It doesn’t take a financial expert to notice that digital payment adoption is growing, and research bears this out: Globally, electronic payment volumes are increasing at approximately 10% annually, with double-digit growth likely to continue through 2021.

In the U.S. alone, where the average consumer makes just over 375 electronic payments per year, credit card payments grew by an average of 8% year-over-year between 2012 and 2015 and by more than 10% year-over-year in 2016 and 2017. Most of that growth was card payments replacing cash.

This phenomenon is not new, but does appear to be accelerating, driven by factors such as an abundance of new electronic payment methods—many of them layered on top of existing payment methods—focused on convenience, reliability, security, and speed.

For the companies delivering these services, meeting user expectations means investing in a distributed presence that can challenge traditional network and system architectures. Just as people gather together in cities to gain the synergies of a social network, for business and leisure, there is a parallel in the “urbanization of IT,” with payments players creating infrastructure with direct access to data sources, service providers, networks and clouds to gain the performance and cost benefits of direct connections.

Simply put, the more transaction components—data, applications, networking controls, and associated technologies—that businesses can interconnect at secure points close to their end-users, the more successful their digital payment services will be.

Choosing The Right Partner

A white paper developed by the Initiatives Group and released last year by Equinix, Inc. identified three key trends shaping the worldwide real-time payments industry – and all three illustrate why businesses navigating the industry need to carefully examine their ecosystem and consider rearchitecting their infrastructure to solve some of the fundamental challenges that impact their ability to reach target users and interconnect with business partners.

The key trends outlined in the white paper, which includes case studies of the Americas, Europe, and Asia-Pacific markets, are:

- Real-time payments: Though initial developments in the real-time payments space were focused on consumers, the focus has shifted to businesses and merchants as consumers have proven reluctant to pay for payments. The B2B space, by contrast, has seen a proliferation of solutions, including the invention of a “request to pay” functionality with the associated documentation attached. When funds are to be securely transferred within seconds, it places higher demands on the underlying technology of payment systems, especially for processing fraud in real-time which means low end-to-end latency and adjacency of third-party data streams is critical.

- Regulatory intervention: A growing number of regulators are mandating that personally identifiable information, encryption keys and payment-related data be kept within the country (ex. General Data Protection Regulation (GDPR) which took effect in the EU in May 2018). At the same time, these regulators seek to boost economic efficiency by driving greater adoption of electronic transaction technology, and to promote competition and innovation by opening customer banking data to third parties.

- Open banking, which could draw new players into the industry as banks create AP gateways for third-party providers with authorized access to customer data, facilitating the creation of new products and services and consequently leading to new opportunities to add value through data.

Private, direct connection between multiple payment players is critical in the evolving world of digital payments. This is especially true for financial institutions, who are trying to build payment hubs that connect to all payment rails from a single location, so they can centralize common functions such as fraud screening as well as lower their networking costs. Establishing connections with new partners through traditional methods such as an MPLS network can take weeks or even months, whereas connections between companies within the same data center can be set up overnight – or within minutes, if they are virtual connections on a cloud exchange. Payments providers who leverage multi-tenant “meet-me” network architecture to directly connect with partners through neutral colocation facilities have seen reductions in their new partner and customer network onboarding times happen within 24 hours or less, while external links have taken days, if not weeks.

As the digital payments ecosystem continues to evolve, it challenges both existing business models and the infrastructure underneath. Today, the rails on which money moves are not only distinct in their messaging formats and protocols, but often the infrastructure supporting them, which tends to be purpose-built for transferring payment details and little else. Open APIs are going to change this model, in part by adding room for additional data that can create value around the transaction.

We expect that sooner than later companies within the payments ecosystem will begin taking advantage of these open APIs, deploying payment hubs capable of not only serving existing rails in a combined environment, but supporting new networks (e.g., blockchain-based) that compete with and add additional value to them.

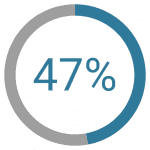

The result will be payment hubs relocating to centers where providers can leverage private connections with partners to exchange data and process payment traffic in ways that are not possible with today’s limited architecture. It is therefore critical that payment companies prepare for this future by rebuilding and their architecture for colocation. According to the Global Interconnection Index Vol. 2, a market study published by Equinix that analyzes worldwide direct and private traffic exchange, direct interconnection to financial service providers for digital payment purposes is expected to grow by 47% by 2021.

As Global Head of Strategy for Electronic Payments at Equinix, Lance leads the company’s business development strategy for the emerging electronic payments ecosystem.