activity is even consistent across global organizations. Finally, consistency and the centralization of payment information and skillsets pave a path to far greater efficiency.

For many of today’s organizations struggling with the overhead of settling intercompany payments, Multilateral netting offers transformative benefits ready to tap. These organizations – as well as smaller companies facing rising complexity – ought to explore the potential savings and simplicity that a new intercompany netting strategy offers as they prepare for the future.