Though checks are frequently dismissed as a thing of the past, especially with the growing number of digital payment options available, they remain an extremely prominent payment method in the United States today. One of the most pressing issues regarding depositing checks is the time it takes for checks to clear and for funds to become available.

With that issue in mind, and to learn more about emerging options for faster access to deposited check funds, PaymentsJournal sat down with Kevin Nason, director of Product Management at Fiserv, and Sarah Grotta, director of Debit & Alternative Products Advisory Service at Mercator Advisory Group.

Checks are still relevant in today’s world

Even though checks are often forgotten, much of the U.S. payments system still relies on them. “The Federal Reserve recently published their first cut at the data from its triennial Payments Study in December and in that report found that there were 14.5 billion checks written for a total of $25.8 trillion in 2018,” said Sarah Grotta.

Grotta explained that while check volume is declining, “it’s still a really significant part of our payments ecosystem, and it’s important to note that there are far more dollars that move by checks than by all of the card payments combined, including debit cards, credit cards, and private label cards.”

There has been some talk of check deposit availability in the context of faster payments with The Clearing House’s RTP platform and what is being envisioned for FedNow, but Grotta noted that these platforms “will not really make checks available instantly.”

Consumers and businesses are willing to pay for immediate funds access

Fiserv’s Kevin Nason defined check deposit acceleration as “making funds available to the customer as soon as they deposit checks, rather than waiting the typical two to three days it takes for that check to clear.” And it’s a service that is appealing to consumers and businesses alike.

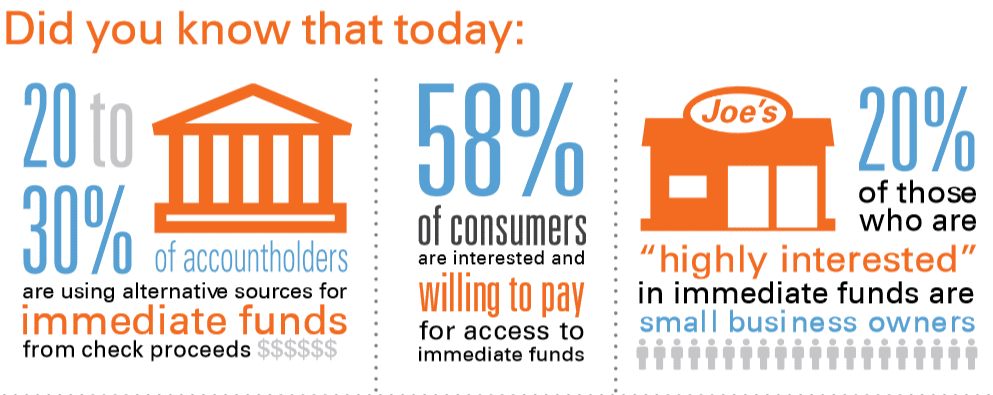

Fiserv’s research found that 58% of consumers are willing to pay for accelerated funds availability from check deposits. Accelerated funds are frequently used on emergencies like health events, home repairs, or car repairs. Additionally, 20% of small businesses would leverage accelerated funds availability from check deposits to fund payroll, purchase supplies for upcoming projects, etc.

Traditional payment providers and fintechs recognize the value of this feature, and have begun to allow consumers to access immediate funds at the cost of a fee. For example, Square recently announced that it will begin imposing new fees for merchants to transfer funds to their bank accounts instantly.

Small businesses are looking to switch financial institutions

A rising number of small businesses are looking to switch financial institutions in upcoming years, and accelerated funding is a critical feature that business owners seek out when deciding which financial instruction to switch to.

A Fiserv survey of small business owners found that over two-thirds (68%) indicated that a financial institution’s ability to offer real-time instant transactions was “important” or “very important” in terms of what they want in a new provider.

Four key areas are driving small businesses to seek out new financial institutions:

- Enhanced

digital functionality: Financial institutions that offer better and faster

mobile or ATM experiences are more likely to appeal to small business owners. - Better

user experience: This goes hand in hand with increased digital

functionality, and is “becoming table stakes now as opposed to just something

that’s easy to use,” said Nason. - Alternative

financial services options: Payments is not a “one size fits all” type of environment

anymore, and small businesses are looking for financial institutions that fit

their unique needs. - Accelerated

availability of deposits and payments: Accelerated availability of funds

ties back to each of the other key areas as an alternative financial service

that both enhances digital functionality and improves user experience.

These points may be particularly relevant to financial institutions, which tend to struggle to keep up with deploying evolving technology, said Grotta. “Smaller financial institutions find themselves losing customers to the largest banks that are introducing new technology very rapidly,” she said. “Because of this, looking for ways to provide a better experience that doesn’t require a monumental investment is really critical for most financial institutions.”

With the increasing number of non-banking providers entering the payments space—a recent example being Google’s move into checking—those four areas will be critical for traditional financial institutions to grow and maintain their deposit base and differentiate themselves from fintech competitors.

Challenges consumers face regarding accessing check funds— and how Fiserv hopes to solve them

The challenges consumers face regarding accessing checking funds aren’t new. As Nason put it: “Everyone at one point in their life has made a deposit and hoped it would clear before another check they wrote actually came into the bank.” Major challenges include the typical two to three day delay and resulting unavailability of funds, a lack of understanding of financial institutions’ funds availability policies, and confusion around the timing of these deposits.

While these challenges have been ongoing for years, there is one thing that is new: the solutions created to solve them. Fiserv specifically has tackled the problem of delayed access to check funds by launching its Immediate Funds solution.

Fiserv’s Immediate Funds solution enables instant check access

Fiserv’s Immediate Funds product addresses these challenges by creating a model that makes funds from qualified checks available immediately. Fiserv uses analytics based on a database to determine whether a deposit will be approved for immediate funds— and a vast majority are. The offer rate is in excess of 90%.

Consumers who do not get approved for immediate funds aren’t forced to experience the feeling of rejection, however. While Fiserv proactively makes the offer of immediate funds access for a fee to qualified consumers, their check will simply go down the normal deposit path if they aren’t qualified.

On top of that, Fiserv designed the system and process to exclude consumers’ personal identifiable information. It makes decisions around items, not consumers, meaning that institutions and consumers alike don’t have to worry about personal information being improperly managed.

Conclusion

Ultimately, even the long-established practice of depositing checks has exciting new solutions designed to meet the needs of modern consumers. Fiserv’s Immediate Funds addresses the challenges faced by consumers and businesses that need access to funds more quickly than traditional check deposits allow.