Pandemic-spurred shockwaves to supply and demand are driving significant liquidity risks for companies across the world. Volatile foreign exchange markets are only accentuating uncertainty about corporate cashflows.

While it’s crucial to closely track liquidity and risk metrics even in the best of times, COVID-19 has rendered these measures all but essential to maintaining stability (or as close to it as possible right now). CFOs and boards now look to their corporate treasurers for liquidity visibility and cash forecasting that’s reliable and uber-current. FX exposures must be hedged to create accurate and comprehensive reports of liquidity and the pressures on working capital.

Enabling informed risk management decisions in the face of FX volatility calls for companies to utilize robust analytics and enact well-defined market risk policies. Identifying potential impacts on cashflows and earnings allows companies to make appropriate adjustments to their existing hedging strategies to minimize risk.

Recognize areas of exposure

Identifying and analyzing exposures – and their contributions to overall enterprise risk – are foundational steps to effective FX risk management. Accurate exposure forecasts provide the baseline for modeling all risk management activities going forward. It’s important to center forecasts on a sensible time horizon: one that’s not so short that risks are downplayed, and not so long as to reduce accuracy. For a comprehensive portrait of risk, both intercompany and external exposures need to be surfaced. Natural hedging and seasonal shifts in the business cycle should be factored into these forecasts. Companies grappling with a complex matrix of market risk factors will also need to recognize and account for interrelations among those risks.

Establish your FX risk measurement methodology

Once baseline forecasts are established, the next step is to determine the correct methodology for measuring FX risk. Candidates for your chosen methodology include an earnings/cashflow approach or an economic-value approach. For a foreign exchange book, for instance, a cashflow approach is the best-suited methodology, because shifts in currency pairs lead to upward and downward shifts in earnings. On the other hand, consider an investment portfolio of fixed income securities: here an economic-value approach is ideal, because the portfolio’s present value would decline if the interest rates increase.

1) Scenario modeling (or deterministic modeling).

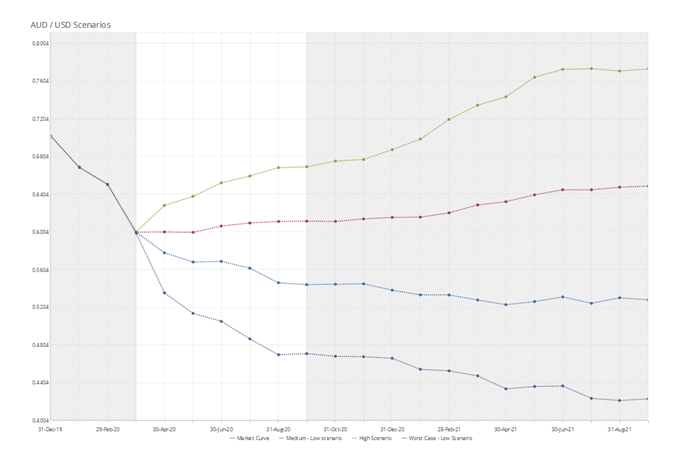

Scenario modeling offers the simplest approach to stress testing, projecting cashflow scenarios in likely, worst-case, and best-case ranges. This analysis doesn’t attempt to predict future FX rates. Instead, it focuses on offering a clear visualization of risk exposure across a range of potential FX rate scenarios, and quantifies the impact on cashflow under those scenarios. This makes it possible to report risk as a variance between likely and worst-case outcomes, or best- and worst-case outcomes. While treasurers are focused on minimizing downside risks, incorporating the best-case scenario is particularly valuable in highlighting the opportunity costs of any measures taken to reduce negative impacts.

A forward market curve commonly serves as the likely scenario. The best- and worst-case scenarios can be modeled as parallel shocks to the market curve, or by incorporating more realistic movements that model specific changing circumstances.

2) Cashflow-at-Risk simulation (stochastic modeling)

A Cashflow-at-Risk (CFaR) simulation applies Monte Carlo simulations to produce large quantities of potential future FX rate paths, and aggregates them to forecast exposures. Whereas a spreadsheet model calculates the outcome of just a single scenario, this sophisticated modeling method eliminates guesswork from scenario forecasts. CFaR simulations can calculate tens of thousands of scenarios, using fixed or random seed values.

CFaR is quite effective in providing a clear understanding of a company’s exposure risks, and testing the effectiveness of risk management strategies. The simulation produces a broad range of potential cashflow outcomes, and calculates the statistical likelihood of each coming to fruition. Said another way: the model projects how dire cashflow situations might become over a certain time period, to a specified level of confidence.

Treasurers have a choice of simulations, and in the algorithms used to generate simulations – such as Brownian Motion, Geometric Brownian Modified, and Mean Reversion – to select in creating the most accurate representation of the particular risk factors their companies face. Parameters such as volatility, long-term mean, and others must be added to the model to accurately portray their impacts on risk outcomes.

3) Value-at-Risk model

The Value-at-Risk (VaR) model studies potential impacts on market values instead of future cashflows, leveraging historical rates or simulated price curves to do so. VaR analysis helps treasurers to assess the maximum potential investment losses caused by FX volatility, over a specific time period and with a specified level of confidence.

For cashflow analysis, scenario modeling and CFaR are the most appropriate tools – VaR lends itself to analyzing market stress on investments. To achieve a breadth and depth of viewpoints on the company’s risk profile, these metrics can also be used in tandem. For instance, treasurers may use a CFaR model to produce a worst-case circumstance, and then use scenario models to stress test against that circumstance.

Considerations

With a model selected and forecasts consolidated, treasurers must then incorporate existing hedging contracts into all models. Modeling must also account for contingent cashflows, such as an option being struck due to certain market price paths occurring within a scenario.

Treasurers should take account of the following inputs and parameters when deploying analytic models:

Utilizing certain inputs allows models to explore protections against previous periods of stress. It can be instructive, for example, to model the annual volatility and average shock sizes that occurred in the 2008 crisis, and see how the company’s current exposure profile performs when faced with equivalent shocks. Comparing before-and-after cashflow metrics for the current book and proposed hedging strategies will also yield valuable foresight.

Conclusion

The COVID-19 pandemic has driven unprecedented volatility around the world. Commodity currencies like AUD and NZD face downward pressure, while safe haven currencies like USD, JPY, and CHF have new strength. Oil prices face historic lows, further affecting CAD and NOK, in particular.

Given the uncertainty in revenue streams due to this volatility, risk management policies should rightfully undergo review. The impacts of FX shocks and funding stresses must be closely understood and factored into decisions around risk tolerance. Effective stress testing offers the insights needed to better understand risk exposures, and to enable wiser hedging policies.