Many financial institutions are closing branches or limiting access to their physical locations to help slow the spread of COVID-19, which can be highly disruptive for customers who depend on branches to manage their banking needs. To minimize this disruption, financial institutions must offer seamless online and mobile banking services so their customers can manage their financial needs without leaving home.

While many customers have already made the digital shift, there is still a large population who has yet to adopt digital banking. Financial institutions would be wise to engage these customers and introduce them to digital banking. After all, the move to digital is more than just a temporary fix for the global crisis. It is the future. Experts predict that a majority of customers that engage with digital services during this time will most likely not return to their old banking habits when branches re-open.

To talk more about what digital features consumers want, why digital customers are valuable for financial institutions, and some of the best practices to increase digital engagement, PaymentsJournal sat down with Jamie Armistead, Vice President and Business Line Leader – Zelle® at Early Warning Services and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Digital Banking Services Minimize Customer Disruption

Digital banking services have been gaining traction for some time, but COVID-19 has brought a new sense of urgency for financial institutions to implement them. For example, a Lightico survey of 1,000 customers recently found that 82% of consumers are hesitant to visit bank branches amid COVID-19, and two-thirds are more likely to try a digital app or online banking service.

In general, financial institutions already have solid digital offerings, noted Armistead, but now is “really an opportunity for them to serve customers who may have been on the fence or haven’t downloaded a mobile banking app, which really highlights the importance of having a speedy, seamless interaction so initial digital interactions are positive.”

Mobile Banking Options are Important to Consumers

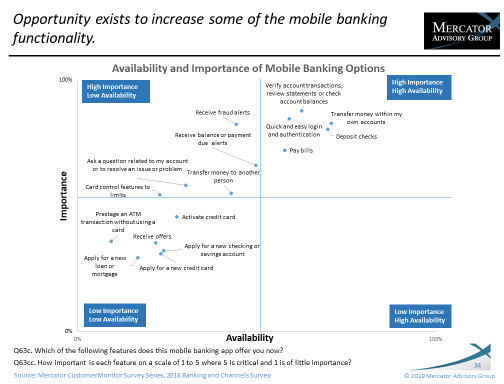

Digital and mobile offerings were important to consumers well before COVID-19. The following chart provided by Mercator Advisory Group depicts what consumers feel is important to have in their mobile banking experience, based on a study of more than 3,000 consumers:

The upper right hand side of the chart depicts mobile features that customers consider highly important and are already commonly found on mobile solutions offered by financial institutions today: reviewing transactions, bill pay, and mobile remote deposit capture, to name a few.

On the other hand, the upper left corner “contains services that customers say they want and are really important to them, but are less likely to find with their current bank or credit union; card control, fraud alert, and mobile person-to-person (P2P) options fall into this category,” explained Grotta.

Digital Engagement is Valuable to Financial Institutions

Citing a study conducted by Fiserv and Bank of the West that quantified the value of digital banking, Armistead laid out numerous benefits that financial institutions gain from customer digital engagement:

- More transaction activity. Customers who digitally engage transact at both a higher volume and a higher dollar value, with average monthly increases of nearly 13% after customers enrolled in a digital service. In other words, “they increase their utilization of the product for both frequency and amount.” This stands true for both credit and debit card use.

- Increased product holdings. In mobile apps and online services, financial institutions get brand and advertising impressions that result in a noteworthy increase in digital consumers’ product holdings. These impressions make digitally engaged customers more likely to turn to their existing financial institutions for their future financial needs. This makes sense; if a customer is using a mobile app multiple times per week, that brand is at the top of their mind when future banking needs arise.

- Less customer attrition. According to the study, attrition rates over a period of 15 months showed that digital customers are 35% less likely to leave their bank than non-digital consumers.

Digital Offerings Will Add Value Long Past COVID-19

Together, these benefits end up driving overall customer value and increasing revenue. Even if banks choose to use COVID-19 as the catalyst to promote digital offerings, they won’t solely be used to address the needs of a pandemic. Rather, digital banking offerings make great economic sense in the long-term.

Customers once resistant to mobile or online banking are likely to switch to digital channels. “Once people who have been holding out decide to go digital, they will find the value and benefits of a digital experience,” said Armistead. He anticipates that up to 70-80% of new digital customers will fundamentally change how they bank—even after the pandemic is over.

Person-to-Person (P2P) Payments are a Must-have for Financial Institutions

The importance of digital and P2P payments, especially during the era of social distancing and the unlikelihood of society returning to normal in the near future, can’t be overstated. These capabilities are top priorities for consumers who need to pay back neighbors for groceries, reimburse family and friends for cancelled events and send money to loved ones in need.

That’s where Early Warning’s Zelle comes in. Currently, 837 financial institutions are contracted to participate in the Zelle Network®, making it fast, safe and easy for consumers to send and receive money digitally. As a bonus, transactions per user continue to grow as consumers find ways to use Zelle, COVID-19 related or otherwise. Since the beginning of March 2020, Zelle enrollments increased, running more than double-digit rates above average.

Other Best Practices for Financial Institutions to Increase Digital Adoption

Financial Institutions should spend time analyzing the status of their institutions when it comes to developing and enabling the digital features customers want. Those falling behind must consider accelerating these offerings to better serve their customers now and in the future.

Another suggestion is to maintain the capacity to take on the challenges ahead. This may include implementing sophisticated marketing capabilities that allow financial institutions to dynamically control messaging sent to consumers. This is especially important as banks assure customers that their needs will continue to be met.

Beyond feature functionality level, integrated account opening and the ability to offer a seamless account opening experience are also must-haves looking forward.

The Takeaway

Digital banking has been expanding for years, but COVID-19 has accelerated the need for fast, safe and easy mobile and online services. Customers engaging digitally offer financial institutions numerous benefits, including increased transaction activity and product holdings, higher revenue generation and lower customer attrition. Certain digital functionalities, such as P2P payments, will be particularly crucial for banks to adopt during this time.

“Now that you have an increasing number of customers engaging in digital banking, financial institutions must be there to meet that next round of financial needs their customers will have, and leverage that channel engagement already being seen with digital offerings,” concluded Armistead.