Offering full services to new customers can be risky for financial institutions. For customers, it’s challenging to establish credentials and deposit history from day one. How can financial institutions address the cash flow needs of their new accountholders?

To learn more, PaymentsJournal sat down with Rayleen Lindquist, Director of Product Management, Deposit Liquidity Solutions at Fiserv, and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

The evolution of overdraft services

Overdraft services are a staple offering that financial institutions typically provide their customers. “This service assists customers when things get tough, or when they just misjudged their balances. Overdraft services provide deposit liquidity to most account holders when items are presented against what we call insufficient funds, but of course, they’re only paid within limits,” explained Lindquist.

Overdraft services have been around for many years. In the early days, account officers would manually review transactions overdrawing an account and make decisions to pay some or all items into overdraft or return them for insufficient funds. This decision was typically based on account tenure and other available knowledge about the account holder. A subset of financial institutions still use this manual decision-making method to this day.

However, most financial institutions have migrated to three main processes to determine an account’s overdraft limits:

- Fixed limits, based on product types and lines of business, providing a one-size-fits-all approach.

- Matrix limits, or rules-based limits, based on the analysis of multiple account data points.

- Dynamic limits, based on calculated risk scores and the ability to repay.

All of these provide overdraft limits that are used in the financial institutions’ core processing of exception items. This allows an automated decision whether the items can be paid or returned based on the available balance combined with the overdraft limit.

Of course, the process of setting overdraft limits is constantly evolving. The impact of the pandemic has made financial institutions look more closely at their strategic direction and overdraft policies, with increased focus on risk management. For example, PNC Bank has introduced a new overdraft product called Low Cash Mode. Other industry players are offering special products without overdraft limits or fees.

“Likewise, Congress and industry regulators will always have opinions on large financial institutions and their overdraft policies. We can be sure of one thing, and that’s that there’s always going to be change in our industry,” added Lindquist.

Riley agreed, noting that, “as long as there are checking accounts, there will be overdrafts to contend with–it’s just the nature of the beast. It can become a regulatory hot area, and it’s very important that there [are] structured ways to approach it.”

Young accounts are at greater risk of deposit charge-offs

Financial institutions categorize bank accounts as “new” based on the number of days that have passed since the account was opened. Depending on the financial institution, this categorization may last 30 to 90 days or even longer. After this, there is a period of time during which accounts are not considered new but haven’t been open long enough to be considered mature. SmarterPayTM from Fiserv classifies this period as “Young Accounts”, which generally applies to accounts that are 180 days old or less.

SmarterPay is a deposit analytics solution that Fiserv developed to help financial institutions assess and manage risk at the account level. SmarterPay calculates overdraft limits for over 50 million young and mature accounts. Recently, Fiserv introduced its Young Account Management module with an algorithm to assist financial institutions in minimizing and managing the risks related to this segment of accountholders. The overdraft limits for this segment are based on predictive variables, parameter settings, and business rules set by the financial institution.

“50 million accounts is a very impressive number when you think about household banking. The latest FDIC study says that 95% of U.S. households have a banking account of some sort, whether it be a DDA account or prepaid account, and that’s important,” commented Riley.

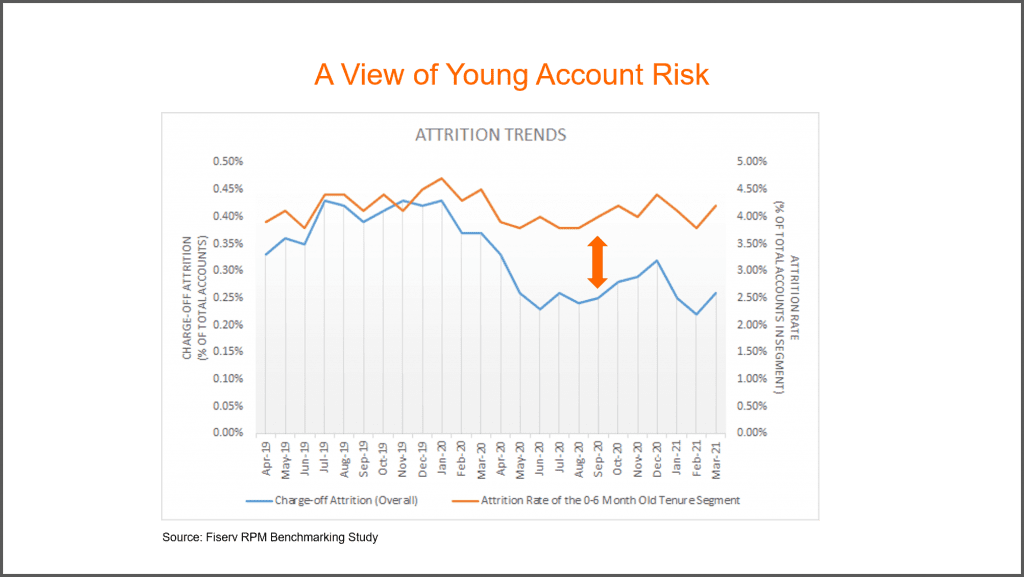

Financial institutions depend on newer accounts to grow their business, but they come with a downside. More specifically, the young account segment has a higher risk of deposit charge-offs than mature accounts that have been open at least a year. According to Lindquist, accounts that have been open for 180 days or less are within the highest risk category. Even within this group some accountholders are riskier than others. This risk gap is apparent in the graph below, provided by Fiserv:

Young account risk exposes yet another need in the industry; the need to create predictive analytics specific to this segment and establish unique treatment methods.

SmarterPay Young Account Management addresses risk posed by young accounts

Fiserv is well positioned to create solutions that address the risk posed by young accounts. “Because we’ve worked with some of the largest institutions in the United States and we’ve been able to amass a significant amount of data, we are in a unique position of being able to build more effective analytical models,” Lindquist said.

The Young Account Management module gives financial institutions another tool to help provide the right liquidity solutions to their accountholders. It also better equips financial institutions with the full functionality needed to better assess all customers based on Fiserv patented analytics and risk-scoring model. In other words, financial institutions now have the flexibility to set parameters separately based on young and mature account segments.

The takeaway

SmarterPay from Fiserv makes it possible for financial institutions to keep up with market changes. The Young Account Management module enables fixed or dynamic limits depending on the needs of an institution and provides liquidity for young accounts based on their risk and ability to repay. This saves accounts from charge offs and fosters crucial relationships between financial institutions and their customers. As an added bonus, SmarterPay comes with the opportunity to expand liquidity for mature accounts with less risk.

“By offering thoughtful, personalized solutions that support customer needs, financial institutions build loyalty and goodwill and are able to balance regulation, risk, and retention. To sum up, using Young Account Management is the responsible thing to do for your account holders as well as [for] the institution,” concluded Lindquist.