Let’s face it: the pandemic has all but crippled the U.S. economy. Millions of citizens have been left jobless in the wake of the devastating COVID-19 virus, so it’s no surprise that delinquent credit has led to an uncharacteristic rise in delinquent payments.

Delinquent credit is the falling behind of monthly payments to the lending bank. After two or more payments are missed, the delinquency status is typically reported to the credit bureau, negatively affecting the borrower’s credit score.

The government has provided citizens with some forbearances, such as deferred student loans, a moratorium on evictions, and an increase in unemployment benefits. But for some American families, a few thousand dollars and a temporary lapse in certain payment responsibilities are still not enough to keep their credit profiles in good standing.

To discuss how community banks can help combat credit delinquency and help members get ahead, PaymentsJournal sat down with Jim Simon, EVP, Chief Administrative Officer & Chief Credit Officer at TCM Bank, N.A. and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

How community banks can keep credit delinquency rates low

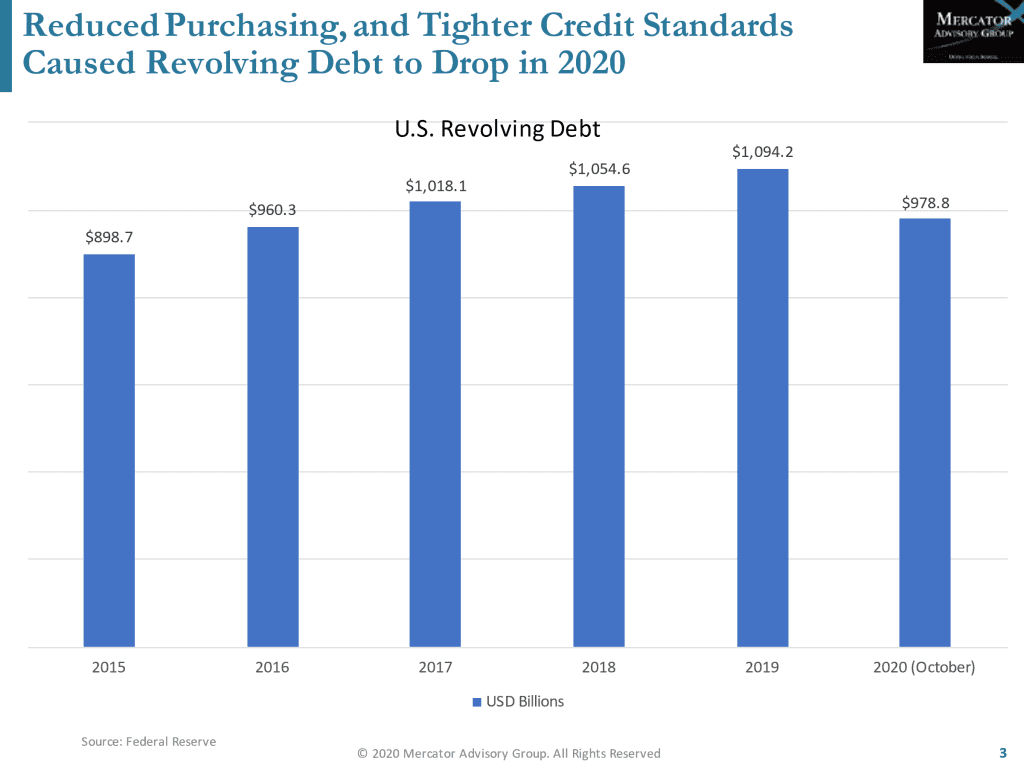

From 2015-2019, the U.S. saw a steady increase in revolving debt caused by delinquent balances. As the chart below shows, however, credit delinquency debt significantly decreased from 2019 to October 2020due to reduced consumer purchases and tightening credit standards.

Most borrowers would like to repay their debt if they are able. “The disruption from unexpected unemployment [numbers in the] double digits, [which] the United States is not used to, really populated that box in the area of ‘want to pay but can’t pay,” said Riley.

When asked for his thoughts on how community banks can help to keep credit delinquency rates low, Jim Simon offered one solid piece of advice: listen. “People will be very willing to share, particularly if you adopt a collegial, collaborative, consultative approach to the collection calls,” Simon advised. “Listen, understand what the issues are, listen to the timing of those issues [and] how long you think they’re going to last.”

