Data aggregation continues to gain importance in the financial services world. But what value does it offer?

PaymentsJournal sat down with Paul Diegelman, VP of digital payments and data aggregation at Fiserv, and Sarah Grotta, director of the Debit and Alternative Products Advisory Service at Mercator Advisory Group, to delve deeper into the topic.

Defining data aggregation

Data aggregation, or what Diegelman referred to as “consumer permission financial data aggregation,” can be broken down into two parts: consumer permission and financial data aggregation.

The consumer permission component of the definition refers to the fact that in data aggregation, consumers should consent to the process and provide the necessary credentials for their bank. In return, consumers expect security, privacy, transparency in the use of their data, and some form of benefit.

The second component, financial data aggregation, consists of the financial data that is pulled—or aggregated— from thousands of sources, including banks, credit unions, credit card platforms, investments, mortgage companies and other payment providers. Aggregators like Fiserv have built what Diegelman referred to as an “underlying set of pipes,” allowing these parties to connect together in a faster process and deliver something of value to consumers.

Visa’s $5.3 billion Plaid acquisition

Visa’s January 2020 announcement of its $5.3 billion acquisition of third party data aggregator Plaid caused major players in the payments world to focus more of their attention on data aggregation.

Though open banking is not mandated in the U.S., there is a growing interest on the part of consumers and small businesses to connect their bank and credit union accounts to a third party app or platform. Data aggregators such as Plaid, MX, Fiserv and others are needed to facilitate this connection and the sharing of information, making it available not only through P2P payment apps like Venmo or Zelle, but also through private label debit cards like GasBuddy and Cumberland Farms, mortgage originators, and some digital-only banks.

Visa’s acquisition underscores how important data aggregation has become and reveals the direction it is heading. According to Grotta, Visa’s decision to buy Plaid gives it “a jump start in what is becoming the private sector approach to open banking in the United States.”

Consumers are interested in using platforms that manage their finances

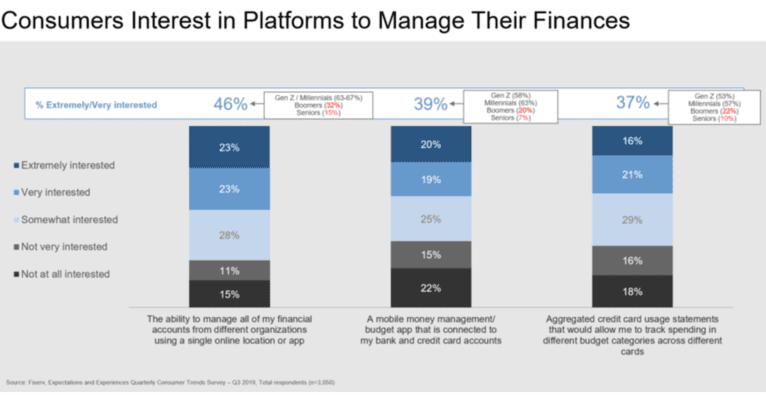

The results of the 2019 Expectations & Experiences: Consumer Payments survey from Fiserv indicated that consumers are interested in several financial management techniques that would require data aggregation.

In the survey, over 3,000 consumers ranked their interest level in the following financial management techniques:

- The ability to manage their financial accounts from different organizations using a single online location or app.

- A mobile money management/budget app that is connected to their bank and credit card accounts.

- Aggregated credit card usage statements that would allow them to track spending in different budget categories across multiple cards.

For all three options, over one-third of the respondents were “Extremely Interested” or “Very Interested.” The generational difference was noteworthy. In some cases, Generation Z consumers reported being four to five times more interested in using these techniques than older adults.

Data aggregation benefits consumers and businesses

Diegelman provided PaymentsJournal with a clear example of data aggregation making the consumer experience smoother.

