Child identity theft and subsequent fraud is often waged by scams that target children through social media and gaming apps. It is one the most worrisome cybersecurity issues in America today.

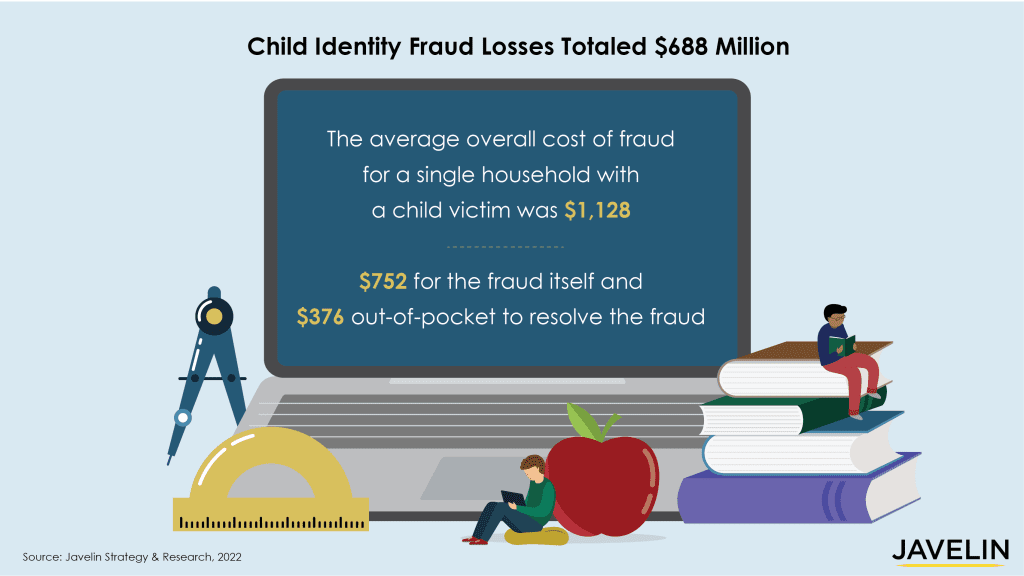

According to Javelin Strategy & Research’s 2022 Child Identity Report: The Perils of Too Many Screens and Social Media, the fraud losses per household with a victim of child identity fraud was $752 in the past year. That is up from $737 in the previous year. Increased awareness is having an impact. Overall child identity fraud losses totaled $688 million from July 2021 to July 2022. That is down from $918 million the previous year. Javelin attributes that decrease to increased public awareness and more collaboration between parents,law enforcement and their financial institutions.

Javelin Director of Fraud & Security Tracy Kitten recently moderated a webinar about child identity fraud. It featured Ben Halpert, the founder of SavvyCyberKids.org, Dave McCain, a special agent with the U.S. Secret Service, and an anonymous parent whose teenager was the victim of identity fraud.

ID Theft and Fraud: Difficult to Detect, Difficult to Monitor

Child identity fraud often goes unnoticed for years. It only makes itself known when the affected child eventually applies for a job or a student loan. Or the child attempts to file taxes for the first time, said Kitten.

“It’s also very difficult to monitor,” added Kitten. “Unless you as a parent are sharing an account with your child, you wouldn’t be clued in to who they are interacting with online.”

Halpert noted that more education for parents to help their kids be tech-savvy and safe online is needed.

“You teach your children not to walk away with someone they don’t know at the mall; but they are communicating with all these strangers who are sitting behind a screen,” Halpert said. “Parents need to be more aware of what their child is doing online.”

Social Media: Fraudsters Target Kids

This is especially true on social media, which is where fraudsters often target kids. Children are more willing to give up personal information online. And they are generally much more open and talkative on social media than adults. That means fraudsters can obtain personally identifiable information (PII) from a child to commit fraud. Javelin strongly encourages parents to not allow their children to have personal profiles on social media. They should wait until at least the age of 8. And they should limit their children’s access to social media until at least age of 6. When children do engage on social media platforms such as YouTube or Messenger Kids, they should be doing so on an account that is linked to a parent or guardian, and even then, the risks are great.

Criminals target children on social media because of how quickly they can multiply their attacks.

“If a criminal can take over the social media account of a child that has 1,000 connections, they can spread fraud to all those people (to which the child is connected),” Halpert said.

It’s important for parents to be aware of the potential signs of fraud. And they need to be proactive in dealing with them, Kitten added.

“For example, if a password to an email account suddenly doesn’t work, it may be something to look in to,” she said. “Don’t assume the child just forgot the password; it could have been taken over and changed.”

Working With Law Enforcement

In years past, parents may have been reluctant to contact law enforcement after a child identity fraud incident, or may not have known whom to contact. Luckily, that is changing. Javelin notes that engagement with law enforcement related to child identity theft and subsequent fraud has seen a healthy increase in the past year, suggesting that consumers are more readily engaging with law enforcement.

Agent McCain advises parents whose children may be victims to first contact local and state authorities; then, depending on the severity of the fraud, the case could eventually be kicked up to federal authorities.

ID Theft and Fraud: Burden on the Whole Family

Child identity fraud often creates a burden on the whole family. Kitten notes that the number of hours required by families to resolve a case of child identity fraud is 16. And that doesn’t even take into account the emotional impact.

The anonymous parent said that their family only found out about the fraud when their daughter tried to file taxes for the first time.

“It’s still not resolved, and the real issue is that someone out there has all of her information, which they could do something with at any time,” the parent said.

Javelin recommends that all parents enroll in a full family identity protection and monitoring service. They should look especially at one that also monitors social media accounts.

That’s something the parent did after the fraud was discovered, and she urged others to do so before fraud strikes.

“I would tell others, proactively enroll in an identity monitoring service,” the parent said.

Help from Financial Institutions and Credit Bureaus

Financial institutions and credit bureaus can both play key roles in helping reduce child identity fraud. Halpert noted that while an adult can quickly go online and freeze their credit in a few easy steps, doing so for a minor is actually an onerous, paper-based, and time-consuming process. He urged credit bureaus to enable parents to be able to freeze their child’s credit quickly and digitally.

“Credit bureaus need to help us on this,” Halpert said.

Financial institutions can also play a key role by providing education around child identity theft risks. Banks and credit unions can also stand out and gain a competitive advantage if they provide these services, Javelin noted.

Financial institutions should also encourage their customers to sign up for text and email alerts that warn of any suspicious activity.

“This is a basic alert function that financial institutions need to do better jobs of encouraging their customers and members to take advantage of, and institutions also need to ensure they are promoting the ability to sign up for these alerts so consumers can easily and readily employ them,” the Javelin report noted.