With the global pandemic forcing many physical businesses to close and people to remain indoors, the commerce landscape has been severely impacted. Consumers are often unable or unwilling to shop in physical stores, and traditional payment methods such as paper money are increasingly viewed as potential mediums to transmit the deadly COVID-19 virus. Retailers have responded by changing the way they operate, communicate with customers, and support transactions.

For many retailers, these changes revolve around reimaging their digital footprints and digital outreach strategies. These merchants are focusing on aligning their enterprise around the end-to-end experiences that drive customer satisfaction. Such efforts include modernizing existing systems, focusing on increasing authorization rates, and reducing declines.

To better understand how merchants are responding to COVID-19, PaymentsJournal sat down with Peggy Alford, EVP of Global Sales at PayPal, and Ted Iacobuzio, Vice President and Managing Director of Research at Mercator Advisory Group. During the conversation, Alford and Iacobuzio discussed how merchants are now interacting with their customers, what opportunities and challenges exist, and how PayPal is helping companies navigate this new reality.

How COVID-19 has impacted the way merchants and consumers interact

The most salient trend in the retail world brought on by the pandemic has been the accelerated shift from physical to digital. A digital transformation that was expected to take two years has instead been compressed into just the past two months.

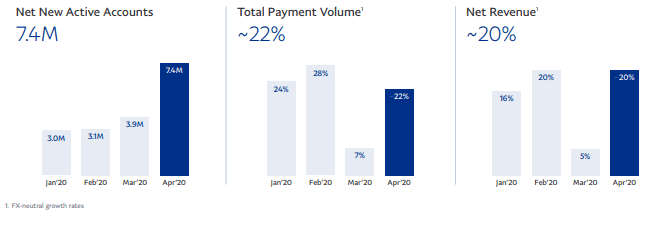

In April, for example, PayPal added about 7.4 million new active accounts to its platform, a monthly record for the company. Pre-COVID-19, PayPal would typically see about 100,000 net new users on its platform each day. Now, this number has shot up to almost 300,000 net new users a day.

The uptick in new accounts has been accompanied by an uptick in volume. May 1, 2020 marked the largest single day of transactions in PayPal’s history, eclipsing both Cyber Monday and Black Friday—two of the biggest commercial days of the year. The rise in new users and transaction volume reflect the fact that there is substantial demand for digital payment solutions.

“What that’s indicating is the companies we serve are really looking to continue operations and grow their business by shifting to digital,” said Alford. With consumer behavior changing, this shift toward digital is more or less a requirement; companies that fail to respond will lose out to those that do.

What consumers want in this changing world

While adjusting to the new retail world imposed by COVID-19, companies need to respond to consumer behavior and expectations. One central desire of consumers is that of choice; they want to be able to transact and manage their money through different methods, whether in person or online. Therefore, companies that support different payment methods, ranging from Venmo to Google Pay, are best positioned to stay competitive.

Consumers also want purchasing power and flexible finance options. Businesses can provide this relatively quickly and without making huge upgrades to existing payment infrastructure. Relatedly, consumers are looking to save money. While this has always been true, the economic insecurity caused by the pandemic has made the desire more pronounced. “It’s helpful to support consumers in finding items at prices they can afford through shopping and promotion tools,” said Alford.

Safety is another primary concern of consumers. Part of the concern is over physical safety. Many consumers want to avoid cash or key pads because these physical entities could contain pathogens. QR Code-enabled payments and other contactless payment options are therefore a safer alternative.

Consumer concern for safety also extends to their personal information and money. People want to transact with companies they trust. When consumers trust a company, they are more willing to shop there. PayPal’s market research indicates that “there’s a 50% lift in consumer willingness to buy when PayPal is present at checkout, whether or not they ultimately use PayPal,” explained Alford.

Merchants can meet consumer expectations

In order to meet the consumer expectations discussed above, merchants need to shift their focus from physical processes to digital ones. “Businesses and merchants used to think of physical first and digital second,” noted Alford. “That mindset has had to shift in order for businesses to survive.” As PayPal’s volume data shows, that shift is well underway.

Merchants have had to change their strategies to reach consumers. For example, restaurants have embraced carry-out and delivery options, while retailers have turned towards e-commerce and in-store pick-up options.

Alford pointed out that simply offering digital shopping and payment methods is not enough. Companies need to also make these digital methods simple and intuitive; consumers want excellent user interfaces that are easy to use.

The challenges retailers face in shifting digital

Since a lot of merchants have been primarily focused on the physical side of retail, they may be under-invested in digital. For many companies, they may not currently have infrastructure in place to accommodate e-commerce.

“In fact, in a study that PayPal conducted late last year, we found that across all age groups, nearly 80% of the consumers surveyed have shopped via smartphone, yet only 63% of businesses are optimized to accept mobile payment,” said Alford. The nearly 15% gap underscores the work some merchants need to do to keep up.

How PayPal is helping retailers pivot to digital

“A full suite of simple solutions, many of which businesses can start using in minutes, can be found on the PayPal homepage by clicking get support for your small business, including how to create QR Codes for contactless payments, selling on social or creating an online store,” said Alford.

In addition to this resource page, PayPal has multiple products that can help merchants.

“We recently announced the rollout of an in-app QR Code feature that allows customers and businesses to conduct in-person transactions at a safe distance and touch-free using their PayPal wallet,” added Alford. Another example is PayPal’s Honey, an application that helps consumers find the best price for an item. Companies that offer consumers this functionality will benefit as a result. PayPal also supports a wide range of payment options, including Google Pay, Apple Pay, Venmo, and the traditional payment methods. Therefore, a company that partners with PayPal can support the many payment choices consumers want in the shifting commercial landscape.