“Let’s say a consumer applies for a mortgage, and as part of the qualification process they need to provide three months of bank statements,” he said. Today, many mortgage originators are “providing the ability for the borrower to input their banking account credentials into the originator’s loan system, which then connects to an aggregator like Fiserv or Plaid.”

This means that consumers can avoid the headache of bringing in paper bank statements or finding, scanning, and then emailing the statements as PDFs. Instead, such an approach offloads the work to an aggregator that provides the digital rendering of that statement directly into the mortgage generator’s platform.

“It’s entirely possible that this makes the mortgage process go much faster for the consumer. Speed and convenience are two dimensions data aggregation can provide, and consumers value speed when it comes to their finances,” added Diegelman.

Data aggregation helps businesses, too. If a business wants to increase its customer base, and needs information to grow, using a data aggregator is an obvious opportunity.

Beyond that, though, data aggregators have already built the infrastructure needed to retrieve data from a banking or financial services platform and, at the consumers’ request, send data to a permissioned third-party. It would be extremely difficult, costly, and time-consuming for individual companies to take on the burden of building out thousands of connections themselves, when they can instead opt to take advantage of already in-place data aggregation systems from aggregators with strong data security.

Consent and privacy are hallmarks of a strong data aggregator

Strong data aggregators must live up to expectations of both sides of a transaction. When consumers want to connect their bank transactions to other apps, they do it for a specific purpose and expect their data to be used for that purpose. They have privacy expectations regarding who sees their transactions and how secure the transactions will be. Financial institutions, banks, and credit card platforms on the other end of the transaction have similar expectations.

Furthermore, even though a consumer provided their username or password via an app or platform of their choosing, this does not mean that the app has access to the credentials. Instead, the consumer’s credentials are often held in the smaller realm of data aggregation providers who offer security as part of their aggregation offering.

Data aggregation enables faster payments

Data aggregation is already working to enable faster payments. For example, if a consumer has to pay a monthly fee for their child’s school lunch, but the school only accepts ACH payments, it can be tedious for the parent to find their checkbook and routing information. Alternatively, a school website with an aggregation component would allow parents to connect their bank account using their bank account credentials.

Another strong example of data aggregation enabling faster payments is the use of P2P payment platforms, such as Venmo or PayPal, instead of writing a check or going to the ATM to withdraw cash. After linking a bank account with the app, consumers can send money to others with the click of a few buttons. The recipient can then immediately deposit the funds into their account.

Grotta noted that data aggregation services may also be the mechanism that launches real-time payments in the point-of-sale environment. “It will certainly be an area to watch to see if new apps or payment devices connection with aggregation start developing new POS payment capability outside of the current networks being used today,” she said.

The future of data aggregation

Looking forward, Diegelman identified two major developments related to data aggregation that are already underway: the shift away from screen scraping and the evolution of open banking.

The legacy method of data aggregation, known as screen scraping or credential-based harvesting, relies on an aggregator writing scripts and automating the same process a consumer would use to log into their bank. Then, the data that has been requested gets pulled.

The legacy method of screen scraping may create a burden on the technical infrastructure of banks, or may be a less-secure practice than other options. Thus, Diegelman expects larger financial institutions to continue to shift toward a form of direct connection such as OAuth, a token-based model that provides a dimension of privacy and consent.

Secondly, open banking is maturing in the U.S. market at an advancing rate that is expected to continue. With that in mind, Fiserv became a board member Financial Data Exchange (FDX) in 2019. FDX brings together payments industry leaders that want to “develop standards around account aggregation with the goal of balancing consumers’ desire to utilize and share their data for some purposes and banks’ prioritization around data security and use cases.” Standardization by leaders in the industry will be needed to successfully expand the open banking market.

Conclusion

Data aggregation is currently experiencing high growth in the financial services world, and that growth won’t be slowing down anytime soon.

With aggregation, the convenience and speed demanded by consumers is made possible. Ultimately, maximizing the power of data through data aggregation services benefits consumers, businesses, and financial institutions alike.