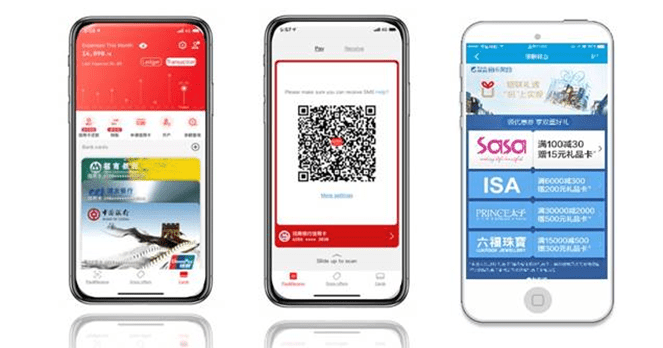

If you have a bank card in China, it’s most certainly a UnionPay card, as it has reached near de facto status among Chinese consumers. More than merely the payment card association originated from China, or even a cashless payment system, UnionPay has launched its mobile payment application as a unified mobile payment traffic portal that consolidates a wide range of resources and channels and connects to mainland China’s major commercial banks.

Launched in December 2017, UnionPay’s mobile app surpassed 150 million users in April 2019 – less than 1.5 years since it joined the mobile payment battlefield.

Despite its popularity in China, outside of the country UnionPay is less well-known to Westerners. Yet its growth is increasingly difficult to ignore, as it now owns twice as much market share as Visa and three times that of Mastercard in terms of cards issued, with a total card issuance of over 7.5 billion. UnionPay transactions accounted for more than 11 trillion USD in 2017. And now UnionPay is accepted in 174 countries and regions, and is making a strong presence in North America and Europe.

As a rising star in the sector, UnionPay is a worthy challenger to the status quo of the “duopoly” of Alipay and WeChat Pay. The launch of its mobile app leaves it well positioned globally to take on formidable competitors namely an ecommerce network with hundreds of millions of loyal consumers (Alibaba), and the largest social networking platform that leads all mobile applications in terms of total traffic (WeChat).

The growth is impressive since UnionPay has found itself in the middle of a major transition in payment systems worldwide, namely the importance of credit cards challenged by the growth of mobile payment platforms. UnionPay has shown it is ready for this kind of shift, however, and through the use of a QR code platform, has put itself in a strong competitive position. Given its massive presence, it’s hard to call UnionPay an underdog in this race, but its rapid growth is a tale told both at home and abroad.

Leveraging a strong relationship within the banking infrastructure

One of the key advantages Union Pay has over its rivals its relationships with the banking infrastructure. UnionPay has always taken a mutual stand with the mission of serving both its member organizations (banks and other financial institutions) and businesses. This approach largely enhances its compatibility of collaborating with all kinds of institutions and merchants, and eliminates possible interest conflicts or concerns such as those related to data privacy or holding fund in transactions.

As a result of its relationships, bank cards issued by almost all Chinese banks can plug in to UnionPay mobile app. For Chinese consumers who in total possess billions of bank cards (5.46 cards per capita according to the Central Bank), UnionPay’s app is best positioned of the “Big 3” to manage all their cards for all consumption scenarios. Through UnionPay mobile app, users can bind all UnionPay cards and use the QR code payments function. On top of that, UnionPay has an extended ecosystem, such as 80 kinds of credit cards from over 20 banks that can now be applied within the app, the more 300 banks that have activated debit cards balance enquiries, and the almost 100 bank-activated credit cards that offer bill check and repayment (with no handling fees).

UnionPay’s full coverage in financial institutions, POS devices and ATMs is no doubt the major reason why UnionPay mobile app has enjoyed a fast development track in China. Now it is successfully and rapidly ramping up its presence in overseas markets with an aggressive merchant acquisition program.

When the Card is Not Enough

To a Western audience familiar with the dominance of the credit card for payments, UnionPay’s staggering growth in North America looks like enough to make it a severe competitor on these shores. North American merchants have taken notice as Chinese travelers come to visit, and they’ve opened their arms wide to receive the preferred card-based option. As of November 2017, more than 80% of merchants in the United States have accepted UnionPay credit cards, and almost all ATMs have accepted UnionPay cards. In Canada, it’s a similar story with over 280,000 merchant locations and 90% of ATMs now accepting UnionPay.

But accepting UnionPay isn’t enough anymore: in the past five years, Chinese consumers have transformed their payment method from “cash-only” to “cash-free.” The act of swiping a card is giving way to scanning a QR code, and this preference for mobile payments has created two juggernauts in that space: Alipay and WeChat Pay. With both Alipay and WeChat crossing the 1 billion global user mark earlier this year, the potential reach of both mobile payment platforms is astronomical to say the least — both in and outside of China.

Taking a Third Option

Exploring the benefits of UnionPay’s growth into mobile payments for merchants is another key factor to exploring how UnionPay has exploded onto the scene, but it also requires a touch of nuance.

For merchants, the UnionPay mobile app is a key to unlocking the purchasing power of 7.59 billion UnionPay cards issued worldwide — but some are finding they need help in integrating this boom in potential dollars. That’s where payments enablers (full disclosure: including my company, RiverPay) come in. Enablers act as smart payments partners of UnionPay International and essentially advocates of the service. As one of only a handful service providers actively promoting UnionPay QR code payments solution in the US and Canada in the early stage, RiverPay counts hundreds of merchants in its client base who accept UnionPay. And several other companies like RiverPay, are together fighting the “ground war” to expand the UnionPay footprint.

Integrating the QR code payment function of the UnionPay mobile app onto merchants’ existing cashier systems without disruption, we enablers get merchants on board to accept mobile payment apps preferred by the Chinese. We are essentially opening the gateway to access billion-dollar purchasing power for North American and European merchants via the UnionPay app. Research shows that by accepting payment made through platforms familiar to Chinese consumers like the UnionPay app, retailers can see an increase of up to 60% in foot traffic and sales. With a gateway system provided by enablers, payments initiated through UnionPay and other mobile apps can be accepted on websites, mobile websites, mobile apps, etc. without changing merchants’ current checkout flow.

Well-positioned for the next era of digital payments

As the dividends unleashed merely from user traffic have been used up, it has been widely accepted that the next stage of mobile payments competition will be based on the ability to enhance consumer experience and the capturing of consumption scenarios. Especially in the global markets, payments enablers like RiverPay serve as the extended arm to support UnionPay’s ambition of extending its presence in various vertical sectors and thus link purchasing power and consumption needs.

QR code is also a channel to integrate payment with marketing promotions, loyalty programs and other value-added services. In this respect, UnionPay mobile app will definitely benefit from UnionPay’s years of experience in running validated promotion campaigns for cardholders, as well as build on the established partnership between UnionPay, card issuers and merchants.

Ultimately, the addition of a “third horse” to the race is beneficial for the consumer, the merchant and all three payment platforms. It’s the argument of a rising tide lifting all boats, and this rising tide is ready to spend.