The rise of electronic payment methods in recent years has led to predictions that cash could become obsolete. Despite the pessimism of the electronic payments boosters, cash use has remained a stable and enduring part of the consumer payments landscape. With COVID-19 disrupting daily life and altering consumer behavior in unexpected ways, a renewed perception that cash is on the way out has entered the media.

The argument goes that as consumers strive to avoid virus transmission, paper money may be too dirty of a payment method to use during the pandemic. Instead, the argument goes, people will flock to electronic payment methods that don’t require the physical exchange of an object they believe could potentially harbor the virus. While many surfaces and objects could become vectors of disease spread, science has proven that germs are more prevalent on non-porous surfaces like plastic and stainless steel than on banknotes. So while the notion of cash as a mechanism for disease spread makes some sense at first glance, the reality is very different.

A recent report commissioned by Cardtronics and designed and executed by Javelin Strategy & Research explores consumer sentiment “toward cash and payments, including any hesitancy to use various payment instruments due to the health crisis.” The report, “Health of Cash Check-Up May 2020,” dispels the notion that consumers have a health-driven aversion toward cash and that cash is on the verge of decline; instead, the study finds that cash is alive and well.

Consumer payment preference is virtually the same as 2019

Consumer payment preferences reveal the clearest evidence that cash is not about to be displaced due to COVID-19-related health concerns. Payment preferences refer to how people prefer to pay in various situations.

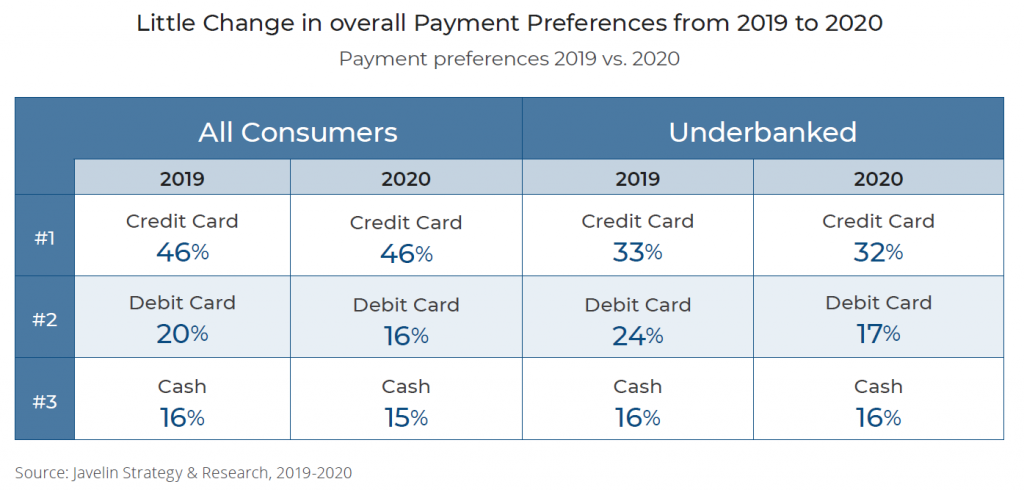

Cardtronics’ report compared consumer payment preferences from April 2020, during the depth of virus-related lockdowns, to the preferences consumers expressed in the fall of 2019. As the report noted, “preferred payment methods are virtually identical today to the fall of 2019.” In the fall, 16% of all consumers picked cash as their overall most preferred payment method. By April, well into the pandemic-induced lockdown, 15% of consumers expressed the same sentiment. The virtually identical “favorite way to pay” result showed that consumers did not appear to be averse to cash use.

This finding underscores the fact that “Cash still has a place with the American consumer,” noted Peter Reville, director of Primary Research Services at Mercator Advisory Group. “It is still widely used in today’s economy.”

Consumers are not worried about cash

There is a common media narrative that people are worried about how dirty cash is, but when asked, consumers have largely said otherwise. Cardtronics found that only one in ten people consider cash to be “very unsafe.” In contrast, one in four consumers said cash was “very safe” to use. An additional 51% of people viewed cash as either safe or neutral, meaning that the vast majority of people do not consider cash to pose a health risk.

In addition to viewing cash as a safe way to pay, many believe it’s still as important as ever. The Cardtronics survey asked people to respond to the statement “Cash is as important today as it ever was.” In response, “Over 80 percent of respondents agreed or were neutral while only 6 percent strongly disagreed.”

Where cash rules

One reason why cash is regarded as so important is that many customers turn to it for lower dollar value transactions. For example, Cardtronics’ survey found that in 2019, 59% of consumers ranked cash as the ideal payment method for transactions below $10. By April 2020, the number dropped only slightly to 54%, still the most popular way to pay for small dollar transactions, further showing how cash remains popular despite the pandemic.

Reville explained that Mercator’s data reveals a similar attitude among consumers. “Our research shows that cash is most popular in the types of locations that are typically low-ticket like convenience stores and QSRs (fast-food).” For many, cash is simply the most convenient and quickest way to pay for smaller transactions.

In addition to low-dollar transactions, cash is still popular for peer-to-peer (P2P) payments. Cardtronics’ report found that among all consumers, 38% most preferred cash when receiving funds from another consumer. The next closest payment method was non-bank P2P money transfer services (such as Venmo), with 17% of consumers reporting this was their preferred method.

“Many consumers choose their preferred payment method because they say it helps them with money management,” said Reville. “For some it is credit cards, for some it is debit and for others it is cash.” When it comes to P2P transactions or those below $10, cash is the clear favorite.

Cash is critical for the underbanked

Another appeal of cash—and one reason why it will remain with us for the foreseeable future— is that it serves the underbanked and unbanked population. According to the Federal Reserve, a striking 22% of the population is either underbanked or unbanked (16% and 4%, respectively). For these people, cash is the most important way to pay for goods and services.

Nearly three in four underbanked consumers reported using “as much or more cash within their payment mix today versus before the crisis.” This finding mirrors Mercator Advisory Group’s research on the topic. Because of how crucial cash is for the most economically vulnerable members of society, Reville doesn’t believe cash will go away any time soon.

Payments are down across the board

One reason people may perceive cash payments to be declining is due to the overall decline in payments of all types, including the daily small dollar transactions, such as the visit to the coffee shop, that cash is known for. Cardtronics’ research found that nearly half of consumers reported spending less in April than they had two months prior. While all payments have declined in absolute terms, cash has not declined as a portion of the payments mix or in consumer preference, proving the resiliency and continued importance of cash as a consumer payment choice.

When stores open back up, expect cash to retain its popularity among a large portion of consumers. Despite some continued pessimism about the health of cash, this payment method remains truly alive and well.* Why medical experts are speaking up for cash in times of COVID-19 (CashMatters)