The first couple of weeks of sheltering in place regulations saw finance and accounts payable organizations scrambling to set up remote operations and get payments out the door. Most were able to accomplish these goals quite well. Now we’ve moved into the next step–establishing efficient workflows and productive practices. It’s still challenging, however. Companies have to find ways to keep people safe while executing paper-based processes that keep their teams office-bound. For example, many companies still have to go into the office to pick up mail, circulate invoices for approval, and prepare checks for mailing.

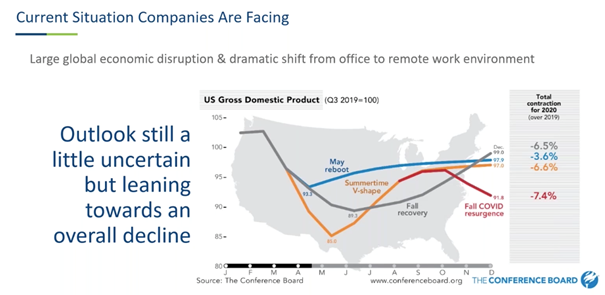

They also must consider the best way to move forward and develop strategies for managing their teams through economic uncertainty. The Conference Board, a non-partisan economic think tank, recently sketched out three possible scenarios. Their best-case scenario predicts a 3.6% decline in US GDP for 2020, while the worst case would see a 7.4% decline. In other words, nobody knows what the next six to 12 months are going to look like.

That means AP needs to focus on conserving cash while keeping operations moving. They can expect more calls from suppliers since Accounts Receivable teams typically ramp up their efforts in tough times. They need to prioritize payments and capture early pay discounts. Procurement is going to reach out to try and renegotiate prices or terms. Treasury is going to be very interested in the timing of payments and managing working capital. It’s on the AP team’s shoulders to make sure they’re engaging with these teams and coordinating efforts.

At the same time, they’ve got to consider the efficiency and the productivity of their own team as we continue to work remotely. Among other things, that means coming up with a strategy for shifting to electronic payments at scale.

Many organizations have had this goal for a long time, but, depending on the research you look at, around 40 percent of business payments still issue by check. This number is down from a decade ago, but still problematic in a remote work environment. So why don’t businesses pay more of their suppliers electronically? Well, as everyone who rushed to shift suppliers to ACH payments when shelter at home orders took effect has learned, you can’t just flip a switch and move all your suppliers.

It’s easy enough to find a bank to handle ACH transactions for you. It also sounds a lot cheaper upfront than checks—if you only look at transaction processing costs, which are usually well below $1.

But with ACH, you have to enable your suppliers one by one, and then store and update their data securely. That becomes a fixed cost because there’s a constant churn of suppliers and their bank data–changes usually around once every four years per supplier. You should also expect to manage exceptions that arise with ACH file submissions and more nuanced supplier questions.

Thinking ACH is cheap or straightforward is one of the biggest misconceptions holding companies back from paying electronically. That’s not to say you shouldn’t make ACH payments. That said, they should be part of a holistic strategy that addresses the entire payments workflow, encompassing all forms of payment, including international wire payments.

What does that look like?

Card first

If you’re going to reach out to suppliers to enable them for electronic payments, you should first ask them to accept payment by credit card.

Virtual cards–sometimes known as single-use ghost accounts or SUGAs–are not as well-known as they should be in finance and accounting circles. Still, they can be an incredibly valuable part of your payment strategy. Unlike P-cards or company-issued credit cards, virtual cards exist to pay suppliers easily. Each card has a unique number that can only be used by the assigned recipient in the designated amount. That provides AP with substantial control and makes it one of the most secure, fraud-proof payment methods. You also should expect to receive rebates to offset some of your AP costs.

The main challenges are enablement and outreach, which don’t require significant effort on the part of AP teams since virtual card payment and remittance are relatively straightforward for suppliers. All that’s left is to structure your rebate program to support your team’s efforts and then some.

ACH for most

If a supplier declines to accept card, which often happens due to the interchange fee, your second request should be to enable them for ACH. Most vendors will say yes to this; in fact, they’d prefer it to check. Just be sure you have a realistic appreciation of the true ACH payment operating costs, including enablement and data management, as well as fraud support.

Check for holdouts

While the number is dwindling, there are some suppliers with a ride-or-die mentality who won’t accept anything but checks. For these suppliers, an outsourced payment provider can do a print check from an electronic file, so your team doesn’t have to handle all the paper.

Your payment strategy should include automating the payment workflow. Fintech ePayment providers wrap these disparate workflows into one interface so that all AP has to do is click “pay.” Then their payments will issue to their suppliers in the method they elected to receive. Because these platforms are in the cloud, payments can be approved and scheduled remotely, with visibility for multiple team members.

Heightened fraud protection

Your payment strategy should also include fraud protection. The pandemic, the move to remote work, and challenging economic conditions have created a perfect storm for a rise in all types of crime, including payment fraud. It’s essential to have strong internal controls, especially now that sensitive information is residing in your teams’ homes and on their personal networks. Preventing theft is a key component of cash management.

It used to be that organizations mainly worried about check fraud, and that’s still a problem, but it’s reduced quite a bit thanks to controls such as Positive Pay, Positive Payee, and watermarks on checks. So far, there aren’t similar controls for ACH. As businesses have gravitated towards ACH solutions, such payments have become more of a target for fraudsters. That’s a problem because the funds move faster, making it much harder to recover a fraudulent ACH.

Business Email Compromise (BEC) schemes are the most common type of attack. These involve fraudsters masquerading as suppliers, company executives, or other high-ranking personnel, requesting that funds route to a new, fraudulent bank account. We’re already seeing that the pandemic has provided BEC scammers with new material to convince an overwhelmed AP to comply with these requests.

To protect your team, you need a partner who can support your enablement and fraud protection goals, so your team can stay focused on cash management.

Finance and AP have long intended to go electronic, but the transition has been slow. It’s not just the flip of a switch or the sudden addition of a new payment type. Very few businesses realize how strategic the shift is until after they’ve committed to an update. Many companies that don’t plan accordingly have had to revert to check payments when they realized the actual cost and effort it takes to switch suppliers over. Rather than trying to attack a single pain point, you have to address the whole process from top to bottom.

Now we are going to see an acceleration of this shift with the remote workforce and challenging economic conditions. There is a new imperative, and there is also new technology. Interestingly enough, a lot of the fintechs providing B2B payments technology got their start during the great recession, when the financial system collapsed, and cloud technology was being born. These are now mature companies, ready to “cross the chasm” and transition their partners to 100 percent electronic payments.

Written by Josh Cyphers, Vice President of Product & Strategy and Derek Halpern, SVP of Sales for Nvoicepay.