Listening to the issues of the customers allows community banks to point them in the right direction, whether it be a forbearance, reduced rate, or a fixed payment plan. An attentive community bank associate that prioritizes the creditor relationship—if and when a borrowers’ delinquent amount is lowered and their credit delinquency status turns around—can earn increased customer loyalty.

“[It’s] very important to do some listening and be creative in terms of some of the solutions you’re able to provide,” concluded Simon.

Community banks help members get ahead

Higher delinquencies often mean worse credit scores. And while FICO scores are the typical barometer for credit health, times have strayed far from normal. Banks may want to consider rescoring their credit portfolio to provide a benchmark from where a banking professional can then gauge whether the financial state is getting better or worse.

There are also people who have done better financially in the pandemic climate and may have legitimate needs that can be met by a credit line increase, as well as those who are opening new businesses because they have found a niche that can thrive in this environment. “There’s still opportunities for new business, which certainly can help offset increased losses on the portfolio, if you’re bringing in new, quality accounts, to generate some additional profit stream for your credit card portfolio,” added Simon.

By maintaining or monitoring FICO scores and using those to back up some possible solutions for a delinquent balance, borrowers will be more likely to speak with a representative about repaying their debt. “The folks that are willing to talk to you are the ones that are going to be the most willing to pay, when they have the ability, so keep the conversations going,” instructed Simon.

Of course, there will be borrowers who are not going to repay their delinquent balance, but there is still opportunity there. If the community bank can create an in-house recovery plan as opposed to outsourcing the credit delinquency to a collection agency, they avoid cutting off the conversation. When the bank informs the borrower that they understand the customer cannot make the monthly payment and are willing to work within the person’s capabilities, the customer may agree to a lowered monthly payment, which keeps their account healthy and active in the institution’s books.

“Keep them in a payment habit. It’s less costly, it’s a better experience for your customer. And I think there’s a long term positive out of that, as well,” said Simon.

Not all portfolios are created equal: How can community banks adjust and strengthen members’ portfolios?

It is important for community banks to continuously review their portfolios’ underwriting parameters and make changes as needed. “[Community banks] have an ability to dissect the portfolio and get some metrics out of it in terms of performance first payment defaults [and] delinquencies,” said Simon. “If you rescore the portfolio with FICO score and look at delinquency bands by FICO, those are the types of things that can help you to adjust your underwriting.”

And while it’s important to track how a portfolio is behaving now, it’s just as crucial to continue to track it going forward. “We’ve seen a deleveraging, we’ve seen the revolving balances decrease. What are the purchase patterns? Are you still having strong sales volume? Are the merchants that are being used in your card portfolio the same as they’ve been? Have they changed?” asked Simon. Looking at this all at a high level can be very telling.

This final piece of the puzzle that is required for community banks to well-manage their portfolio will come when revolving balances start to increase. “When people start carrying balances, it’s very possible they’ve leveraged,” informed Simon. With the stimulus program and enhanced benefits, some people have managed to build up a bit of a nest egg. Once that runs out and balances begin to build, community banks should look for where that is happening and see if its lower or upper FICO bands, all while paying attention to what’s going on in the economy at that point in time.

If challenges with delinquent payments persist post-COVID, “you may want to go in and start thinking about doing some line management or reducing limits for people that are considered to be kind of higher risk,” suggested Simon. “That certainly can have a dramatic impact on the losses of the portfolio and time.”

The ghosts of delinquent payments past influence the future models of community banks

The Great Recession. Ever heard of it?

During the Great Recession, people were drowning in debt and willingly walked away from their real estate investments. However, many Americans did everything in their power to avoid delinquent payments on their credit cards because that’s how they were surviving day to day, month to month.

“I think that the Ghost of Christmas Past is played an interesting role in the current situation,” joked Simon. “People have deleveraged on their credit cards, [and] I think they’ve done that intentionally, because that’s their way of protecting that access to credit.” This behavior is another added overlay to what’s going on in the broader scope of the U.S. economy and should be noted and tracked.

With so much change in the financial state of the country since the start of the pandemic—including stimulus payments, unemployment, and an exchange of presidential power—community banks already have some insight into which variables have changed. But there is not a one-size-fits-all solution for banker’s portfolios, and continued interaction with the card holders and communication within each organization will be key in helping customers through a unique and challenging time.