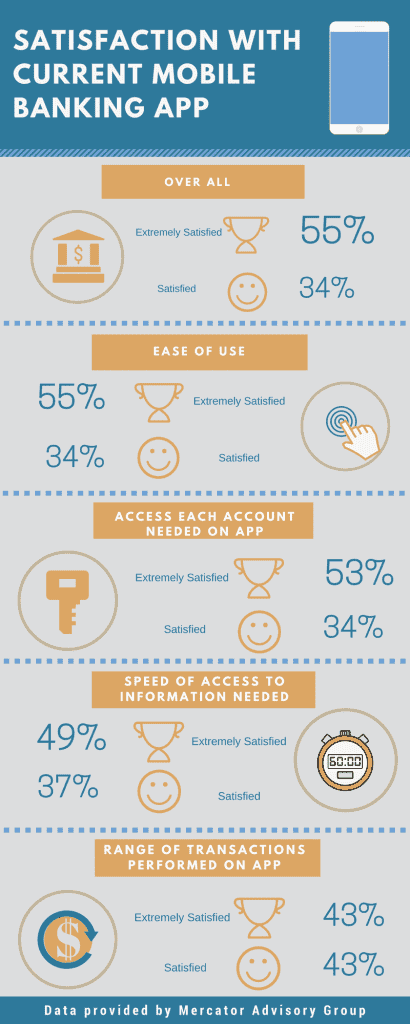

Mobile banking is growing at a rapid pace as most consumers use a mobile device to do some type of banking activity. While young adults led the way, mobile banking is a convenience that most U.S. adults embrace for making just-in-time transactions, paying bills, transferring money or just to check balances or verify transactions were made. While more consumers still access mobile banking on their bank’s website, mobile banking apps are becoming an easier way of managing your bank accounts and making transactions. In fact, the latest findings from our CustomerMonitor Survey Series consumer research published in our report, Digital Banking: Improvements Needed to Compete with Fintech, consumers’ satisfaction with mobile banking apps is high – 88% of mobile banking app users are satisfied with its overall performance including 55% who are very satisfied. When asked to rate their satisfaction with their mobile banking app’s ease of use, ability to access the accounts needed on the app, speed of access to the information needed and the range of transactions they can perform on their app, users were most satisfied with the ease of use, particularly compared to using even a mobile-optimized FI website (mentioned by 55% who were extremely satisfied). Mobile app users appreciated their ability to access the accounts needed, also highly ranked, but mobile banking app users were least satisfied with the range of activities they can perform on the mobile banking app, and perhaps a reason most still use the FI website using a mobile browser. Mobile banking users also claimed in this study they would use mobile banking more often if they could receive more education and training on how to use the features of their mobile banking app, either in the branch, on the phone or online.