Like companies in other realms of financial services, credit unions must grapple with how to build the experiences their members want in a world that is increasingly digital, particularly since the onset of the COVID-19 pandemic.

As more and more of their members adopt digital tools to access their accounts and engage with their financial institutions, credit unions are devoting more resources to optimizing the experiences in those channels.

In this episode of the PaymentsJournal Podcast, Brian Day, Technical Sales Engineer/Solutions Consultant at PSCU, and Mercator Advisory Group’s Sarah Grotta, Director of Debit and Alternative Products, discuss how credit unions can make informed decisions about plotting their digital road maps. Creating low-friction, pleasing member journeys can position credit unions for growth and success now and into the future.

Digital: It’s Where Customers Are Going – or Have Already Gone

PSCU’s own numbers tell the story: Consumers have considerably shifted toward using financial institutions’ digital channels. This shift has been driven, in part, by a change in habits forced by the pandemic, as branch visits were either closed off entirely or curtailed while consumers sought other ways of accessing their accounts.

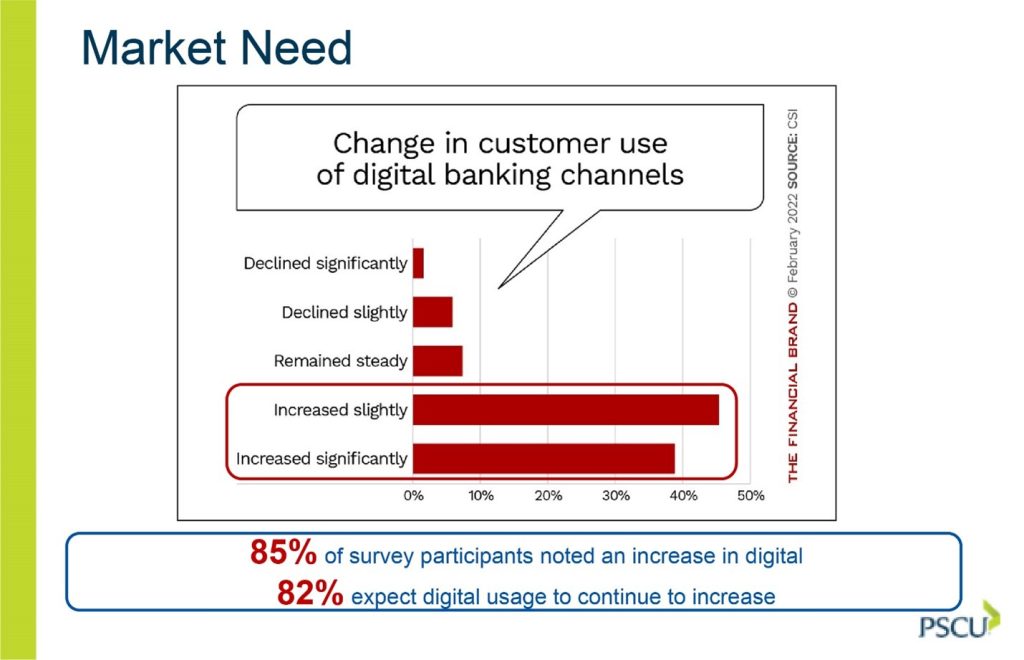

That shift has not been temporary, largely because it was already occurring before the pandemic set in. Now, the permanency of the shift is clear: Consumers who migrated to digital channels have stayed there and are being continually joined by others. Among respondents to a PSCU survey, 85% note an increase in digital channel use, and 82% say they expect their digital use to continue increasing.

“We were seeing growth broadly across the industry pre-pandemic,” Day said. “Then COVID-19 really accelerated that.”

In his digital consulting, Day is seeing the shift play out in two major ways:

- New credit union members are joining and interacting primarily through digital channels. “Frankly, that was out of necessity [amid the pandemic],” Day said.

- Existing digital users are expanding their use of features in digital channels.

The expectation that digital use will only continue expanding has played out in how businesses in the digital banking space have reacted. These reactions include:

- More investments

- New digital features

- Large issuers and fintechs increasingly entering the space

“It’s critically important for credit unions to get a sense of what they’re doing today and how that stacks up against the competition,” Day said. “Specifically, are they offering a robust set of features? Are they removing friction as much as possible from that journey?”

Prioritizing the Digital Journey

Grotta suggested that the pandemic’s role in shifting consumer patterns has, in significant ways, built a guidepost for credit unions as they decide what to prioritize.

“Certain digital products have really seen a huge surge,” she said.

Day concurred, noting that the financial reports across the industry pointed to enhanced digital use, thus driving attention and investments.

“That climate has caused credit unions to say, ‘This is really, really important, and this is something we really need to focus on,’” he said.

The top-of-mind questions, from a credit union perspective:

- Where do we start?

- What features do we need to develop?

- What are the experiences we need to focus on and make free of friction?

“We need to narrow it down and look at the granular perspective,” Day said.

Key Words: “Functionality” and “Utilization”

PSCU, through its Advisors Plus arm, now offers the Curinos Digital Banking Hub to help guide its clients through those questions to uncover what makes the most sense for meeting their members’ needs now and into the future.

Curinos goes into the marketplace and develops intelligence to help institutions see the road ahead, in terms of the present challenges, the trends in the marketplace, benchmarking, key performance indicators, and ultimately, a return on investment.

“It will help them look at and compare their digital experiences versus what others are doing and prioritize,” Day said.

Grotta used the example of a credit union that wants to add loan payments to its roster of digital banking features. It can draw on intelligence to see how prevalent that feature is across the marketplace, then examine individual experiences offered by issuers and see how those features are managed. The credit union can then plot its course.

Day noted that such research is being done today by credit unions, but it tends to happen informally. He told the story of a single employee at a client credit union who was testing providers by opening personal accounts with them. When told about the gathered intelligence and information through the Curinos Hub, Day said, “he was really excited about it and his comment was, ‘This is great—I can do the same research without destroying my credit score.’”

Where the Competition Is

Grotta noted that credit unions, as smaller organizations that have thrived by offering personalized service, aren’t under pressure just from larger banks with larger budgets. Neobanks are in the space, and more are coming in all the time. Challenger banks are competitors, too. And they’re taking their share of the market. Javelin Strategy & Research found that in 2021, 52% of all consumer financial relationships were with nonbanks.

“Competition is coming from every direction,” she said.

Day said it’s incumbent on credit unions, as smaller institutions, to understand what their competitors are offering in the digital space, then matching or exceeding those features that are most important to their own customers. The age-old credit union strength of knowing their members personally must extend to knowing their digital pathways and habits. Above all, he said, don’t do damage through friction-filled digital experiences.

“If you’re not delivering the key features that members are looking for on a day-to-day basis, that can be very damaging,” he said. “It’s really critical to have those key components of your journey optimized.”

“If it’s not, there are lots of choices in the market today. The member may not want to, but they may find themselves expanding the relationship into another financial institution that’s providing a better digital experience.”

Grotta pointed to what happened in bill pay, which seemed primed for financial institutions to dominate. But the investments didn’t follow, the experiences weren’t smooth, and billers developed their own, better experiences for customers.

“That’s one of the examples of how not having a great digital experience can really have a significant impact on your ability to serve your members,” she said.